While the short-term attention remains on the outcome of the 2020 US presidential election, which could take days if not weeks to determine, the second wave of the COVID-19 pandemic gathers pace across Germany, Europe as a whole, and the US. Global equity markets rallied despite US election uncertainty that could be decided by a court battle over the state of Michigan. The DAX 30 entered a short-covering rally following a massive sell-off and has now converted its short-term resistance zone into support. Limited short-term upside remains, but the long-term downtrend is intact.

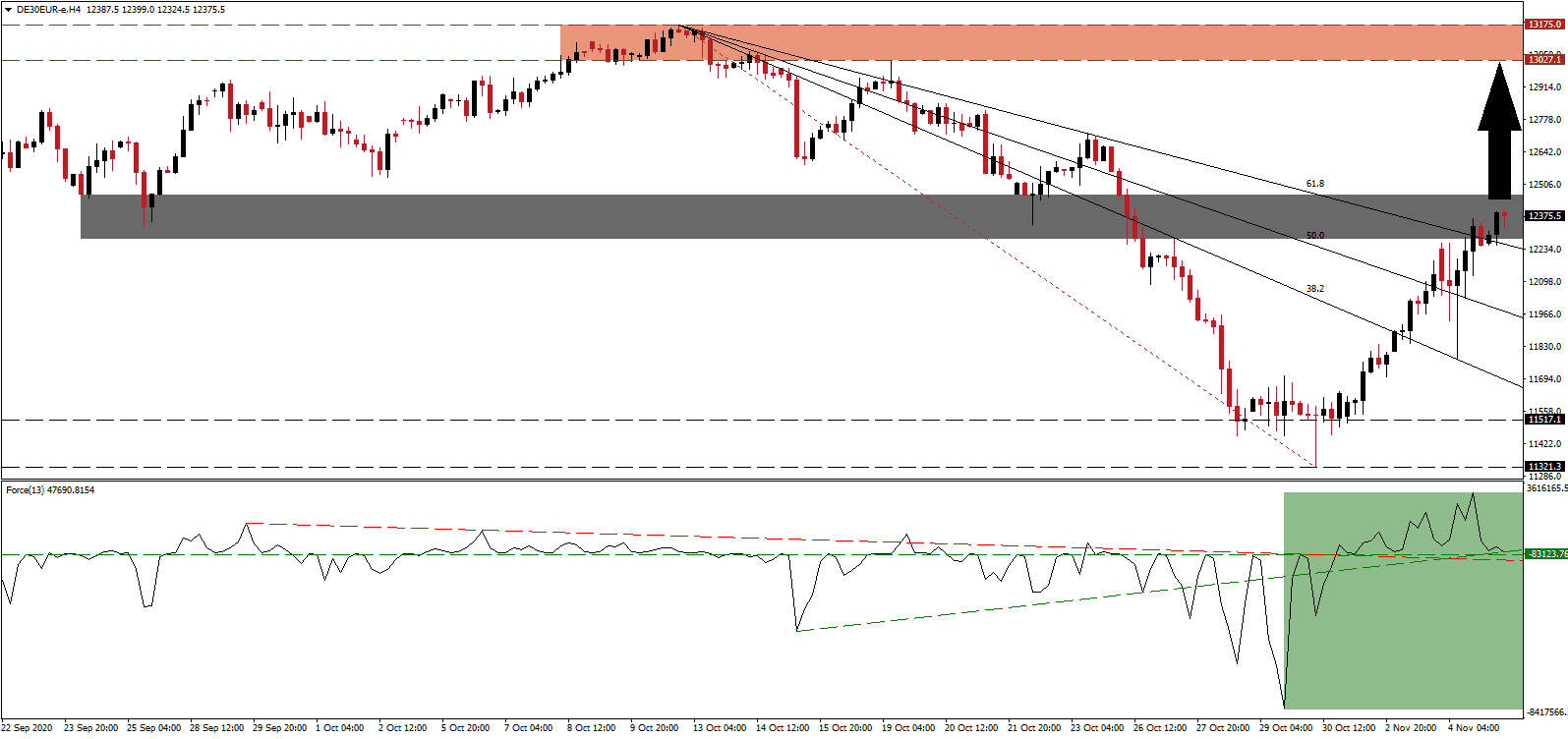

The Force Index, a next-generation technical indicator, suggests an extension of the advance after moving above its horizontal support level following the breakout above its descending resistance level. Supporting a short-term extension is the ascending support level, as marked by the green rectangle. Bulls are in control of the DAX 30 with this technical indicator above the 0 center-line.

With Germany reporting over 20,000 new COVID-19 infections daily, climbing the global rank of most-infected countries, where it presently occupies the number 15 spot, Chancellor Merkel announced a four-week nationwide lockdown. It will be less strict than the first one, even though the pandemic is more severe. Following the breakout in the DAX 30 above its support zone between 11,321.3 and 11,517.1, it embarked on a push through its descending Fibonacci Retracement Fan Resistance sequence. The accumulation in bullish momentum allowed for the conversion of its short-term resistance zone into support, located between 12,276.4 and 12,461.2, as marked by the grey rectangle.

Since most components of the DAX 30 are export-oriented, the latest vote of confidence from constituent Siemens about the economic resilience of China carries more weight than domestic issues. The German technology giant plans to deepen cooperation with Chinese firms, as the German services PMI for October retreated into contractionary conditions. Given the present short-term bullishness, this index can extend its breakout sequence into its resistance zone located between 13,027.1 and 13,175.0, as identified by the red rectangle, before retreating from a lower high and resuming its long-term downtrend.

DAX 30 Technical Trading Set-Up - Confined Breakout Extension Scenario

Long Entry @ 12,375.0

Take Profit @ 13,025.0

Stop Loss @ 12,125.0

Upside Potential: 6,500 points

Downside Risk: 2,500 points

Risk/Reward Ratio: 2.60

A collapse in the Force Index below its descending resistance level, serving as temporary support, will invalidate the confined breakout extension scenario. Traders should consider any advance from present levels as a short-selling opportunity amid a worsening short-term global economic outlook minus China. The second wave of the COVID-19 pandemic is well-positioned to worsen significantly before improving, and the DAX 30 is well-positioned to retrace its advance back into its support zone between 11,321.3 and 11,517.1.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 11,975.0

Take Profit @ 11,325.0

Stop Loss @ 12,125.0

Downside Potential: 6,500 points

Upside Risk: 1,500 points

Risk/Reward Ratio: 4.33