The DAX Index has a habit of causing bedlam in early trading. Gaps feel as if they are commonplace in the German index and speculators need to always be ready with wide stop loss ratios to make sure they are not bounced out of trades, if they have been bold enough to hold onto positions overnight. That also means traders should not be using too much leverage when trading the DAX Index, because if things go against a trader, a depletion of cash can occur dramatically when the index opens its doors.

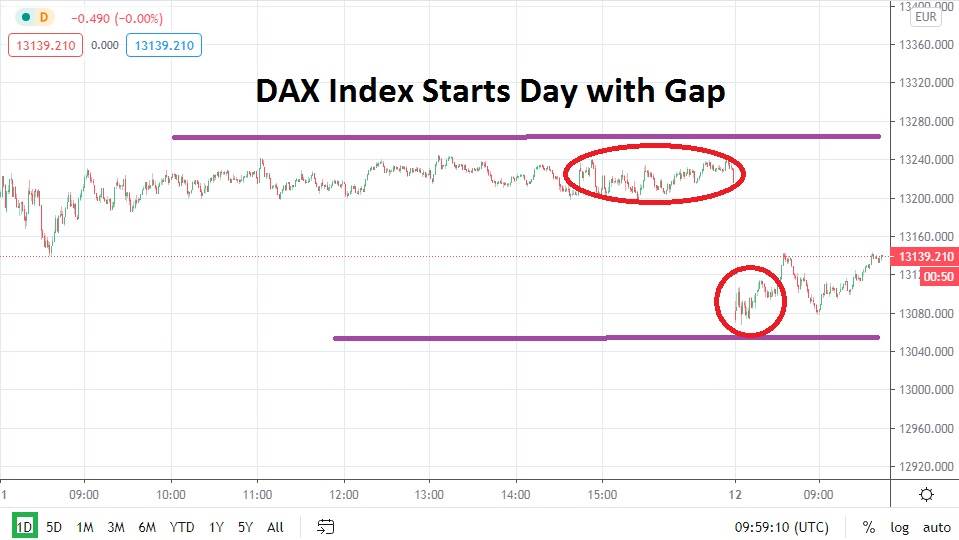

Intriguingly, the gap in early trading this morning has not been able to crash through vital support levels and the DAX Index has actually shown the ability to regroup and traverse slightly higher. Yes, the German index is trading below yesterday’s closing values as of this writing, but targets above are close enough to target for speculative traders who believe risk appetite will remain the flavor of the day near term.

US future markets are indicating a mixed opening, but these early calls from the American equity markets come as the indices are approaching record highs, which may be causing some cautious reactions. The notion that US markets are sustaining their higher values gives credence to the suspicion that the DAX Index will continue to do the same, as investors in the indices await another round of positive influence.

Optimistic impetus can come in many forms. Yes, the US elections appear to have created a winner with Joe Biden, but Donald Trump is not ready to concede defeat. However, investors looking to the future likely believe the outcome remains solid and they are counting on a tranquil transition of power when the time arrives. Also, coronavirus numbers, while still concerning in the European Union, have been showing statistical evidence of improving.

The DAX Index appears to be a potential speculative buy if traders believe more positive momentum will emerge within equities short term. Speculators should use limit orders to look for reversals higher by placing trades slightly above support levels. If USD equity indices continue to signal a mixed opening, the next handful of hours may prove a solid time frame to look for a slight trend downward in order to buy the DAX Index and look for upside action to develop going into the weekend.

DAX Index Short Term Outlook:

- Current Resistance: 13185.000

- Current Support: 13074.000

- High Target: 13238.000

- Low Target: 13010.000