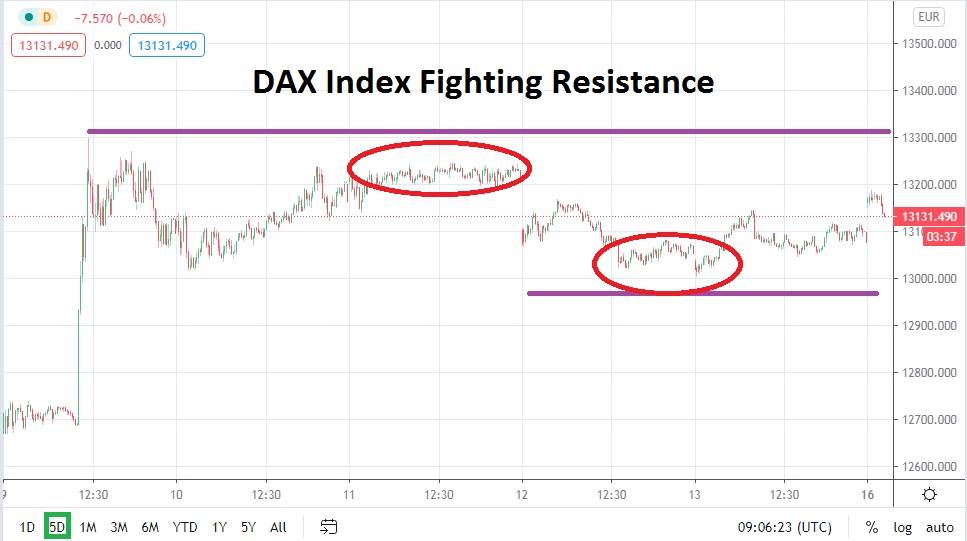

The DAX Index has produced a rather consolidated value range the past few days of trading. After producing a significant gap higher on the 9th of November to approximately the 13250.000 mark, the German index has run into a buzzsaw of resistance and produced rather choppy trading for market participants. There has been a flourish of strong global risk appetite early this morning and this has been demonstrated on Asian stock exchanges which are challenging higher values.

US future markets are also indicating a fairly strong opening for American indices, but the DAX Index remains fragile in certain regards. However, one positive thing speculators may want to acknowledge is the ability of the German index to sustain its values above the 13000.000 level, and this may prove to be key evidence which generates bullish buying.

Trading this morning did see a slight surge higher followed by profit taking in the DAX Index, but significantly, support seems to be adequate, and if it is maintained around the 131250.00 juncture it could spur the belief that upside potential exists. However, this sentence also may be starting to sound like a broken record to speculators who have become wary of the inability of the DAX Index to achieve new highs. The current high water levels of the German index have been battling tough resistance since mid-July and have not been able to generate a significant and sustained bullish run.

Cautious financial houses may have legitimate fears about economic implications and outlooks because of the effects of coronavirus and domestic fiscal concerns in Germany. However, the ability of the DAX Index to sustain higher values with these shadows hovering also points out a certain amount of resilience which exists and the likelihood equities will find the willpower to climb higher. The question is: when will another leg up occur?

Timing the exact pivot points for strong rises in equity indices can often lead to trouble, but technical charts support the suspicion that the DAX Index may be ready to see a bullish move develop which could actually begin to challenge resistance. If global risk appetite remains optimistic short term, there seems to be a legitimate opportunity for speculators to pursue upward momentum and target higher values for the DAX Index.

DAX Index Short Term Outlook:

- Current Resistance: 13185.000

- Current Support: 13020.000

- High Target: 13238.000

- Low Target: 12997.000