While Switzerland handled the first wave of the COVID-19 pandemic better than most of its European neighbors, the conditions during the second wave are notably worse. A recent survey revealed Swiss citizens worry more about the collapse of the healthcare system, the economy, social conflicts, isolation, and the lack of solidarity. Switzerland presently ranks ninth in Europe for total COVID-19 cases per 1,000,000. It helped push the EUR/CHF into its resistance zone, but the lack of bullish momentum may spark a reversal.

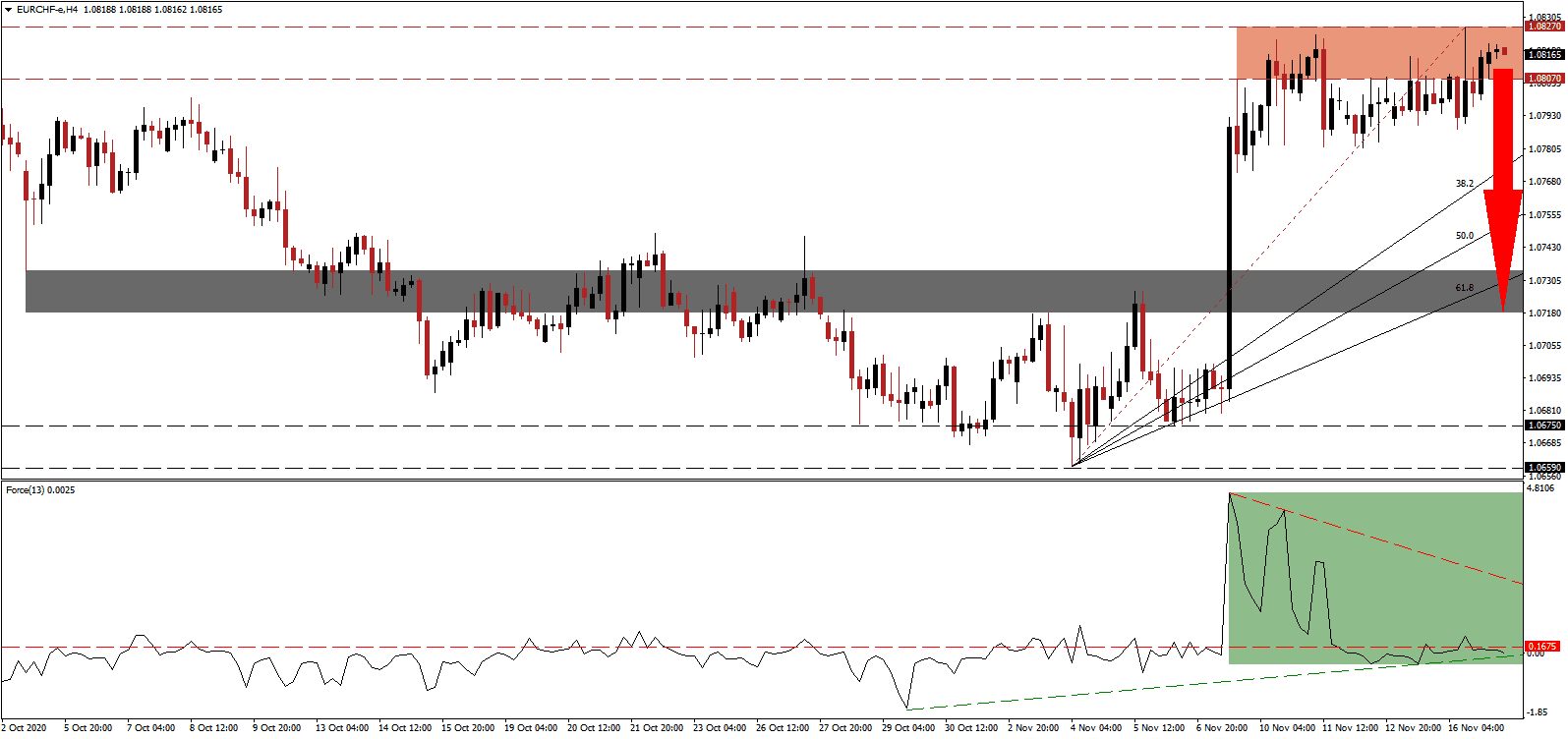

The Force Index, a next-generation technical indicator, created a series of lower highs, allowing for a negative divergence to form. It has retreated below its horizontal resistance level, as marked by the green rectangle, where it can challenge its ascending support level. Adding to long-term downside pressures is the descending resistance level. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control over the EUR/CHF.

Global insurance conglomerate Swiss Re published a report suggesting the COVID-19 pandemic will wipe out $12 trillion in economic output by the end of 2021. The export-oriented economy of Switzerland will feel the impact, but the Swiss franc retains its status as a safe-haven currency. More costly market interference by the Swiss National Bank (SNB) could spike volatility, as Eurozone problems apply downside pressure on the euro. The EUR/CHF is well-positioned to complete a breakdown below its resistance zone between 1.0807 and 1.0827, as marked by the red rectangle.

Switzerland is reaching out to the East to sustain its economy and unlock new export opportunities. ASEAN and Switzerland hold talks to deepen cooperation, as the wealthy Alpine nation seeks access to the world’s largest trading block created by the Regional Comprehensive Economic Partnership (RCEP). Switzerland also engages with China, a signatory of RCEP, to bolster political dialogue. The EUR/CHF is vulnerable to a profit-taking sell-off, which can take it through its ascending Fibonacci Retracement Fan sequence and into its short-term support zone located between 1.0718 and 1.0734, as identified by the grey rectangle.

EUR/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.0815

Take Profit @ 1.0720

Stop Loss @ 1.0835

Downside Potential: 95 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 4.75

Should the Force Index accelerate above its descending resistance level, the EUR/CHF can attempt a breakout. The upside remains reduced to its next resistance zone between 1.0860 and 1.0877. Given the deteriorating economic and health conditions across the Eurozone, led by France and Germany, Forex traders should take advantage of any advance with new net short positions.

EUR/CHF Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 1.0850

Take Profit @ 1.0875

Stop Loss @ 1.0835

Upside Potential: 25 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 1.67