The euro has rallied significantly over the last several weeks heading into December, showing that the decline of the dollar is still very much on the minds of traders. The market is likely to see a lot of momentum either built up or broken down by Brexit as well. Not only does the Brexit situation have a massive influence on what happens to the British pound, but it also will have a significant amount of influence on the euro, as it will help facilitate cross-border transactions between Europe and one of its most important trading partners.

The coronavirus situation is another factor that will be moving this pair over the course of December. The coronavirus figures in the European Union have begun to slow down, while the numbers in the United States continue to accelerate. This could provide a little bit of a boost for the euro, as currency traders have been paying close attention to the coronavirus in general. This will continue to be a factor until the vaccine gets distributed, which will be well into 2021.

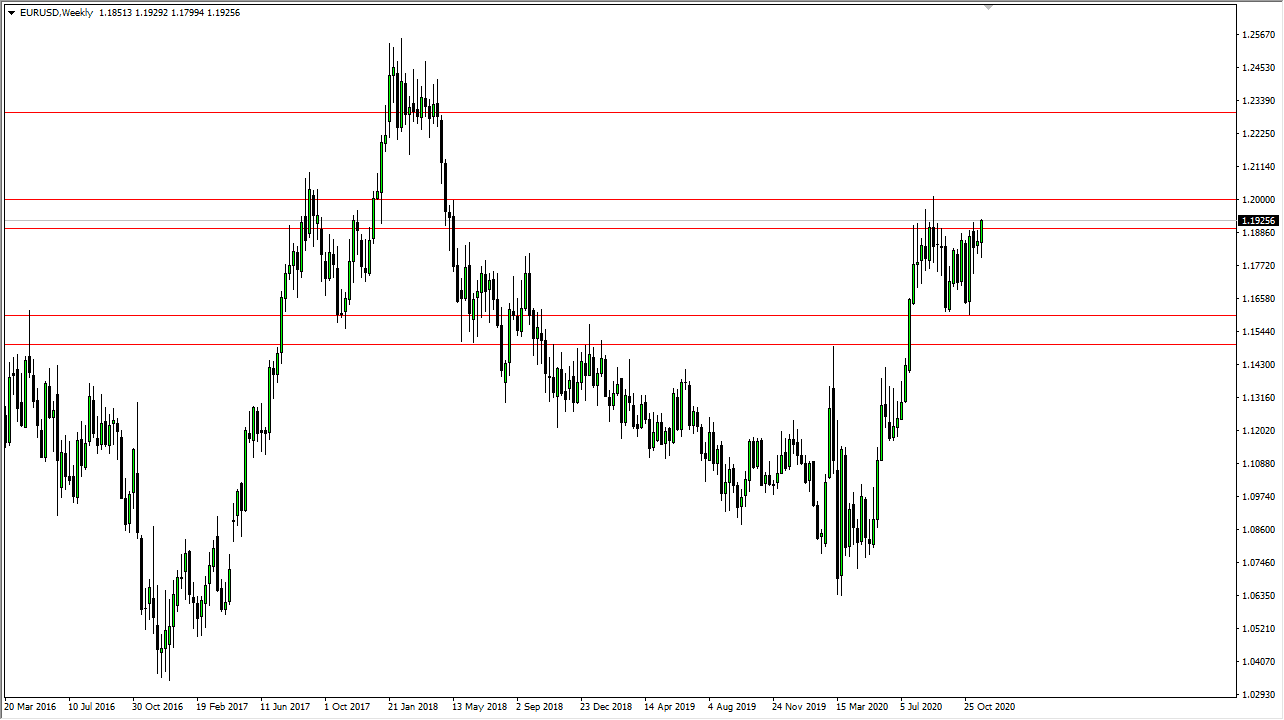

The Federal Reserve has released its Meeting Minutes, suggesting that they are willing to do whatever it takes to accommodate the economy. There are a lot of concerns as to whether or not Congress will pass a coronavirus relief bill anytime soon, which could weigh upon the US growth situation as well. It is a weird dichotomy at the moment, because traders are banking on a post-coronavirus world allowing for a return to normalcy, and therefore will be willing to step out on the risk spectrum. However, at the same time, we know that several economies are going to be locked down. This is part of what is going to keep this market very choppy, but the overall upward tilt continues. This is to say that although the market does look very bullish, between 1.19 and 1.20 there is a significant amount of resistance it will take work to get through. If and when we do break above the 1.20 level, it will open up the door to the 1.23 handle and beyond. We already know that the Federal Reserve is not going to be tightening monetary policy for at least a couple of years, so as the world becomes more “comfortable”, it will continue to sell dollars. Keep in mind that late in the month there is Christmas, which means that liquidity will certainly be an issue.