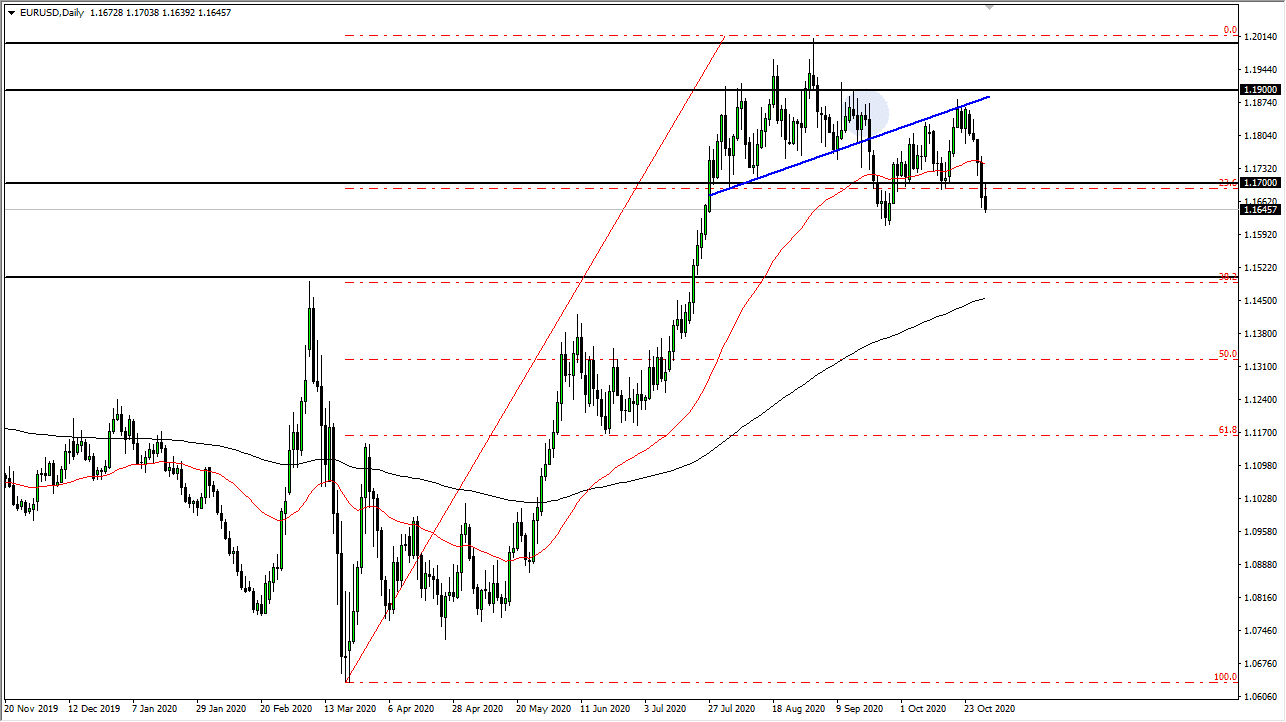

The Euro initially tried to rally during the trading session on Friday, but then gave back quite a bit of the gains as soon as we got close to the psychologically and structurally important 1.17 handle. The market is very likely to continue going lower, perhaps trying to smash through the 1.16 level underneath. If we can break down below there, then it is likely that we will start to look towards 1.15, an area that will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure and also a confluence of events.

You can see by looking at the chart that the 200 day EMA is sitting just below that 1.15 level and is also at the 38.2% Fibonacci retracement level. The question then becomes whether or not it offered enough support to keep the market above, or if we will simply crash through it. I think there are a lot of things going through the markets at the same time, not the least of which is the uncertainty of the US elections. Furthermore, we also have the European Union looking to lock its economy down, due to the coronavirus numbers increasing in various places. The market looks likely to be very noisy. I think that if we do not get stimulus, this market is going to go much lower. Furthermore, if the European economy crashes the way it could, that will continue to put negativity into this market. I think it is only a matter of time before we would have somebody try to pick this market out, but right now it looks like it is destined to go lower. I believe that the 1.17 level will continue to offer plenty of resistance, just as the 50-day EMA will do so above that.

I do not have a scenario in which I am willing to buy this pair, at least not in the short term. The fact that the US elections are going to be so hotly contested suggests that we are probably going to continue to see a bit of a “risk off” type of scenario, in which we could see more people looking towards the US dollar again. At this point, I do not know if it is a trend change, but we clearly have a strong pullback coming.