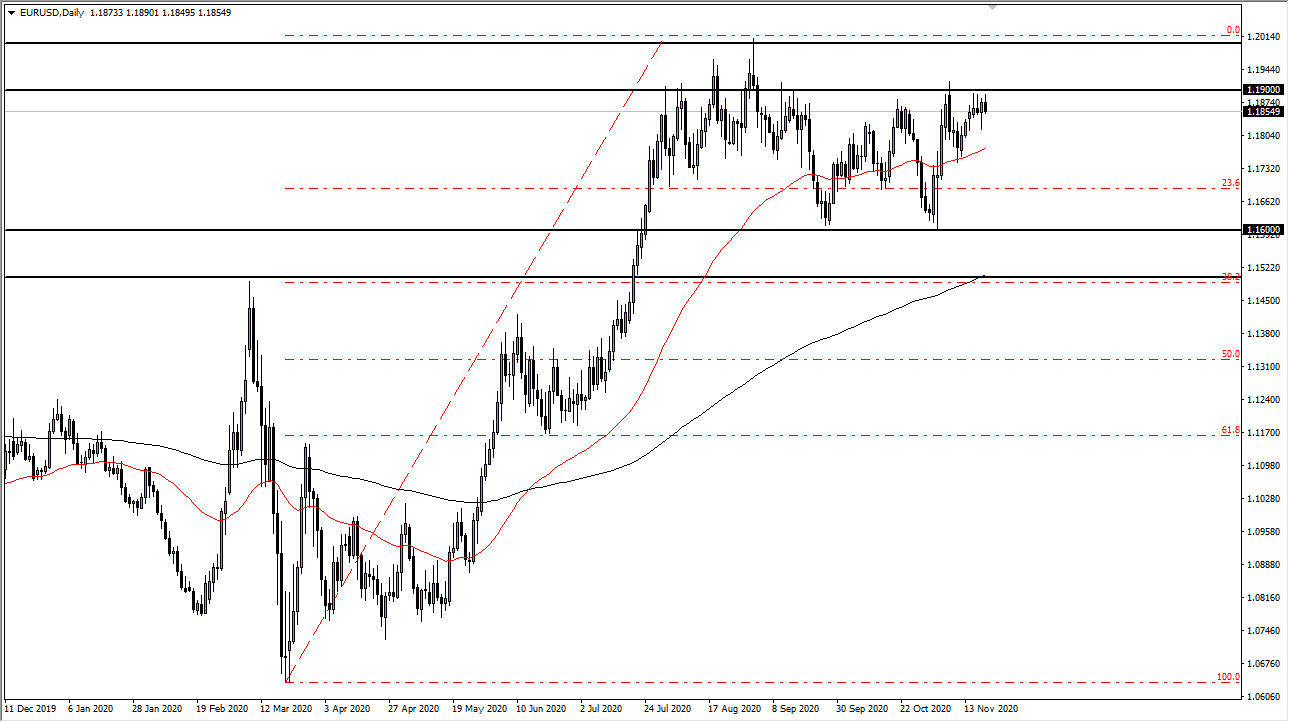

The euro initially tried to rally during the trading session on Friday, but continues to see a lot of noise right around the 1.19 level that extends to the 1.20 level. That is an area which continues to cause issues as it is a major barrier. We will eventually see sellers come back in every time we get there. However, there is significant support underneath that will continue to drive this market as well.

The European Central Bank continues to be very loose in its monetary policy, similar to the Federal Reserve. The market will hear a lot of noise in general, but it will see support at the 50-day EMA, which is sitting just below the 1.18 level. If we break down below there, the market is likely to go down to the 1.16 handle. At that area, we have 100 pips worth of support. In general, this currency pair is likely to be a representation of what the markets in general look like. In other words, we are simply bouncing around trying to figure out what to do next.

If the market were to break above the 1.20 level, then we could go much higher, perhaps reaching towards 1.23 handle and possibly even the 1.25 level. That is the longer-term expectation of a lot of traders out there, especially if we get a Brexit deal which would help the European Union as well. The question now is whether or not the ECB is going to loosen the monetary policy, but that is in the prospect of a coronavirus relief bill. However, if we see that the US bond markets are starting to attract a lot of money, then it is likely that this pair will pull back towards the bottom. Looking at this chart, the most recent low is much higher than the one before, which suggests that we could find more momentum. We will continue to see a lot of chop more than anything else, but that is how this pair typically moves.