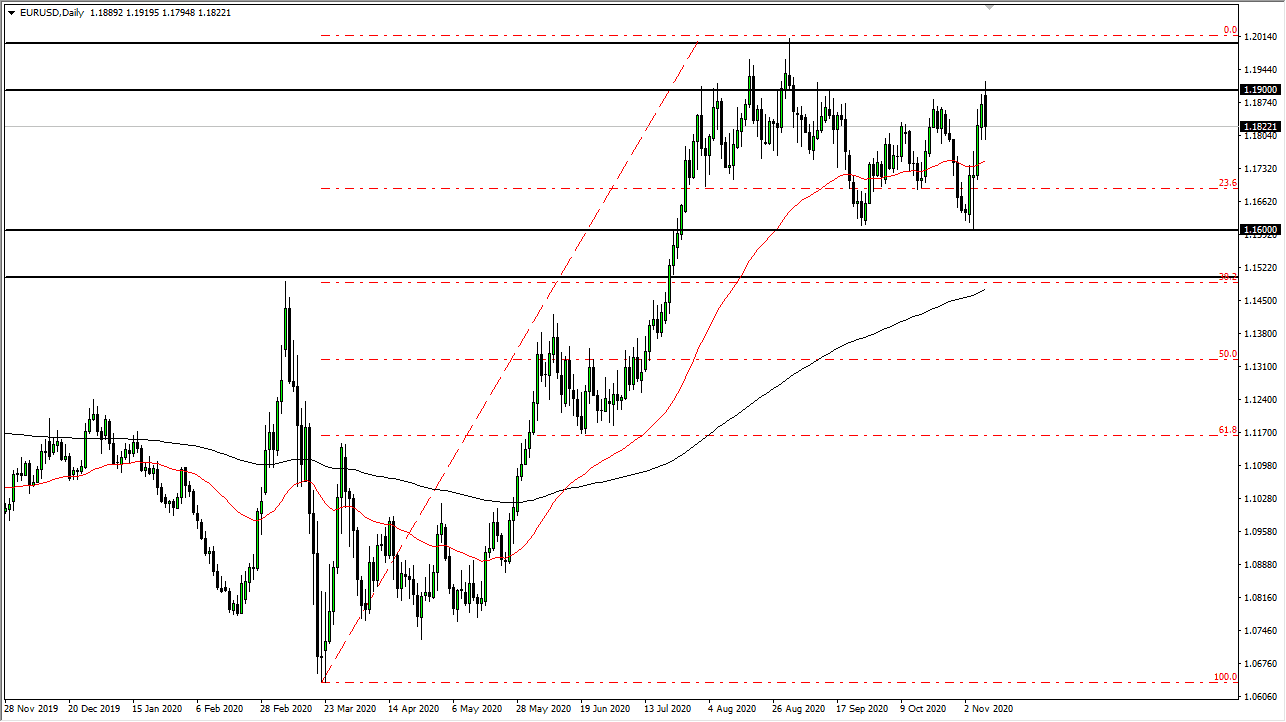

The euro initially tried to rally during the trading session on Monday only to turn around and break down again. The 1.19 level continues to be an area of interest, and it now looks like we could see this market trying to take a look at the area above as a major barrier. If we continue to see a back-and-forth type of trading, then what we have here is a scenario in which the market will continue to find plenty of resistance. The market has seen trouble in that area previously, so we simply go back and forth as we try to figure out what to do next.

Initially, as the news from Pfizer hit the market, people started selling the US dollar in a bid to go more “risk on.” However, we saw a lot of profit-taking, and the market had been so far overextended that we may pull back. If we can break down below the bottom of the candlestick, then it is likely we go looking towards the 50-day EMA underneath, maybe even as low as the 1.16 level, or we bounce from there a couple of times.

The candlestick looks negative, and if we break down below the bottom of it, is likely that we would see more follow-through. Rallies now will probably be sold into, and I do not trust rallies until we get above the 1.20 level, which is a ways off from here. We have lost roughly one complete handle since the highs of the early part of the session. That is something that you do not typically see in the euro, which tells me that there is real trouble above.

If we were to somehow break above the 1.20 level, then the market is likely to go much higher, perhaps as high as the 1.25 level over the longer term. To the downside, if we were to break down below the 1.16 handle, then we have a barrier of support that extends down to the 1.15 handle. Breaking down below there would open up the market to reach towards much lower levels, perhaps as low as 1.13 or so. But I believe more in the idea of consolidation than anything else.