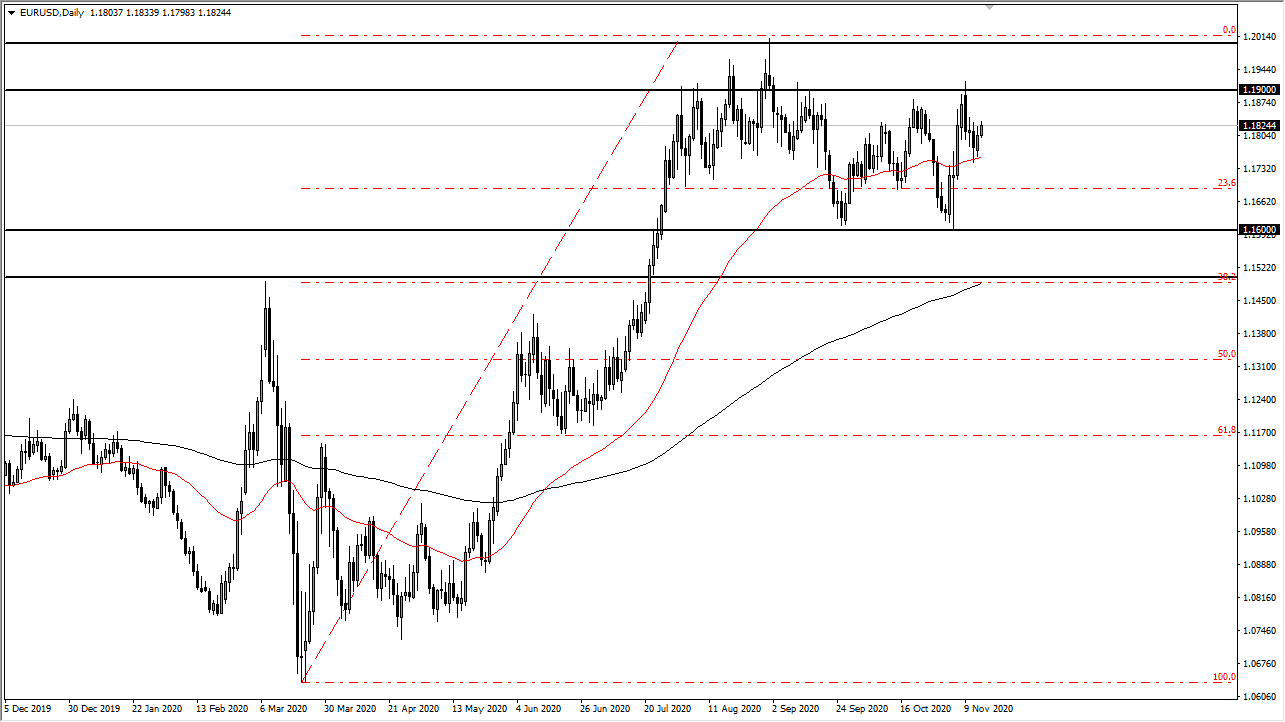

The euro rallied during the trading session on Friday, reaching towards the top of the candlestick from the previous days of the week. We are approaching the area above that could be important, as the 1.19 level has been massive resistance that extends to the 1.20 level. It is only a matter of time before traders start fading the euro again, since the European Union is likely to lock itself back down and cripple its own economy. However, we are also starting to look at massive amounts of coronavirus cases in the United States as well, so perhaps the market is trying to price on some anti-American sentiment as well.

I have no idea what it is going to take for the market to finally break out of this area, but the 1.16 level to the 1.15 level is massive support, as it is the bottom of the range. To the upside, the 1.19 level extends to the 1.20 level as resistance. We are trying to get back towards that top again, but there is a lot of concern in that area for buyers, so I would be more than willing to fade a short-term rally that shows signs of exhaustion.

To the downside, the 50-day EMA sits underneath the most recent bounce, and if we break down below that we may go looking towards the 1.16 level underneath. This is a market that is trying to figure out its next longer-term move, but the euro tends to fluctuate in the same type of ranging. This pair is very choppy because it is the most highly traded financial estimate in the world, but when things eventually start to lean in one direction or the other, we get more clarity. This is a market that still has many things to soak in, so we will break out. But in the short term, I have to assume that the range holds until it does not. If we do break above the 1.20 level, then the market could take off for a bigger move, but we are a long way from there.