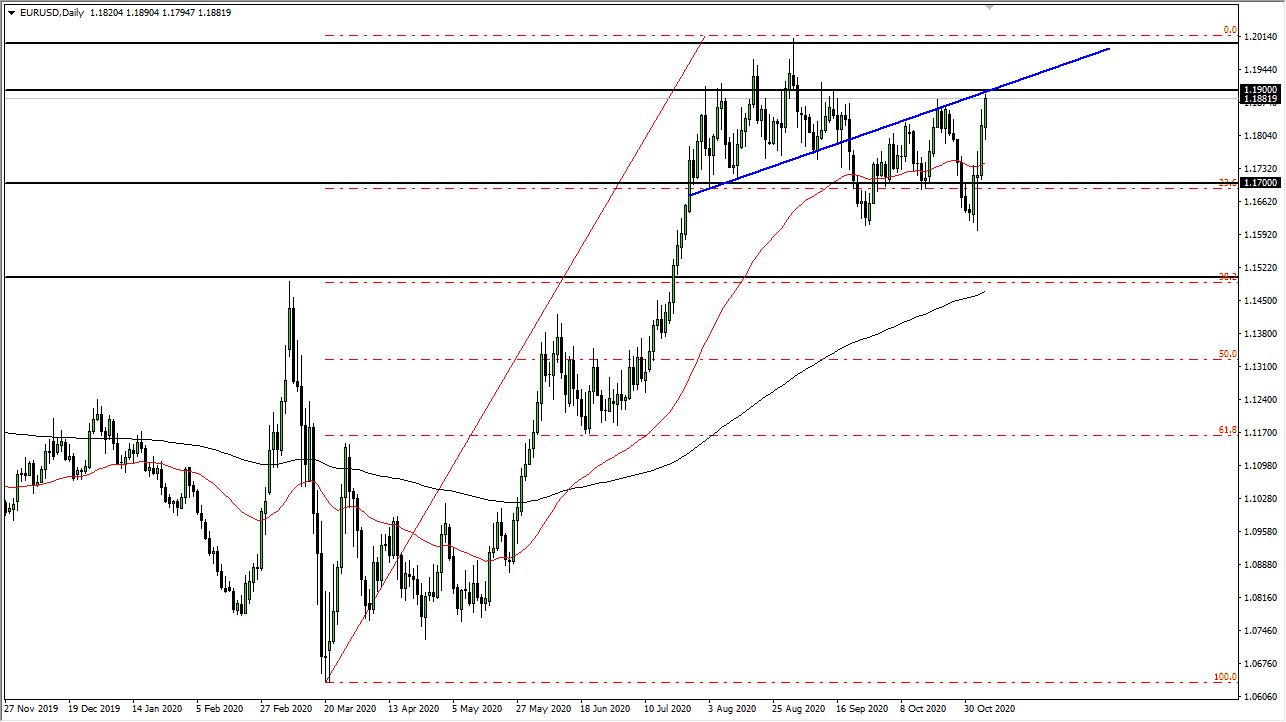

The Euro has pulled back slightly during the beginning of the session on Friday, but then shot straight up to reach towards 1.19 level. That is an area which you can see on the chart is a convergence of resistance. The resistance at the 1.19 level has been rather obvious, so it should not be a big surprise that we would continue to see sellers in that general vicinity. The resistance extends all the way to the 1.20 level, so we have gotten extended at this point and I am looking for some pullback.

Further adding negativity to the chart is the fact that previous uptrend line that we have tested multiple times and has held as resistance is just above. We are looking at a scenario in which we have to make a longer-term decision. There is a lot of trouble waiting to happen because the European Union is locking itself down, which is going to be negative for the economy. However, people are focusing more on the possibility of stimulus out of the United States, albeit a smaller package than originally thought now that the Senate will remain Republican.

Something else that might come into play is the fact that the last four days have been extraordinarily volatile, but have for the most part been very bullish. In fact, they may have been a little too bullish, so people need to take profits or at least step to the sideline. Looking at this chart, the market is likely to continue to hear noisy trading and see fluctutation, while both of these currencies could look rather soft. The Euro itself looks weak against other currencies, but everyone is paying attention to the US dollar. The US Dollar Index is sitting right on top of major support so that could be one of the reasons why we fall. Whether or not it is a longer-term move is a completely different story. The only thing we are seeing now are extreme swings in both directions, which makes trading very difficult. The risk right now is to the downside, at least for the short term.