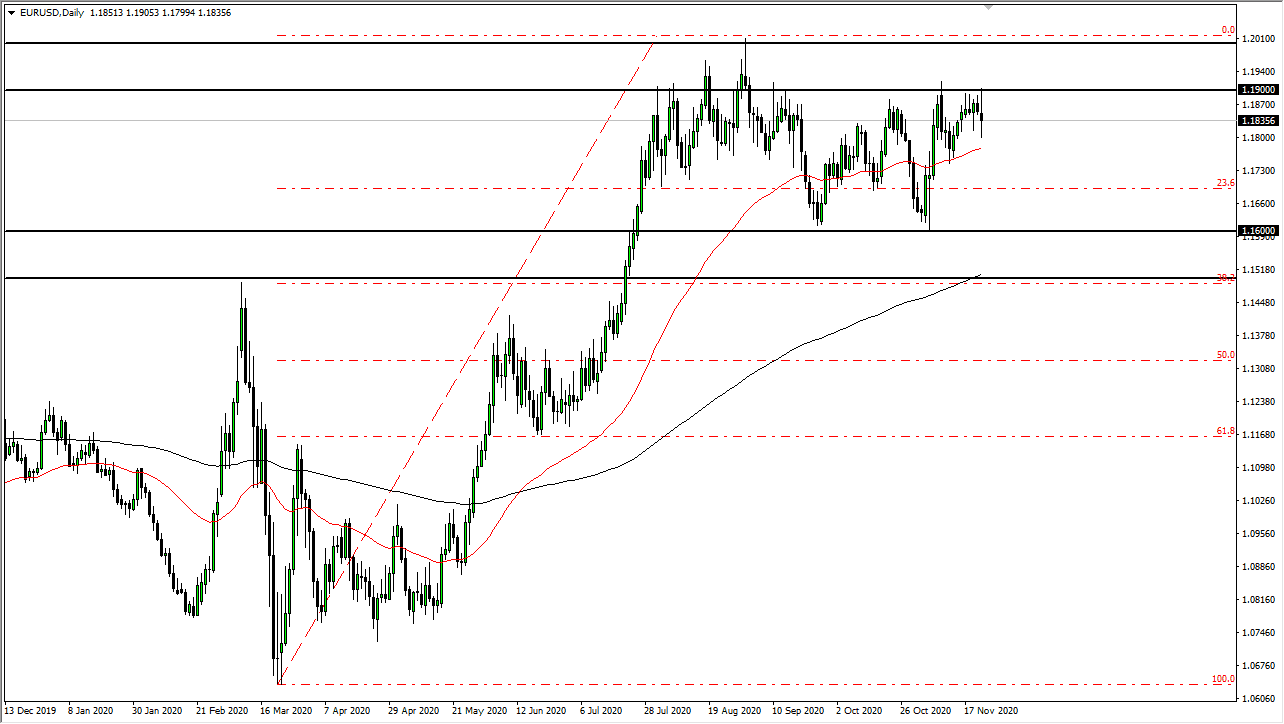

The euro fluctuated during the course of the trading session on Monday as we continue to hang on to the latest headlines involving Brexit, which has a certain amount of influence on the euro as well as the British pound. I look at the overall technical analysis, where I see obvious resistance near the 1.19 level above.

We tested that level during the trading session on Monday, but gave back the gains as soon as we started to get wind of the fact that perhaps the Brexit negotiations were not going as smoothly as initially thought. There was a rumor going around that the British and the Europeans were working on a short-term extension deal so that they can get through the Brexit negotiations. This would be positive for both economies as it would keep the borders open, but after there was pushback on this idea, people began running from both the euro and the pound.

The pair has shown a major pick up and volatility, but we did not break down below the 50-day EMA. The 1.19 level is extreme resistance extending to the 1.20 level, so it is not a huge surprise that we could not break out above there. Another thing that could cause some issues is the fact that it is Thanksgiving week, which could drive down the volume that we would normally expect. That could make some moves a little bit exaggerated at times, perhaps adding to the major selloff that we saw during the day.

Unless we get a Brexit deal, this pair is very unlikely to continue to go higher and break out during the week. The lack of liquidity does make for sudden moves, but it does not bring in the type of volume that will be necessary to break out above what has been such a reliable barrier for some time. The 50-day EMA underneath is reaching towards 1.18 level, so if we were to break down below it, the market could further break down rather significantly to go looking towards the 1.16 level. However, this is a market that will probably spend more time fluctuating than anything else over the next couple of days.