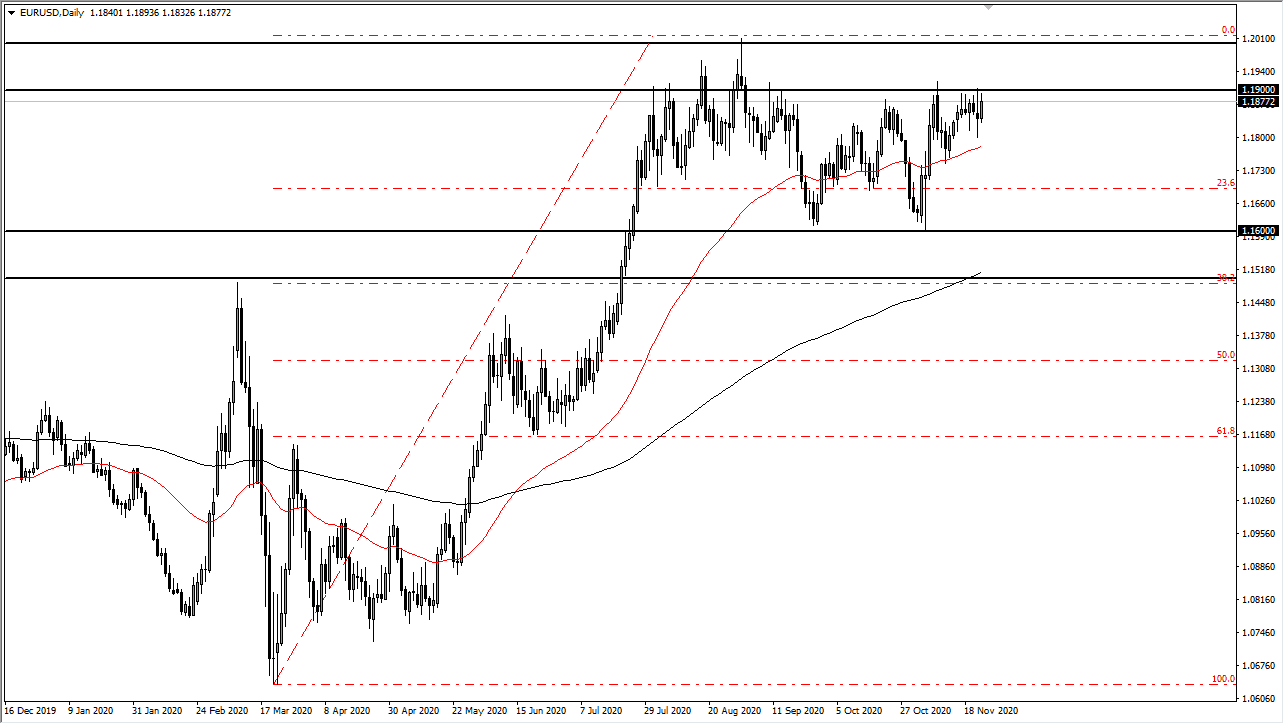

The euro rallied during the trading session on Tuesday again, reaching towards 1.19 level. This is an area that has been very difficult to overcome, and it extends to the 1.20 level. In other words, the market will continue to see a lot of selling in that region. As long as this technical structure holds up, it will be very bad news for the euro. However, it is worth noting that the most recent pullback has been higher than the one before it. Buyers are starting to become a bit more aggressive.

But those buyers still have a lot of work to do before they clear the 1.20 handle. If and when they do, the market is likely to go looking towards 1.25 level over the longer term. It will be interesting to see how this plays out, because the US dollar is being flooded into the system by the Federal Reserve, and people are trying to factor in a “risk on” attitude overall due to the coronavirus vaccine news. There are at least three vaccines that are going to hit the market in the next several months, in which case we will continue to see many people bet on a brighter future, thereby driving down the value of the US dollar.

As people step out on the risk spectrum, they will get away from the greenback as it is a safety currency. However, a lot of the concerns that the market has ahead of it include lockdowns of various economies. It is difficult to see growth in such a reality, so one has to wonder whether or not the currency market is starting to price on things the same way the stock markets have - forecasting well over a year. That is out of the norm for the currency markets, so we could get a snap back occasionally. Nonetheless, there is a lot of volatility ahead. It looks like we will be bullish longer term, but in the short term we continue to struggle.