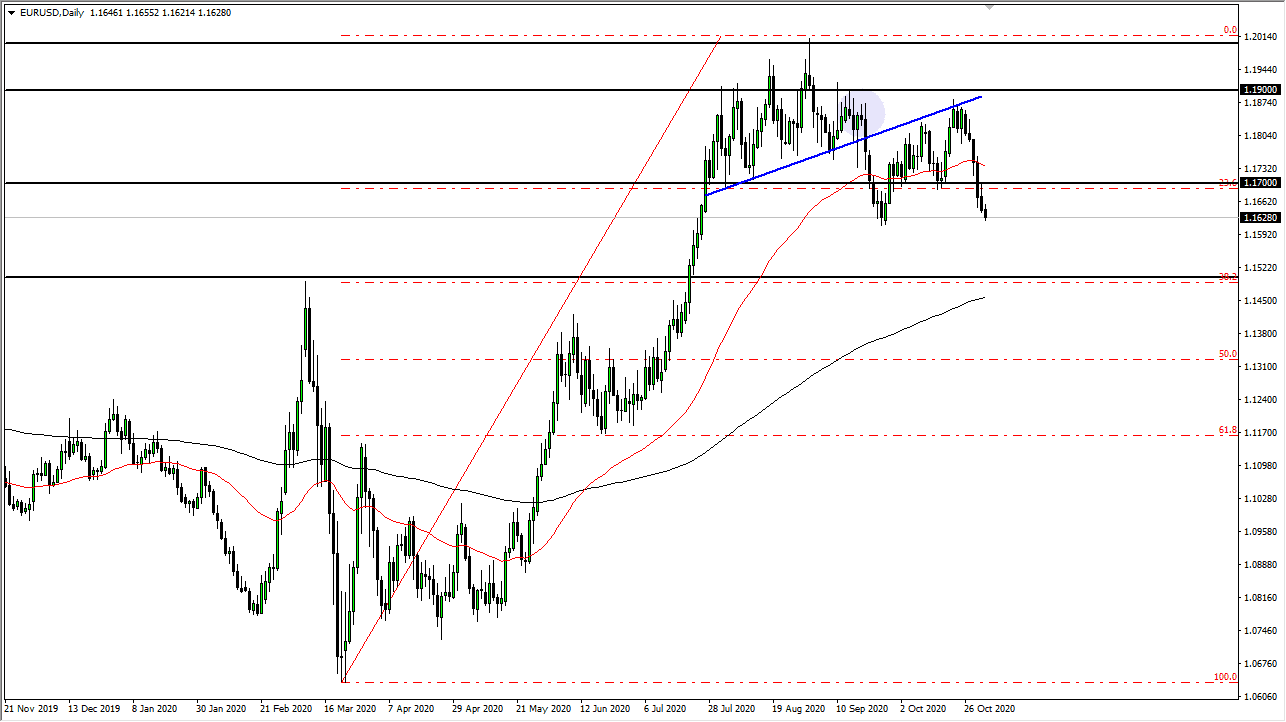

The Euro initially tried to rally during the trading session on Monday, but then broke down again. This is a market that continues to see a lot of negativity, due to a host of reasons. With the European Union looking to close down its economy, it follows that the Euro would suffer. However, we are hanging just above the 1.16 level, an area that has recently been support, so we may get a short-term bounce. That short-term bounce should be a lovely place to start selling the Euro, because there is no reason to think that it should go higher. The United States election will cause uncertainty, especially when it comes the United States. However, the likelihood of the Euro suddenly taking off against the dollar for something sustainable due to the election is very thin.

The candlestick is smaller than the previous one, which tells me that a bounce is likely as well. That bounce is something that I am more than willing to sell, especially near the 50-day EMA which is at roughly 1.1740. I have no interest in buying the Euro, at least not in the short term. I think that we are going to see this market reach down towards 1.15 level underneath, which is the 38.2% Fibonacci retracement level, and of course the 200-day EMA.

Looking at the overall attitude, I think there is much risk during this week. It is difficult to imagine that it will suddenly be a “risk on rally” anytime soon. We have the election tomorrow in the United States and the PMI figures during the week and, even more importantly, the job figures. The FOMC is on the sidelines until we get election results this week, because we have no idea what the scenario is going to be as far as the government is concerned. We do, however, understand that the Europeans are going to do anything they can to shut down the economy because of the virus, and that will work against the value of a strong Euro. We also know that at the next ECB meeting, they should be exploring even more quantitative easing.