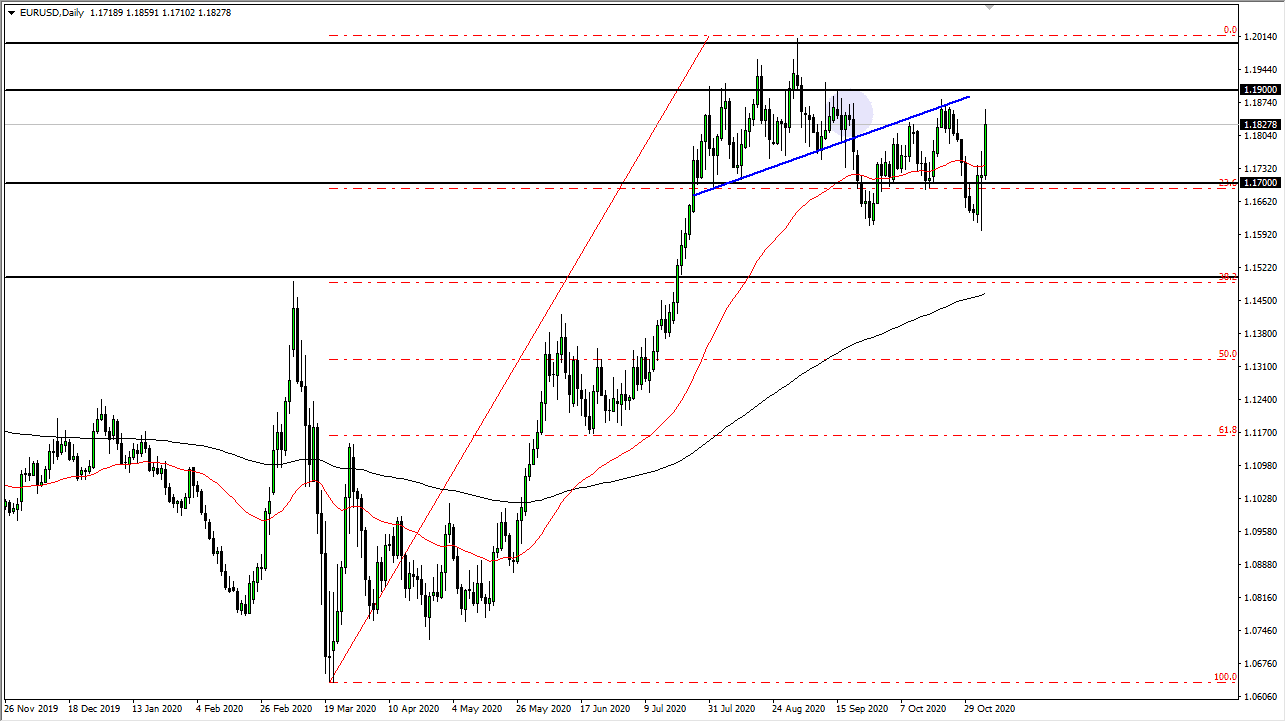

At the end of the day, we crashed into the major resistance barrier but pulled back a bit to show signs of hesitation. As the Friday session features the jobs number, it should not be a huge surprise that people were not willing to throw money into the market late in the day after the announcements.

All of this being said, we are still very much in a range and I think that will continue to be the way going forward. With that in mind, I like the idea of fading any type of rally that shows signs of exhaustion during the day on Friday. Granted, we have seen a nice rally over the last couple of days, but it is hard to imagine that something comes out and the jobs number that changes everything for the longer term. If we do not get a result to the election by the end of the session, I anticipate that late on Friday we will probably see some selling, as money managers look to either take profits or put their money in treasuries to protect wealth.

Furthermore, I believe that the area between 1.19 and 1.20 is a massive resistance barrier that will take a certain amount of momentum to get above. Because of this, I will be waiting to see what the jobs number is, the reaction to the market, and then more than willing to fade signs of strength to get anywhere near that big figure. In fact, I believe that we are simply at the top of a range and it makes sense that you would fade it again, at least until shown something different by the marketplace. Beyond all of that, you have to worry about the European Union locking itself down as it heads to a self-induced recession, with Spain, Germany, the Czech Republic, France, and others shutting down. Looking forward, the European Central Bank is likely to do a lot of stimulus as well, so that will of course weigh upon the idea of a stronger euro longer term. I do not think that we are quite ready to break out to the upside just yet.