There is no doubt that this week will be an important one and will have a strong impact on the performance of global financial markets, including forex. Markets are watching and waiting to find out who will win in the US presidential election, to be held on Tuesday. After that, attention will be given to announcing the policy decisions of many international central banks and, by the end of the week, the US employment numbers. As of now the EUR/USD is stabilizing under downward pressure near the 1.1640 support, the lowest in five weeks. It is a natural reaction to investors' appetite to buy the US currency as a safe haven, in addition to the strength of the second coronavirus wave and the European countries imposing more restrictions to contain the spread.

On the economic side, the European economy witnessed an unexpectedly large growth of 12.7% in the third quarter as businesses reopened after severe coronavirus closures. The recovery was overshadowed, however, by concerns that increasing numbers of cases would cause a new recession in the final months of the year. The recovery in the July-September quarter, as well as concerns about the future, have been reflected in the situation in the United States. The reopening there led to strong third-quarter growth of 7.4%, which restored much of the drop in the first part of the year - but did not dispel concerns about the winter months.

The European recovery, which was reflected in the figures released last Friday by the European Union statistics agency Eurostat, was the largest increase since the statistics began in 1995. It came after a contraction of -11.8% in the second quarter in 19 member states of the European Union that use the Euro, and it was from April to June when restrictions on activities and gatherings were most severe during the first wave of the epidemic. Many economists expected a recovery of around 10%.

France led the recovery at 18.2%, followed by Spain at 16.7% and Italy at 16.1%.

From the US, the pair’s performance was affected by the announcement of the preliminary US GDP growth rate for the third quarter, which was better than expectations of 32% with a growth rate of 33.1% year-on-year. The GDP price index for the period also beat expectations by 2.8% with a change of 3.7%. Personal consumption spending in the US for the third quarter came in below 4% with a change of 3.5%, while initial jobless claims exceeded expectations of 775K with lower numbers of 751K.

Technical analysis of the pair:

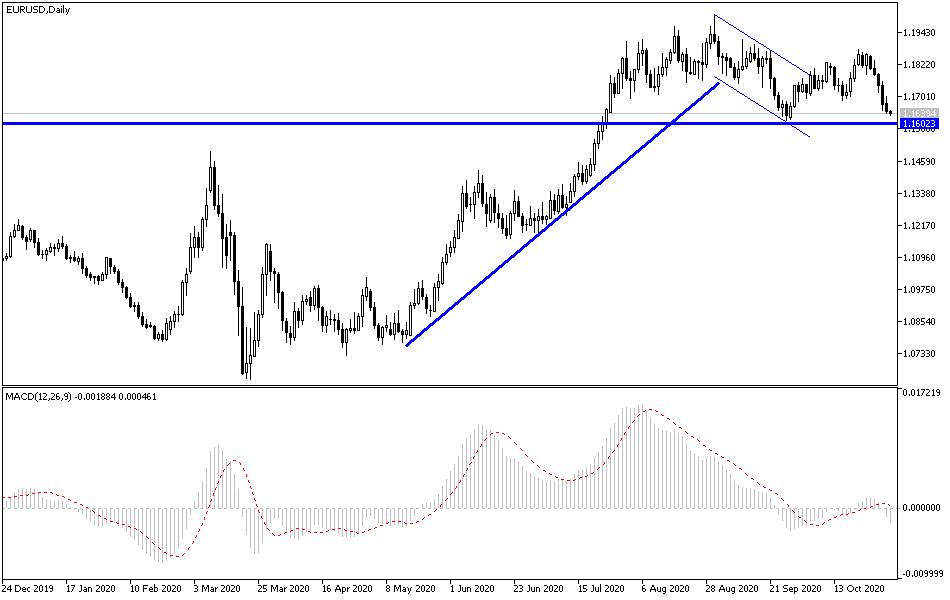

On the near term, it appears that the EUR/USD is trading within a bearish pattern formation amid increasing pressure. The pair is now down, trading at 76.40% Fibonacci level and on its way further down. Accordingly, the bears will look to hold onto the current bearish move by targeting short-term gains around 1.1650 or below at the 100% Fibonacci level at 1.1616. On the other hand, the bulls will be looking for gains from a pounce from the retracement at around 61.80% and 50% Fibonacci at 1.1716 and 1.1750, respectively.

On the long term, and according to the EUR/USD performance on the daily chart, it appears that the pair has recently dropped after a sharp rise. This indicates an attempt by the bears to dominate the pair over the long term. Accordingly, they will target long-term gains around 38.20% and 50% Fibonacci at 1.1491 and 1.1325, respectively. They will also be looking to roll in for profits around 1.1821 or higher at 0.00% Fibonacci at 1.2006.

Today's economic calendar data:

From the Eurozone, the industrial Purchasing Managers' Index (PMI) reading for the Eurozone economies will be announced. During the US session, the ISM manufacturing PMI and construction spending index will be announced.