The EUR/USD currency pair did not celebrate much of the recent optimism about the coronavirus vaccines, and is waiting for the markets to officially approve their handling. The currency pair quickly gave up the resistance at 1.1920 that it was testing in response to that. Then the US dollar returned to rise again, and accordingly, the pair moved down quickly towards the 1.1745 support and tried to retreat to close last week's trading up. But the bounce gains did not exceed the 1.1837 resistance, around where the week's trading closed. With the passing of the US presidential election storm temporarily, investors' focus has returned to the COVID-19 pandemic and its impact on the global economy, which will see restrictions reimposed to contain the new outbreak.

In this regard, the US state of Nevada reported a record number of new, confirmed coronavirus cases for the second day in a row, amid warnings from Governor Steve Sisolak that the state is at a "critical juncture". Sisolak pleaded with residents to stay home and do what they can to protect themselves, a day after announcing that he had tested positive for COVID-19. On Friday, Sisolak told reporters that he was not feeling any symptoms and would be quarantined.

Nevada recorded 2,269 new infections and 15 additional deaths on Saturday, beating the record of 1,857 new infections on Friday. American cases exceeded the 10 million mark.

European countries also quickly imposed restrictions to contain the second wave of coronavirus.

On the economic side, U.S wholesale prices rose moderately in October as food prices jumped to their highest level in five months. At the end of last week, the US Labor Department reported that the Producer Price Index, which measures inflation pressures before they reach the consumer, rose 0.3% last month, slightly lower than the 0.4% rise in September. Food costs rose 2.4%, the largest increase since the 5.6% increase in May which was linked to shortages caused by the pandemic.

The rise in wholesale prices comes in the same week that government data showed that retail prices were unchanged in October, and consumer inflation rose by just 1.2% in the past twelve months. Over the past twelve months, wholesale prices have only increased 0.5%, and core inflation at the wholesale level, which does not include volatile energy and food items, rose by only 1.1% over the past year.

The benign readings on inflation are a welcome sign in the US Federal Reserve, which will feel comfortable staying with very low interest rates for some time. Some economists believe that the Federal Reserve will not start raising US interest rates until 2024.

Instead of worrying about inflation, economists say deflation could become the biggest concern as coronavirus infections increase across the United States. More than 100,000 new confirmed cases have been reported in the United States every day for more than a week. California and Texas each reached a milestone this week with 1 million cases of COVID-19.

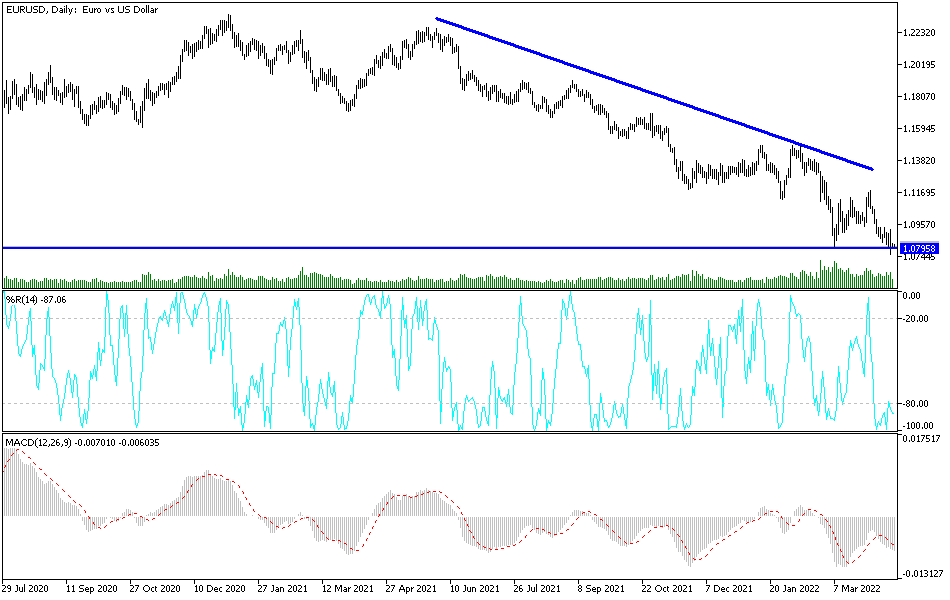

Technical analysis of the pair:

There is no change to my technical view of the EUR/USD performance, as stability above the 1.1800 resistance is still catching the interest of Forex bull traders to move towards higher resistance levels. At the same time, the psychological resistance at 1.2000 remains a big question for traders. Will we see comments from the European Central Bank again on the seriousness of the rise in the euro’s value? On the downside, according to the performance on the daily chart, a drop in the currency pair below the 1.1745 support level will increase the bears' control to push the pair towards stronger support levels. I still prefer to sell the pair from every higher level.

Today, the euro will be affected by the highly anticipated remarks from European Central Bank Governor Christine Lagarde.