The uncertainty of the winner of the US presidential elections, which will be held today, increases the strength of the US dollar as a safe haven. The EUR/USD began this important week by completing the downward path, with losses reaching the 1.1622 support - near its lowest level in two months - and stands at 1.1635 at the time of this writing. It was the sixth consecutive drop and the longest period of continuous losses in more than two months, supported by new “closures” in the major Eurozone economies that affected risky assets such as stocks as well as currencies associated with them, such as the euro.

Warnings from the European Central Bank (ECB) about easing policy in December also helped the euro to collapse, but after falling nearly 2% last week, the single European currency is now benefiting from a set of nearby technical support levels that may help prevent it from falling more in the future.

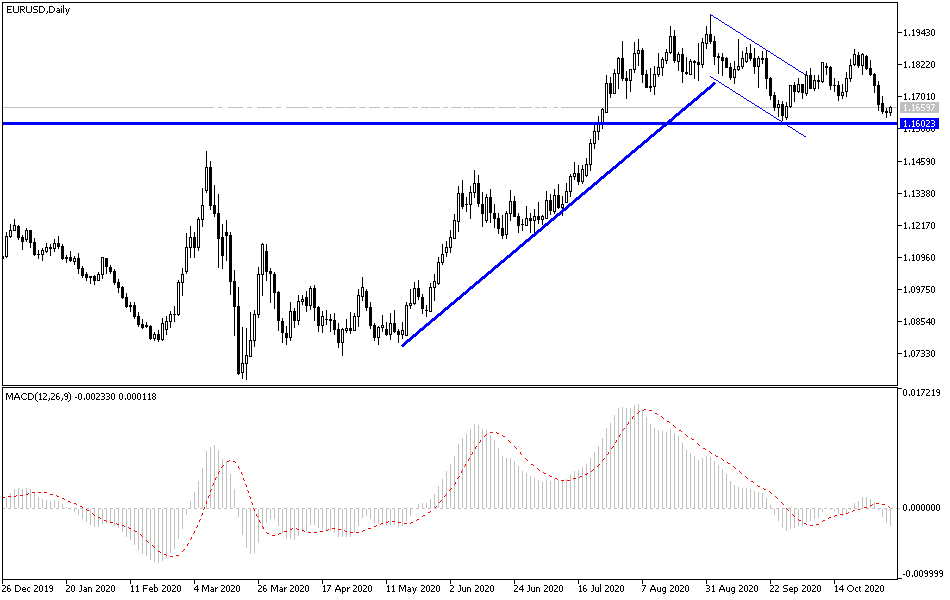

Commenting on the performance, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says, “The EUR/USD pair failed recently at its highest level reached on September 21 at 1.1871, and has now eroded the 1.1688 low from last week. Failure here leads to increased downward risk in the near term, which means losses to the recent low at 1.1612," she said. “The Elliott wave numbers are now negative during the day, indicating room to erode below 1.1612, the currency pair will target support at 1.1495, March high, which, if reached, is expected to hold.”

The US vote Tuesday and the subsequent results of who will win the US election is the main event for the currency exchange this week and will have an impact on price action for a long time after that. The stronger prospect is a "clean sweep" that sees the opposition Democratic Party dominating both houses of Congress, which is seen as likely to affect the dollar while it raises risk currencies like the euro next year. However, weekend reports indicated that US President Trump is closing the gap with Biden in major swing states.

Peter Karbata, Head of Foreign Exchange and Bonds Strategy at ING, said, “We will trust the polls and expect a risk-friendly Biden win today, which is negative for the US dollar, positive for economic cycles, but the risk of delays in results may be minimized, and therefore, the result of the blue wave is positive for the EUR/USD pair (largely due to its negative effect on the US dollar) and thus may push the EUR/USD pair higher than the resistance at 1.1800."

Final survey results from IHS Markit showed that the Eurozone manufacturing sector gained further strength in October driven by acceleration in production and new orders. Accordingly, the manufacturing PMI rose to a reading of 54.8 in October from 53.7 in September. The expected result was 54.4. A reading above the 50 level indicates growth in this sector. According to the details of the results, production increased for the fourth month in a row, with a sharp growth rate of more than two-and-a-half years. Likewise, new orders recorded the largest growth since the beginning of 2018, reflecting higher demand from domestic and foreign markets.

However, employment levels continued to decline, extending the current downturn to a year-and-a-half.

On the price front, the survey showed that input costs rose for the third month in a row, with the fastest inflation rate for 20 months. Firms were able to pass a proportion of the higher input costs to customers. Looking at future production, business confidence remained positive for the fifth consecutive month in October.

Commenting on the results, Chris Williamson, economist at IHS Markit said, "The renewed weakness of business facing the consumer is a reminder that while manufacturing as a whole may be thriving at present, the sustainability of the recovery will depend on the household behaviour returning to normal and the strengthening of labour markets." The economist added, "Looking at the second wave of COVID-19 infections, this is still a long way off."

Among the Big Four economies, Germany is again the best performing country, with the relevant PMI reaching its highest level in more than two-and-a-half years.

Technical analysis of the pair:

Based on the daily chart performance, the EUR/USD pair is still moving within the range of its descending channel since it abandoned the 1.1800 resistance, and we noted at the time that the bears' control will be strengthened. Despite the recent decline, the indicators still have some time to move towards oversold levels. Therefore, the downside wave is expected to continue and the support levels at 1.1610, 1.1545 and 1.1470, respectively, might be next targets. On the upside, it is waiting to cross the 1.1800 resistance again to have the first chance for the awaited rebound.

Today's economic calendar data:

There are no significant European economic releases today and all focus will be on the course of the US elections.