At the beginning of this week's trading, the EUR/USD pair continued the upward correction path, as was the case last week. This comes with the continued drop of the US dollar after it was declared by media networks that Joe Biden had won the US presidential election. President Trump supported record and historical gains for the US dollar as a safe haven in recent years, which culminated in global fears of the COVID-19 epidemic. Upward correction gains resulted in testing the 1.1920 resistance, its highest level in more than two months. But with profit-taking selling, the pair quickly collapsed to the 1.1795 support before settling around 1.1830 at the time of writing.

In addition to Biden's victory, investors' optimism increased from the announcement that Pfizer has a vaccine to confront the coronavirus, with success rates that would qualify it to obtain global approvals.

German exports increased more than expected during the month of September, while imports decreased slightly. According to German statistics agency figures, exports increased by 2.3 percent on a monthly basis, faster than economists' expectations of 2 percent, but slower than the 2.9 percent growth recorded in August. Meanwhile, German imports fell 0.1%, which baffled expectations for a 2.1% increase. Imports increased 5.8 percent in August.

As a result, Germany's trade surplus increased to 17.8 billion euros, seasonally adjusted, from 15.4 billion euros recorded in August. The expected surplus was 15.8 billion euros.

On an annual basis, German exports fell at a slower pace of 3.8 percent, after a 10.2 percent decline in August. Likewise, imports decreased by 4.3 percent, compared to a decrease of 6.8 percent in the previous month. The total unadjusted trade surplus was 20.8 billion euros, which is less than the 21.2 billion euro surplus recorded in September 2019.

The current account of the balance of payments showed a surplus of 26.3 billion euros compared to 23.5 billion euros in the same period last year. Exports to China increased by 10.6% from last year, while shipments to the United States, which has been hard hit by the Coronavirus pandemic, decreased 5.8%. Exports to the UK showed an annual decline of 12.4 percent.

During September, most of the imports to Germany came from China. Goods worth €9.7 billion were imported from there, which means that imports from China increased by 3 percent from September 2019.

The United States of America has confirmed that there are more than 10 million cases of coronavirus, according to data collected by Johns Hopkins University, as infections continue to rise in nearly every US state. Daily new confirmed cases have increased by more than 60% in the past two weeks, to nearly 109,000 per day. Average daily cases are rising in 48 states.

The United States accounts for about a fifth of the world's 50 million confirmed cases.

France has recorded 551 COVID-19-related deaths in hospitals in the past 24 hours, a record since the second wave of the virus started sweeping the country. The latest census brought the total number of people who died in France since the start of the epidemic to 40,987. France is the fourth country in the world in terms of the number of cases - more than 1.8 million as of Monday - since the coronavirus began in early 2020.

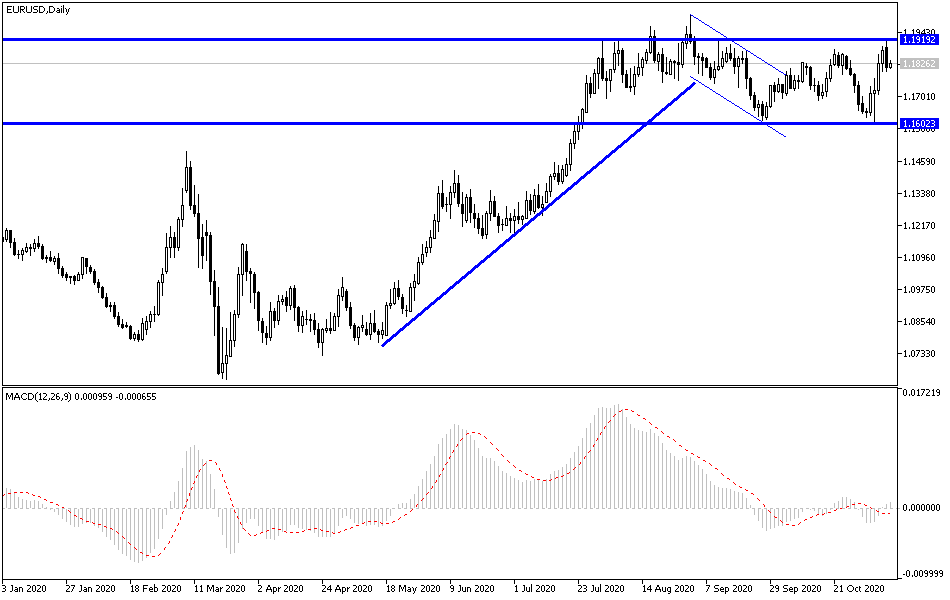

Technical analysis of the pair:

Despite attempts for a bearish correction amid profit-taking sales, the price of the EUR/USD is still in a bullish correction range, and will remain so as long as it is stable above the 1.1800 resistance. As expected, euro gains will continue to face the continued coronavirus infections in Europe, and consequently the imposition of more restrictions that threaten the future recovery of the Eurozone. Therefore, the pair's gains will remain the focus of forex traders to consider selling, especially a test of the 1.2000 psychological resistance, which received negative comments from European Central Bank officials regarding the value of the euro.

On the downside, according to the pair’s performance on the daily chart, if the pair moves towards the 1.1690 support, bears will control the performance again.

Today's economic calendar:

From the Eurozone, the ZEW economic sentiment index reading will be announced, and for the US dollar, the main attention will be on the US Federal Reserve policy officials.