For five trading sessions in a row, the EUR/USD pair has been trying to correct higher, and the retracement gains have stalled around the 1.1893 resistance level at the time of writing. Today, the euro is awaiting the release of Eurozone inflation figures, in a clear absence of US economic releases. Euro gains are under pressure of failure to continue due to successive European restrictions to contain the outbreak of the coronavirus, which registered record numbers exceeding the strength of the first wave. This is in addition to the European Central Bank monitoring euro gains, especially if it moves towards the psychological resistance at 1.2000. The bank believes that the euro’s exchange rate strength will be a strong obstacle to its efforts to revive the European economy.

According to a new analysis from Danske Bank, the attractiveness of the United States as a destination for international capital is likely to ensure that the dollar enjoys continued demand. At the same time, an analysis from Barclays suggests that any bullish potential in the EUR/USD exchange rate will be limited from here. The EUR/USD exchange rate rose again to the top of a multi-week range throughout the month of November, moving from a low of 1.16 on November 4 to current levels on the cusp of the 1.1900 resistance. Accordingly, those who support further gains from the EUR will view this level as offering some noticeable resistance and will therefore be wary of returning to the lower range as a result. However, a break above the current area might open the door to 1.20 again.

According to Danske Bank, the EUR/USD exchange rate at 1.20 represents the exchange rate limit. The Scandinavian lender has issued a new set of foreign exchange forecasts which show that while the euro could rise against the dollar to 1.20 again, the dollar should remain favourable in 2021. In this regard, Lars Merkelin, the bank’s chief analyst, said: "The current negative developments of COVID-19 are leading at the moment. The EUR/USD pair moved towards 1.19 on the back of the US elections, but fell slightly again despite the positive developments of the vaccine."

During 2020, the EUR/USD exchange rate reached its lowest level at 1.0630 at the height of the market collapse in March due to COVID-19, before embarking on a sustainable recovery that brought it to the important psychological level at 1.20 on September 1. Since then, the pair has once again faded into its current trading range.

Not so, says Danske, which sees the next directional move lower. According to the bank: “We still see the EUR/USD pair around 1.20 in 3 months, but on the long term the US dollar is still the 'winner' and we expect the pair to be between 1.16 to 12 dollars.”

Analysts at Barclays agree: “The rise in virus cases and subsequent concerns about a further sharp economic downturn in the near term - even with a more positive outlook in the medium term from vaccine developments - has paused the euro’s rally after the American elections,” says Wayne Yan, a Forex strategist at Barclays in London. “We suspect that some renewed demand for the safe-haven dollar, leading to a better USD performance, is likely to limit the EUR/USD's gains.”

The forecast for a stable dollar in 2021 contrasts markedly with those held by Citibank, which told clients on Monday that they expect the US dollar to weaken by as much as 20% next year. Analysts at the world's largest Forex trader say vaccine distribution next year will help drive the declines, and analysts there also see the possibility of a weak dollar emerging.

This indicates that dollar losses will accelerate and could occur in a relatively fast move. Citibank assumes that the Fed will maintain loose monetary policy even if inflation rises along with the economy's recovery, allowing US bond yields to rise. But looking at 2021, for Danske, the United States will remain a desirable destination for international capital that should ensure dollar support.

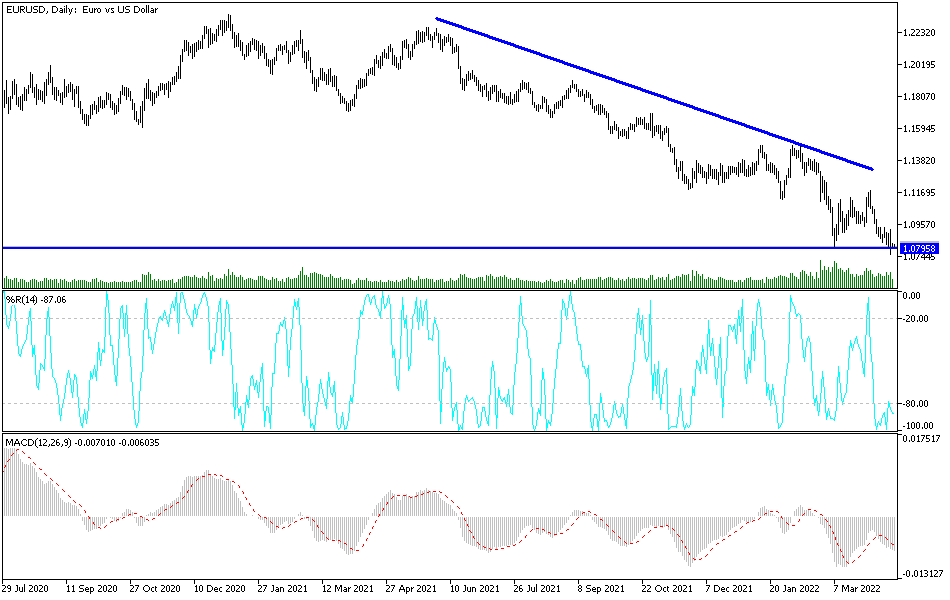

Technical analysis of the pair:

There is no change to my technical view of the EUR/USD pair, as the current stability above the 1.1800 resistance will remain supportive of the bulls in controlling the performance for a longer period. However, as I mentioned in recent technical analyses and in line with the expectations of banks, the aforementioned global markets will continue to monitor the psychological resistance level at 1.2000 and the European Central’s reaction to it, as the opportunity to move towards it remains. On the downside, according to the performance on the daily chart, the 1.1745 support will interest bears to move the pair to stronger support levels and thus represents a clear threat to the current correction.