In an exciting performance since the beginning of this week's trading, the EUR/USD moved in light of optimism about Biden's victory in the American elections and the announcement of a possible coronavirus vaccine. Both were factors supporting the pair in the correction to a higher level, reaching the 1.1920 resistance, the closest to crossing the 1.2000 psychological resistance. But amid European restrictions to contain the coronavirus outbreak which may weaken the stalled European activity in the first place, the pair quickly corrected downward to the 1.1780 support during yesterday's trading, and stabilized around 1.1830 at the time of this writing, The pair may witness limited movement during today's trading in light of the American holiday of Veteran's Day and the absence of important European economic releases. Therefore, investor sentiment will have the largest impact on the direction of the currency pair.

In general, the euro has proven to be an unexpected loser for the positive feelings of investors raised by the successful news of Pfizer developing a coronavirus vaccine. But one prominent foreign exchange analyst says that the European currency can create greater momentum. Kate Jokis, Global Head of Foreign Exchange Research at Société Générale, stated that there is a good chance the EUR/USD pair will reach the exchange rate of 1.20 by December.

As for the EUR, the European ZEW survey of economic confidence for November missed expectations of 63.7 with a very weak reading of 32.8. ZEW's reading of German economic confidence also came short at 39 against expectations of 41.7, while the survey of the current situation came back better than the expected figure of -64.3 versus -65. In France, industrial output for the month of September beat expectations (monthly) of 0.8% with a change of 1.4%, while the unemployment rate for the third quarter rose to 9% from 7.1% the previous month. The forecast had been for a rate of 7.5% for the three-month period.

In the US, jobs in JOLTS for the month of September missed expectations of 6.5 million, with 6.436 million jobs recorded. On the other hand, the US NFIB business optimism index for October beat expectations at 102.2 with a reading of 104. November's Redbook index declined on both monthly and annually levels.

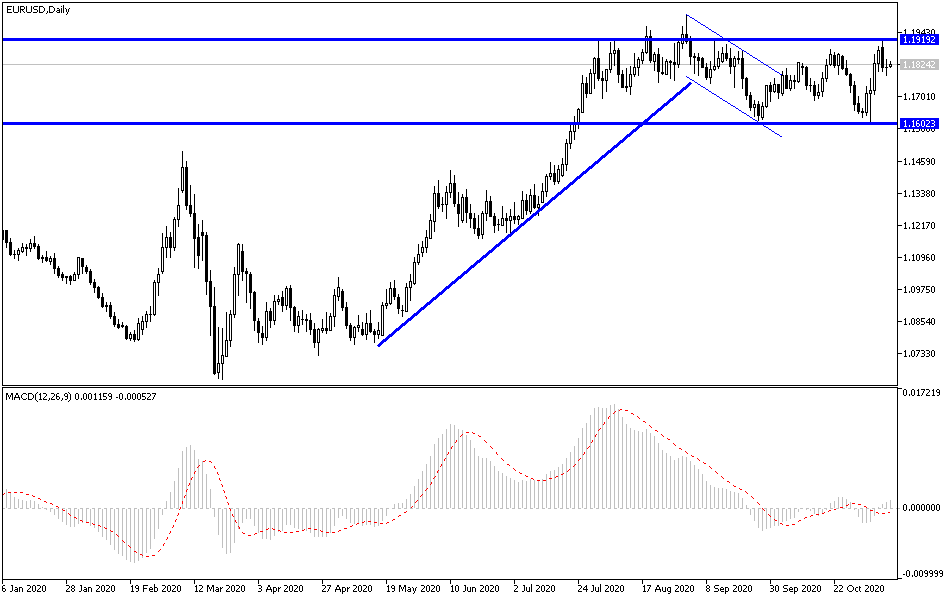

Technical analysis of the EUR/USD pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD pair has declined recently after a sharp rise. The pair is now stuck inside a downward channel, which indicates a possible short-term bearish bias in market sentiment. Therefore, the bears will look to extend the current decline towards 1.1776 or less to 1.1748. On the other hand, bulls will be looking to gain from a pounce of around 1.1828 or higher at 1.1853.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a slightly descending wedge formation. This indicates a slightly long-term bearish bias in market sentiment. Therefore, bears will be looking to ride the downside by targeting profits at around 1.1688 or lower at 1.1491. On the other hand, bulls will be targeting long-term profits around 1.2010 or higher at 1.2207.