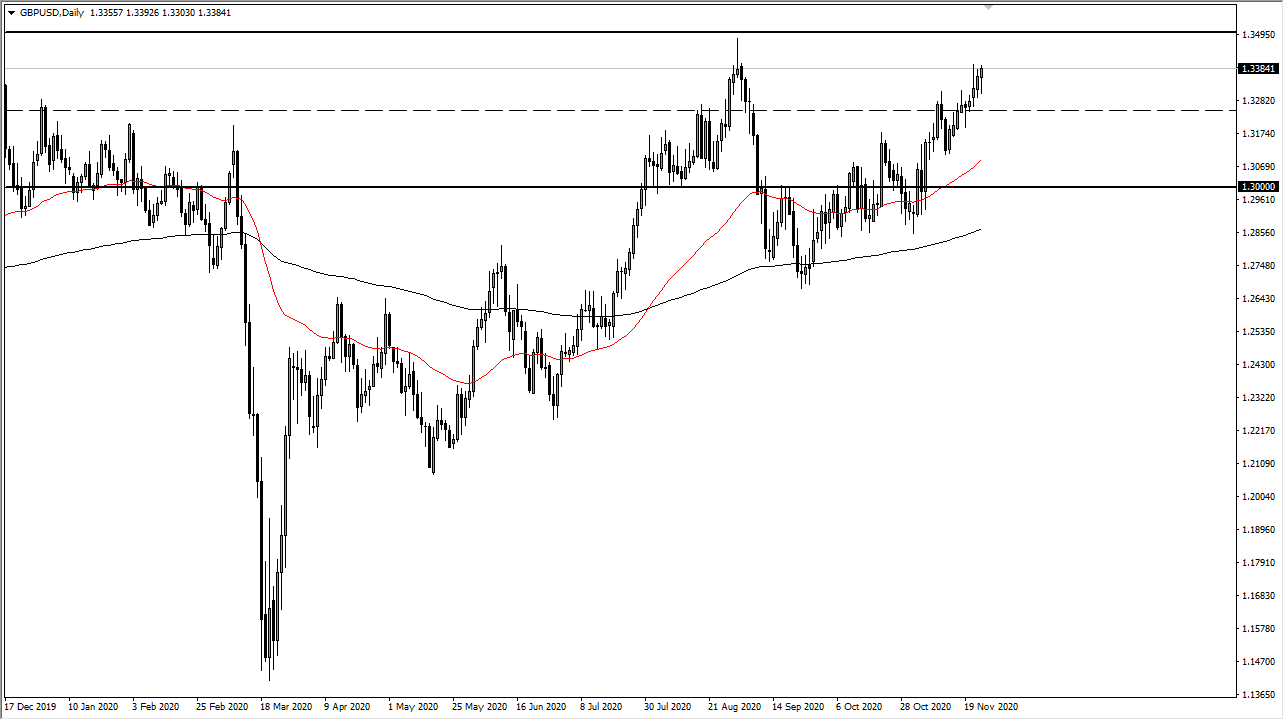

The British pound pulled back initially during the trading session on Wednesday but continues to see a lot of buying pressure as we see hope of a Brexit deal creeping back into the market. Traders are assuming that there will be a deal by the end of next week, so we will likely continue to see a lot of fluctuation; but every time we pull back it will be a buying opportunity. The market has gotten ahead of itself but, given enough time, we should continue to reach towards the 1.35 handle, breaking out to even bigger moves.

To the downside, the 1.3250 level will be supported, and then the 50-day EMA underneath there would be a buying opportunity as well. The market continues to go higher, but the 50-day EMA underneath should be a massive support level. Breaking above the 1.30 level is a good sign for the 50-day EMA as well, and it is at a nice upward angle. However, it is only a matter of time before we get value hunters.

If we break above the 1.35 handle, this will probably be the next leg higher, and it will probably be due to some Brexit news. If we get a deal, I anticipate that the British pound will shoot straight through the 1.35 handle without many issues. The next target would be the 1.3750 level, and perhaps even further from there. To the downside, if we break down below the 1.30 level it would be rather ugly, but that would be due to a "no deal" Brexit. The market would then see a lot of volatility and an extreme amount of negativity. But now we are looking at a scenario where there is probably more room to the downside than up - depending on the announcements - because it would be a complete shock to what most people are banking on.