The British pound continues to get optimistic pressure to the upside due to people believing that Brexit will be solved. The reason I know that is because the British pound has rallied against almost everything and not just the US dollar. Granted, the US dollar is a bit soft due to there being a perceived stimulus coming down the road in America.

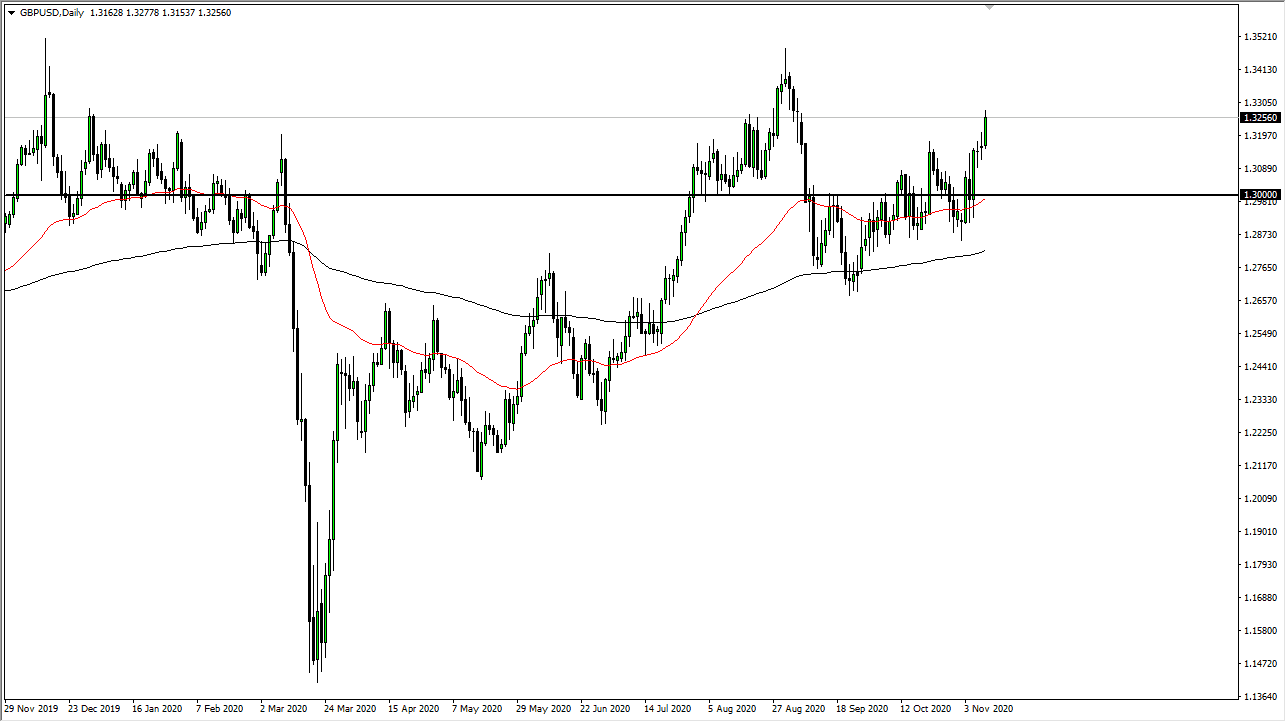

Furthermore, the 1.30 level underneath should be massive support, as it was strong resistance previously. Furthermore, the 50-day EMA sits right around that level which will also attract attention and could provide support. This is a market that looks like it is going to continue to grind higher, the key word here being “grind.” We are going to continue to see the British pound try to break towards recent highs. To the upside, the 1.34 level should be a massive resistance barrier, and I think it is nearly impossible to imagine that we could get above there without a tight.

Underneath, the area between the 50-day EMA and the 200-day EMA continues to be a major “support zone” that traders are paying attention to. It seems the US dollar is threatened by the British pound and other currencies at the same time. However, the biggest concern that I have with this pair is the fact that Brexit is not solved. This pair can be manipulated occasionally by a random quote or tweet.

We are a bit overextended and we should see a bit of profit-taking at the very least, if not flat-out selling. Nonetheless, I look at the idea of buying pullbacks more than anything else when it comes to this pair, because it is a value proposition in general. You need to keep an eye on how the market is going to play out. We have plenty of headlines ahead of us, so you do not want to be buying the British pound after it has rallied. You want to find support and value underneath.