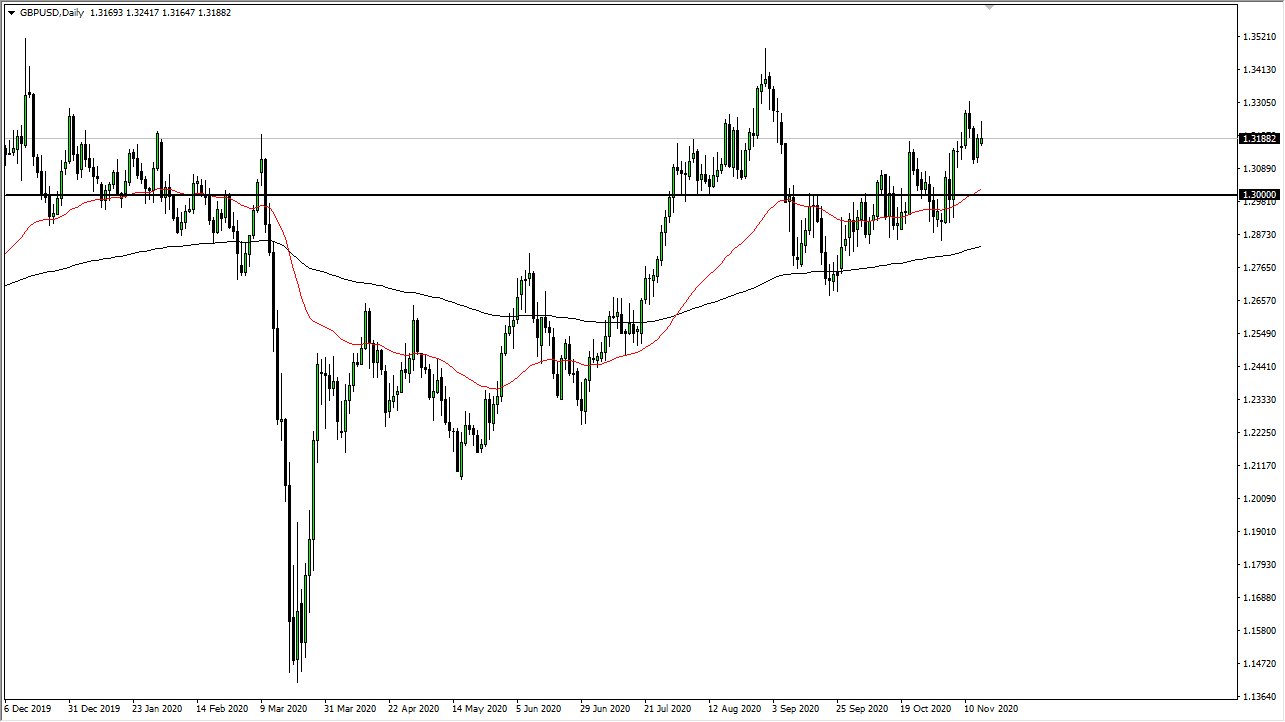

The British pound initially tried to rally during the trading session on Monday but gave back the gains above the 1.3250 level to form a less than attractive candlestick. This ended up forming a shooting star, and it suggests that perhaps we are running out of momentum. That would not be a huge surprise considering the fact that Brexit continues to be a major overhang out there, and we have no idea how that is going to play out in the longer term. Yes, people keep betting on the fact that there is going to be some type of an agreement, but it has been almost 4 years now.

I think a pullback is likely, but I am not thinking that we are going to break down massively and I am not looking to short this market. Rather, I am looking to buy on some type of pullback. I believe that the 1.30 level would be an area of extreme interest as the 50-day EMA is right in that same area, and it is a large, round and psychologically significant figure. Now that we have those two things going on at the same time, I am looking for a supportive candlestick in order to go long. This market is extraordinarily resilient, and every time you think it is over for the British pound, it finds another reason to rally. It is very painful to try to short this market more times than not, so this is what we need to think about.

Looking at this chart, a simple attempt at value is probably what you are going to be looking for. The area between the 50-day EMA and the 200-day EMA would be a great supportive area to look for value propositions, especially based on a supportive candlestick. We may pull back, but there are plenty of buyers underneath who will take advantage of this. However, if we were to break above the 1.33 handle, then the market will continue going towards the 1.35 handle.I have no scenario in which I'm willing to short this market in the near term.