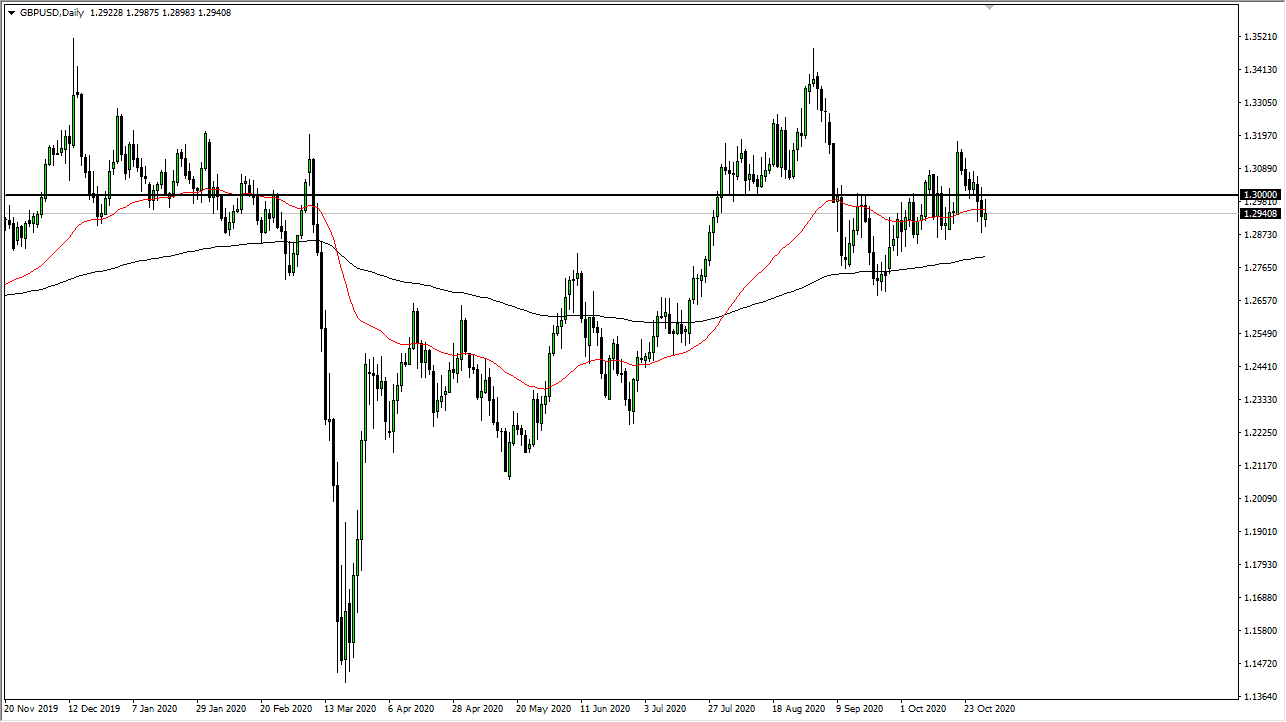

The British pound went back and forth during the course of the trading session on Friday. The market seems to be struggling with the 50 day EMA, but perhaps more importantly the 1.30 level. The 1.30 level of course is a large, round and psychologically significant figure, and if you zoom out to the weekly and monthly chart you will see how important it truly is. It should therefore not be a huge surprise that we have gone back and forth. Furthermore, we have a whole host of fundamental factors out there that will continue to keep this pair rather noisy.

The shape of the candlestick does suggest that there is a lot of pressure above, which makes sense considering that the Brexit situation is still going to be a major issue. I think we are looking at a scenario in which people simply do not trust the British pound. We also have a lot of concerns about the United States, but ironically that tends to drive money into the US dollar as people buy treasury bonds more than anything else. Obviously, those priced in US dollars drive up the demand for the currency.

The election on Tuesday will probably be hotly contested. Beyond that, the questions about stimulus still remain. Although we think that the market is going to get plenty of it, the question is how much? Stimulus is not coming in the short term, so that could put a short-term bottom in the US dollar. If that is the case, then we will probably go looking towards the 200-day EMA underneath which is painted in black on the chart.

Even if we do break above the 1.30 level, there is significant resistance all the way to the 1.31 handle to keep the market down. The market could break through all of that if we get some positive news involving Brexit, which is a threat that has driven this pair back and forth for several years. I suspect a short-term pullback is likely, but I do not think it is going to be a big one.