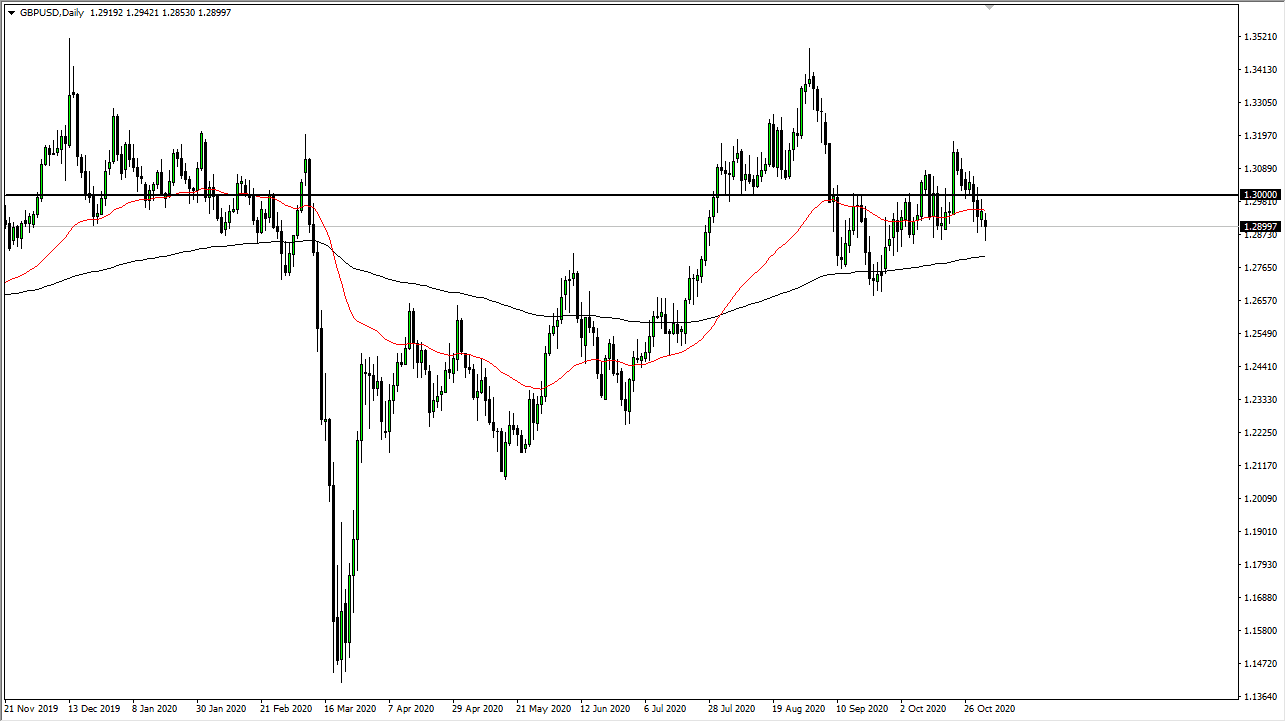

The British pound initially broke down during the open on Monday, as traders caused a gap during the Asian session. We have turned around to fill that gap though, and it looks like we are trying to rally from here as we formed a hammer. This is preceded by a shooting star, so I do think that we will probably see some confusion, as people are waiting to see the end result of a multitude of things.

The US election of course is front and center, but the United Kingdom is looking to destroy its own economy by locking things down. That will, of course, have many repercussions for the British pound, as the economy will likely come to a complete stop. I do believe that we are going to continue to see choppy volatility. This is one of the main markets that you should leave alone, since the plethora of problems coming this week for both of these currencies cannot be underestimated. We also have a Bank of England meeting later this week which will keep things interesting, right along with the jobs figure and the FOMC meeting coming out of DC.

It does look like we have support underneath, but simply jumping in and buying the British pound against the US dollar is reckless. The 200-day EMA underneath could offer some support, but if you are reckless enough to start buying the British pound here, you might want to do it against other currencies. The US dollar may get jumped into since the markets like buying greenbacks in order to find a bit of safety. This is perhaps because of the natural bid for bonds, but it can be difficult to see anything close to clarity in the next couple of days. This is a scenario where you may need to look more towards the weekly charts and wait for finality to all of the current issues.