The British pound has rallied during the trading session on Tuesday, as traders started to bet on a quick outcome to the US elections. If that will be the case, then that is very good for a risk appetite situation, and people will focus on the possibility of whether or not there is going to be massive stimulus coming out of the United States. I suspect that might be a mistake, but this is a pair that has been going higher to begin with.

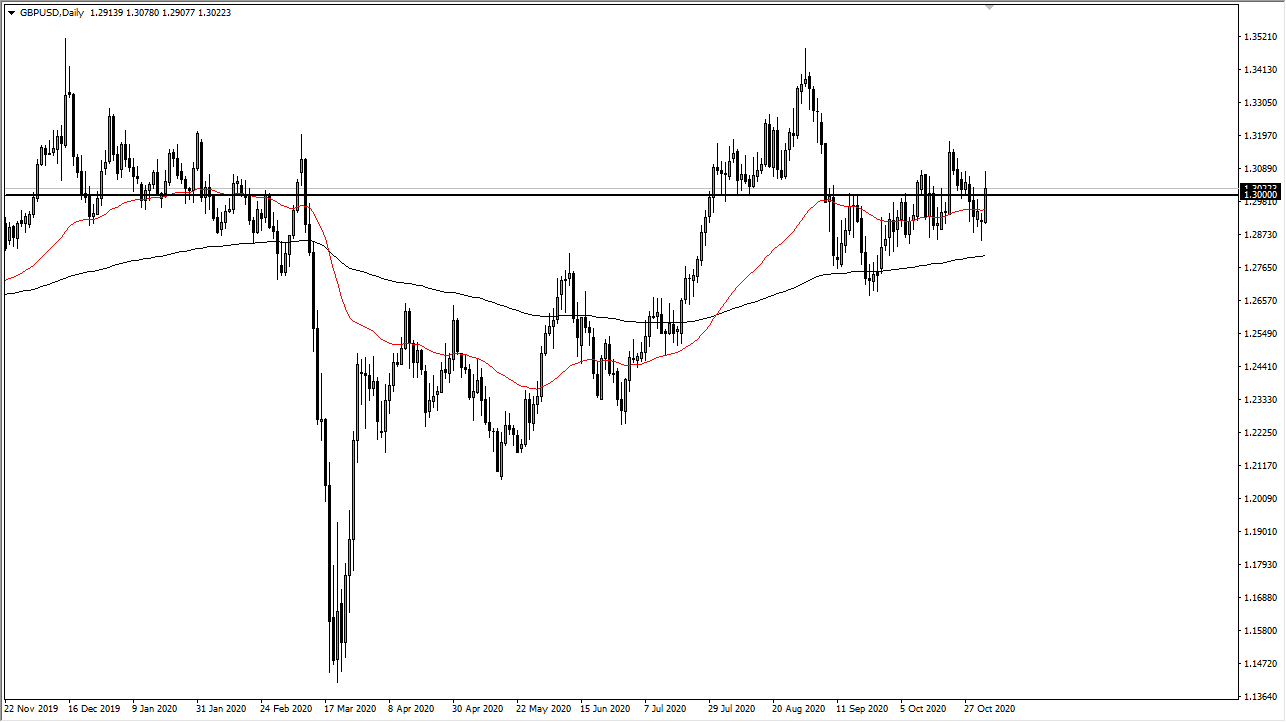

The fact that we pierced the 1.30 level does not mean as much during the candlestick that formed on Tuesday, simply because we have sliced through it several times now. If we can break above the 1.32 level, that opens up the possibility of a move towards the 1.34 handle. Alternatively, if we pull back from this area then we will probably go looking towards the 1.29 level, possibly down to the 200-day EMA. There has been support between the 50-day EMA and the 200-day EMA recently, so you should continue to pay attention to this zone of support.

What is ironic about this is that the trading during the session on Tuesday was all about the US dollar and had nothing to do with the British pound. The United Kingdom is locking down its economy, and even though people assume there will be large amounts of stimulus in the United Kingdom, that does not necessarily bode well for the currency. The real question with the British pound will be Brexit, which will have a major influence on where we go next with sterling. As long as that specter hangs over the head of the British pound, if you are looking to sell the US dollar you will probably be better off using a different currency to bet against it. I believe that the market is likely to go higher than lower, but this is more of a longer-term grind. Volatility should continue to be a major problem.