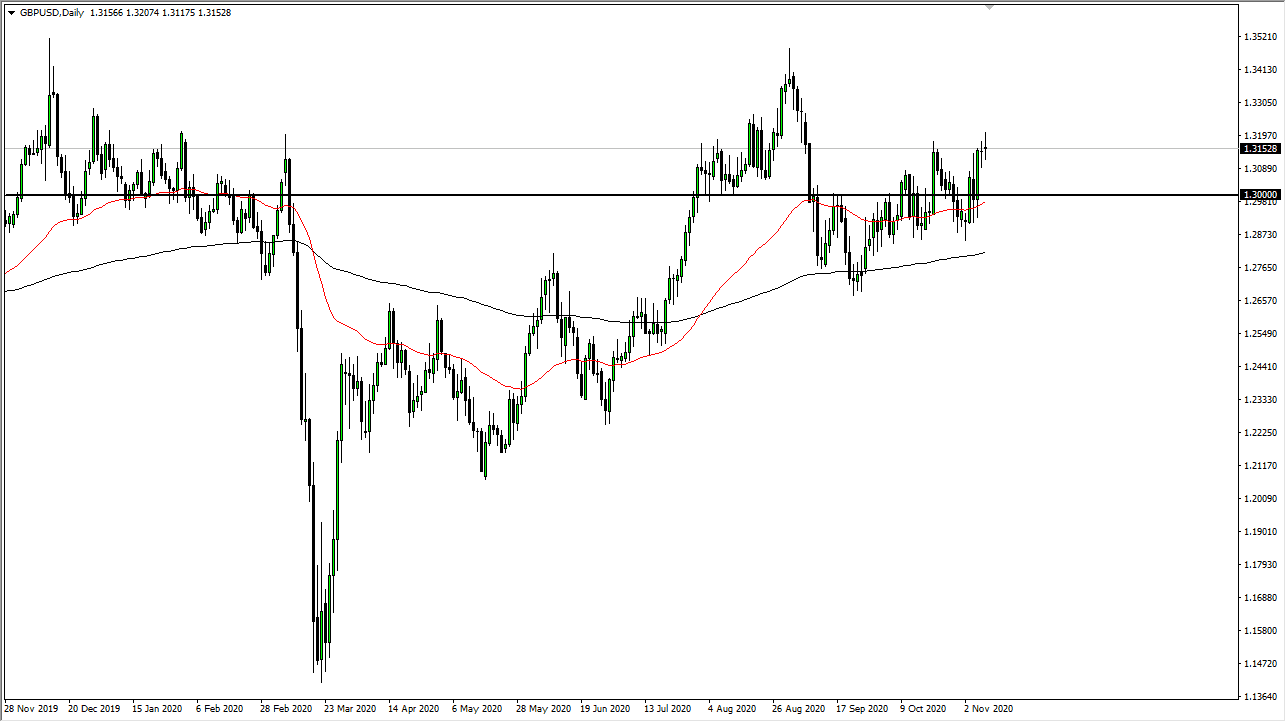

The British pound continues to fluctuate overall, and the 1.32 level continues to cause major issues. It is likely that we get a pullback in the short term. I am not necessarily going to start shorting this market, but I recognize that we may struggle to see a continuation. The British and the Europeans are trying to work things out with Brexit yet again, and it looks as if we are going nowhere on that front.

We are likely to see trouble with the British pound, so if you are looking to buy the US dollar, you may wish to do it against other currencies. We might get positive news about Brexit that would have large effects on where we go as far as the upside. We could probably go as high as the 1.34 handle, perhaps even the 1.35 level. If we get a Brexit solution, that may send the British pound straight up in the air. However, we have been grinding higher overall, and that probably will continue to be the case.

To the downside, the 1.30 level underneath will probably be very supportive, just as the 50-day EMA is reaching towards it. There is a “zone of support” underneath extending from the 50-day EMA down to the 200-day EMA. If we break above the top of the candlestick for the trading session on Monday, then we will accelerate the upside and continue to go higher.

The one thing you can count on with this pair is that it will continue to be very noisy. This is a market that has a lot of moving pieces right now, so we need to keep our eyes peeled for news coming out of London and the EU. In general, buying the dips should continue to work, as it has for the last couple of months.