The GBP/USD currency pair rose to the 1.3177 resistance during last week’s trading, its highest in two months before closing the week’s trading around 1.3147. This comes despite the official announcement of a new failure in negotiations between the European Union and Britain, and as a natural reaction to the USD drop amid controversial US presidential elections. The pair is on a new date for the negotiations between the European Union and Britain, and the financial markets' reaction to the announcement of Biden's victory in the US elections.

Despite the latest performance, the fundamental outlook for the British pound remains negative, and the downside may be strengthened unless the UK-EU trade talks finally release some positive headlines. Before the beginning of trading this week, there was some optimism that an agreement had been reached on fisheries, but the comments from the European Union at the end of next week did not agree to that. It also indicated that major differences between the two sides still exist. Based on these reports, British Prime Minister Boris Johnson wanted to meet with EU leaders in the hope of resolving the current scenario, and largely side-lining Michel Barnier, the chief EU negotiator, who rejected the plan.

Last weekend saw an additional blow to the British Prime Minister's credibility after a recent YouGov poll showed Labour was five points ahead of the Conservatives. This poll showed that the main intention to vote in favour of the Labour Party was by 35 to 40, while Sir Keir Starmer was the best choice for the position of Prime Minister by 29 to 34 percent.

In a surprise move last week, the Bank of England kept lending rates the same, but strengthened the UK's bond-buying program by more than expected, as the UK economy appears to be heading towards a double-dip recession. Accordingly, another £150 billion have been added to this quantitative easing program, compared to analysts ’expectations of £100 billion. This led to the program being promoted by £895 billion as the post-election decline puts the US dollar in key support areas.

Officially, the United Kingdom went into a second lockdown last week, with Prime Minister Johnson's administration and his scholars coming under heavy pressure over the timing of the data used. The data, which showed that about 4,000 people may die each day from the epidemic, have been massively challenged, and scientists have stated that the numbers are not accurate.

This week, there is little official data as the latest GDP and employment figures will be released on Thursday and Tuesday, respectively. The unemployment rate is expected to rise from 4.5% to 4.8%, while the annual GDP of the UK could be at -9.4%.

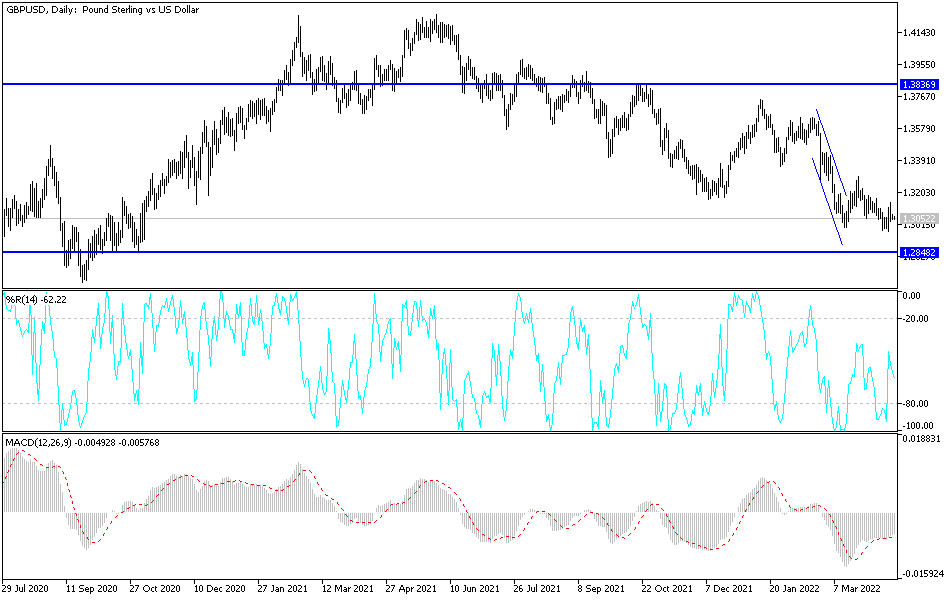

Technical analysis of the pair:

As of now, the GBP/USD pair still has a chance of an upward correction as long as it remains above the 1.3000 psychological resistance. Bulls must clear the resistance levels at 1.3250 and 1.3340 to ensure control of the performance. In return, any attempt by the bears to push the pair towards and below the 1.3000 support will cause the head and shoulders formation on the daily timeframe chart to start triggering profit taking.

Amid absence of US economic announcements today, the pound will be affected by the Bank of England Governor's comments, any development of the Brexit talks, and the extent of investors' risk appetite.