In contrast to other major currencies’ performance, the GBP/USD currency pair moved lower towards the 1.3288 support during last Friday's session and closed the week’s trading around the 1.3308 level. The pair did not benefit much from the risk appetite that dominated investor and market sentiment recently. Last week's rebound gains for the pair did not exceed the 1.3397 resistance. After another failure of the Brexit negotiations, negotiators from the European Union and the United Kingdom will meet for face-to-face talks in London this week to try to reach a post-Brexit trade agreement, but the pound has weakened due to their dispute over fisheries.

According to media reports released on Friday, the EU offered the UK to effectively cede between 15-18% of the EU's current quota to the UK. Apparently, a British source says the offer was rejected outright, which led to growing concerns about the prospect of a deal. "The UK has already torpedoed Michel Barnier's plan to increase British fishing quotas by up to 18 percent of the water before it reaches London," said Joe Barnes, Brussels correspondent for The Express.

Barnes says that his source from the British side told him: "This is ridiculous, and nothing else can be said about it." For his part, British Prime Minister Boris Johnson also told the media on Friday that there are "important and fundamental differences that must be bridged."

It appears that both sides are very far apart on one of the most important things the two sides must overcome if a trade deal is to be made before the end of the year. EU sources told Chris Beck, the BBC reporter in Brussels, that they were surprised by reports that Barnier will soon propose giving up between 15 and 18% of the fishing quotas in UK waters as part of the Brexit trade deal. One diplomat said that this percentage was one of several categories discussed in the past two-and-a-half weeks and would be a "very high price to pay" to "fishing EU countries."

There was no significant British economic release regarding the strength of interest in the Brexit negotiations.

In the US, durable goods orders for October beat expectations by 0.9% with a change of 1.3%. Non-defence capital goods orders from aircraft also beat expectations by 0.5% with a reading of 0.7%, while the preliminary annual GDP growth for the third quarter missed expectations of 33.2% with a reading of 33.1%. The US jobless claims for the week ending on November 20 came against expectations of 730,000, at 778,000. Continuing claims for the previous week were higher than expected at 6.071M versus 6.02M.

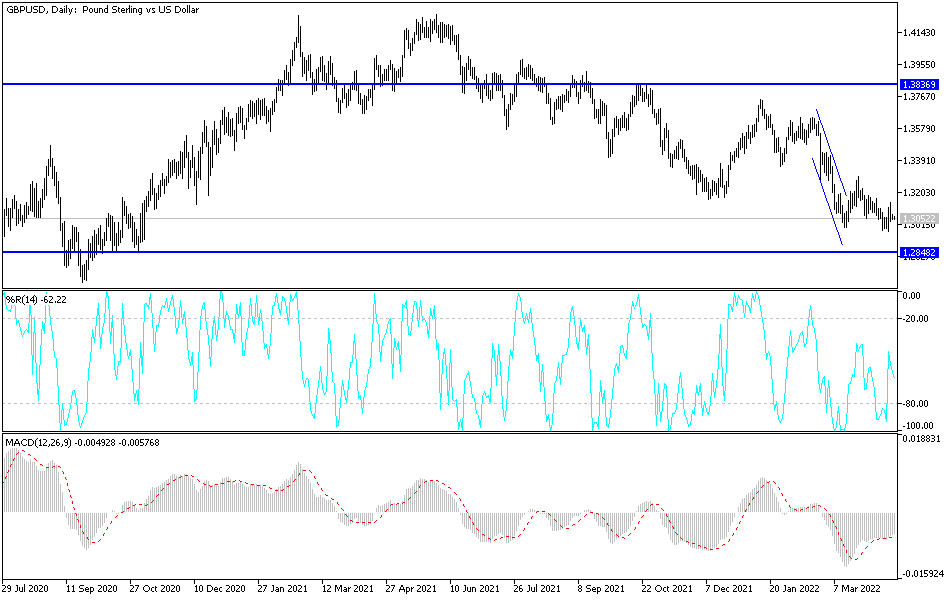

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD pair is trading within an upward channel. This indicates a significant upward short-term bias in market sentiment. The pair has recently retreated to close at the oversold 14-hour RSI levels. Accordingly, bulls will target short-term bounce gains around 1.3352 or higher at 1.3403. Bears will look to extend the current drop towards 1.3254 or lower at 1.3198.

In the long term, and based on the performance on the daily chart, it appears that the GBP/USD is trading in a bullish formation. The pair has recently completed the XABCD double bottom reversal pattern. This placed the pair on a recovery for the upward correction case. Therefore, bulls will look to extend this trend towards 1.3643 or higher at 1.3987. Bears will be looking for long-term gains around 1.2875, or lower at 1.2458.

Today's economic calendar data:

In the UK, the money supply, net lending to individuals and mortgage approvals will be announced. In the United States, the Chicago PMI reading and then the pending US home sales will be released.