Despite the failure of the European Union and Britain to resolve the contention points between them, the GBP/USD pair has strongly benefited from investors' risk appetite and abandonment of the dollar as a safe haven amid the announcement of coronavirus vaccines. Gains extended to the resistance level at 1.3312, near its highest level in two-and-a-half months, before closing trading around 1.3289. The sterling ended its trading bullish for the third consecutive week against the dollar, but failed for the second time to overcome the 1.3310 resistance level. This coincides with the observed Fibonacci correction in September for the downward correction, which was interpreted by some technical analysts as a bearish omen.

Commenting on the performance, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank, who is selling the pound from 1.3310 and targeting support at 1.2975, says: “The GBP/USD pair failed at 78.6% retracement at 1.3310 and 1.3313 at its highest level in November. Close support is provided by the 55-day moving average at 1.2995 and also by 1.2981, the five-month uptrend. This will allow it to slide here in the short term." The pound enters the new week in the face of an immediate pullback from the 1.331 Fibonacci retracement and will have to deal immediately on Monday with an imminent announcement from Prime Minister Boris Johnson to extend the national lockdown until December.

Economists had already expected the UK's GDP to shrink by -6% month-on-month in November due to the current restrictions, which were already enough to indicate a modest quarterly contraction. Another month of turmoil could mean that the recovery in the fourth quarter has now been written off.

The UK is not alone in facing tighter restrictions for a longer period of time, as Germany is also on its way to another month of lockdown this weekend. US cities and states began following European capitals last week after reported infections recorded new daily highs. Meanwhile, the US Treasury's raid on the Fed casts further doubts about the outlook for the fiscal stimulus and the bipartisan cooperation needed to drive it out.

Pipan Rai, Forex analyst at CIBC Capital Markets, says: “Regarding the US dollar, we are tactically and strategically neutral. Selling the US dollar remains very popular in trading even if the short position deviation has been somewhat reduced. Avoidance of risk means that the decline in short positions in the US dollar continues.”

The United States of America's number of Coronavirus cases has exceeded more than 12 million cases, while hospitalization cases recorded a record level which led to the renewal of containment measures that marred the background supporting the risk assets. The dark economic backdrop is a fertile ground for the stability of the US dollar as a safe haven, which has rallied against many of its major rivals recently.

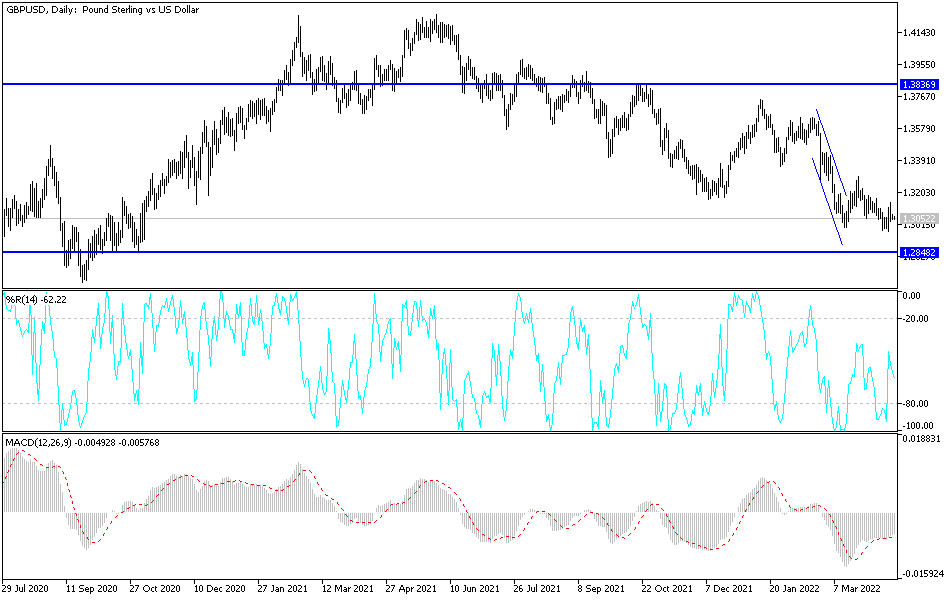

Technical analysis of the pair:

There is no change to my technical view of the GBP/USD performance. On the daily chart, the pair will try to break through the 1.3300 resistance again, and upon the success in that, we may see a test of the resistance levels 1.3355, 1.3420 and 1.3500, respectively. It is worth noting that these levels direct the technical indicators to strong overbought areas, from which one can think of selling operations to reap profits. On the downside, and depending on the performance over the same period of time, there will be no reversal of the trend without breaching the support level at 1.3100. I still prefer to sell this currency pair from every upward level.

Amid the absence of important US economic releases, the pound will be awaiting the announcement of the PMI readings for the manufacturing and services sectors in Britain, as well as the monetary policy report from the Bank of England.