The downward path continues to dominate the GBP/USD performance, which retreated during yesterday's trading session to the 1.2853 support before settling around the 1.2930 level at the time of this writing. This came just a few hours before the start of the US presidential elections, which usually cause a strong change in the performance of global financial markets, especially the currency exchange market. As the US policy directly affects the global economy, the dollar is the international pricing currency. The dollar’s recent gains are supported by the safe haven demand until the results of those elections are announced. After interacting with the results, the dollar will face another important date when the US Federal Reserve announces its monetary policy. By the end of the week, US employment numbers for October will be announced. It really is a very important week.

As for the British pound, it may face a challenge in November, amid fears that the second closure in England will lead to an economic recession that will lead to permanent closure of many companies leading to job losses, which could overshadow any positive developments related to Britain's exit from the European Union.

On Saturday, Prime Minister Boris Johnson announced a second national lockdown for England to prevent what he described as a "medical and moral disaster" on the NHS.

Johnson appeared alongside the government's top medical advisors Chris Whitty and Patrich Vallance to announce the abolition of the staggered system of domestic lockdowns in England in favour of a nationwide lockdown that would be more severe. Such a lockdown poses a significant risk to companies and jobs under severe pressure. "The pound may continue to be depressed for a long and difficult period in November," says Martin Miller, foreign exchange analyst at Thomson Reuters. He added, "It is under pressure with the tightening of the lockdown restrictions in England, the continuing uncertainty about Britain's exit from the European Union, and the daily chart indicates further weakness."

Johnson also said the lockdown will last for one month, but media reports on Monday said the government in fact expects the lockdown to continue into the new year.

According to The Times, cabinet ministers have warned that a second lockdown could extend into the new year, with a short break over the Christmas period. Cabinet ministers told the newspaper that they believed it would be "very difficult" to end the lockdown if deaths continued and hospitalizations increased.

“The British pound fell against both the Euro and the US dollar,” said Rees Herber, an economist at Lloyds Bank. “The Euro also declined against the dollar, which is generally strong despite the uncertainty resulting from Tuesday's election. And while COVID-19 news will likely be the main focus this week, the Brexit negotiations over the week will also continue to be under investors’ focus.”

The announcement of the second shutdown comes as members of the Bank of England’s Monetary Policy Committee are due to meet to discuss whether to cut interest rates or strengthen the money printing program, known as quantitative easing. Economists are leaning to the negative economic impact of the shutdown to urge the bank to take action to try to support the economy.

The general rule is that when a central bank lowers interest rates or increases quantitative easing, the value of the currency issued by that central bank depreciates. Accordingly, economists at Barclays expect the bank to announce an additional £50 billion of quantitative easing that would allow the program to expand into 2021. Far from the short term, Barclays is telling clients in its weekly foreign exchange briefing that they see the risks of a major easing in the first half of 2021, including a high probability of negative interest rates, a development that would severely affect the UK currency in 2021 if it materializes.

The timing of the shutdown comes as progress is seen in post-Brexit trade negotiations with the European Union.

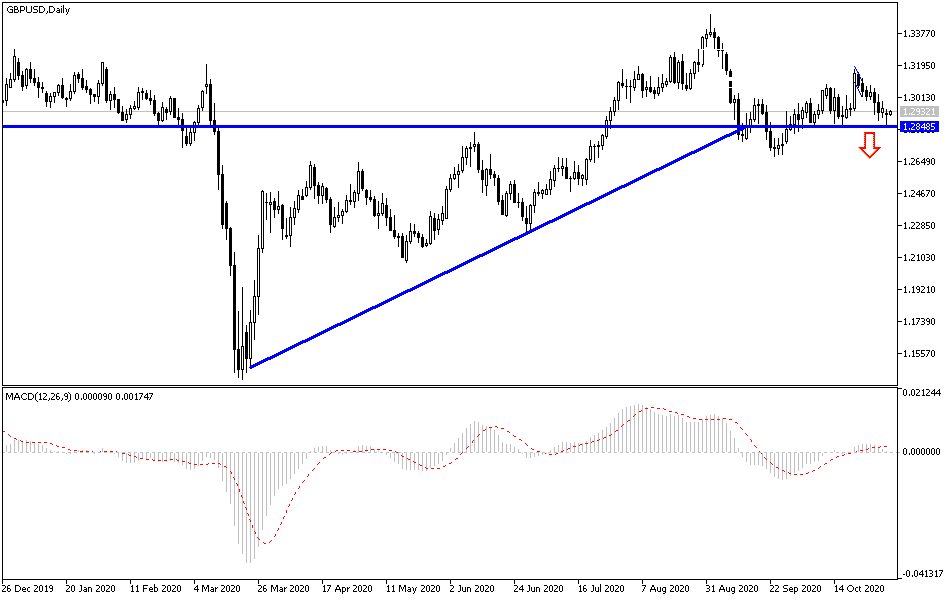

Technical analysis of the pair:

As I mentioned before, I now confirm that the GBP/USD stability below the 1.3000 resistance level will continue to support the bears' control of performance, and it will therefore be legitimate to continue testing stronger support levels. The closest ones are currently at 1.2870, 1.2790 and 1.2630, respectively. Technical indicators still have time to move towards oversold levels. On the daily chart, a return to crossing the 1.3180 resistance will be important to cause a change in the current general outlook for the pair.

There are no significant economic releases today and the US election results will be the main factor affecting the currency pair's path.