The risk appetite amid expectations of Biden's victory in the US elections contributed to a temporary upward rebound in the GBP/USD pair, reaching the 1.3140 resistance in early trading Wednesday. But the pair quickly collapsed to the 1.2932 support before settling around 1.2980 at the time of this writing. This performance confirms the instability and extreme volatility of prices, which is not suitable for many traders, nor for some trading accounts. Accordingly, monitoring should be enough until the final official results are announced.

Commenting on the reaction from the US election results, Derek Halbene, Head of Research and Global Markets for Europe, Middle East and Africa at MUFG said: “Biden’s victory with his inauguration in the Senate seems to be widely expected.” Trump's surprise victory is likely to send the dollar 2-3% higher especially if the Republicans stick to the Senate. If Trump remains in the White House, losing the Senate could weaken the dollar as Trump's actions will be restricted.

Polls close in some parts of the United States late Tuesday evening in Europe, while in other parts, votes will not be counted until Wednesday. Investors will pay special attention to Arizona, Florida, Georgia, Iowa, Michigan, Minnesota, North Carolina, Oahu, Texas and more - all swing states and are among the first to report the outcome in each election cycle.

One of the risks to trade is that President Donald Trump is doing better than clear consensus expectations, and that markets will monitor major “swing” situations for any indication that opinion polls incorrectly predicted the outcome, as was the case in 2016. In this regard, Joshua Mahoney, Chief Market Analyst at IG, said: “As voters in the US head to the polls, traders are hoping to finally see the deadlock in trying to get a second stimulus package. From a market perspective, the key is to find a blue or red hegemony in Congress which would potentially provide a fast way to another fiscal boost in the midst of an impressive economic recovery.”

The dollar has fallen against all major currencies in recent hours, as investors see a clean sweep by the Democrats opening the door to massive stimulus, which leads to higher equity markets and the "risk" type of circumstances in which the dollar tends to perform poorly. A record-breaking 100 million Americans chose to vote early or by mail, posing challenges to rapid delivery of the result. If it turns out that the process is likely to continue for some time, then we expect the enthusiasm to be curbed somewhat, allowing the dollar to return on its previous upward path.

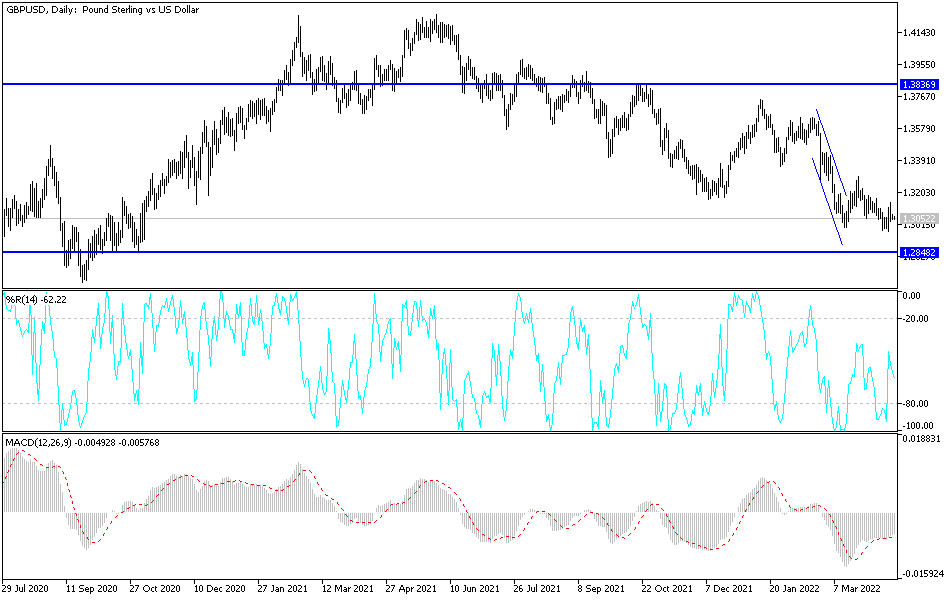

Tehcnical analysis of the pair:

As I expected before, GBP/USD stability above the 1.3000 resistance will support the upward correction. In any case, the rebound and pound gains will collide with the recent British restrictions to contain the outbreak of the coronavirus pandemic and the continuing anxiety about a possible agreement between the European Union and Britain. It is one of the most unstable currency pairs in the coming days. As seen by its performance on the daily chart, breaching the 1.3180 resistance barrier will support a break of the current bears’ dominance on the pair. On the downside, the 1.2885 support will remain very important to move towards stronger support levels. I still prefer to sell the pair from every upward level.

Today's economic calendar data:

From Britain, the services PMI reading will be announced. From the United States of America, the ADP non-agricultural jobs change reading and the US trade balance will be announced, and then the ISM US services PMI reading will be announced.