Despite the return of the US dollar's strength against other major currencies, the price of GBP/USD remained unchanged at the beginning of this week’s trading. This comes amid new market optimism about a possible Brexit agreement between the European Union and Britain. The pair remained flat around its gains with a test of the 1.3208 resistance, its highest level in two months.

Brexit negotiators from Britain and the European Union have met again, seeking a breakthrough in stalled trade talks just days before the deadline for a post-Brexit deal. While chief EU negotiator Michel Barnier met his British counterpart David Frost in London, Britain's House of Lords was trying to tear up a controversial bill on Brexit that threatened to derail negotiations.

British Prime Minister Boris Johnson angered the European Union with a bill that violates parts of the legally binding withdrawal agreement that allowed Britain to leave the bloc in January 2020. The Home Market Act gives the UK the power to override sections of the agreement dealing with Northern Ireland's trade. The United Kingdom acknowledges that the bill violates international lawk. The European Union, US President-elect Joe Biden and dozens of British lawmakers, including many members of Johnson's conservative party, have condemned the bill.

Members of the House of Lords criticized the bill on Monday, ahead of a vote likely to remove illegal provisions from the legislation. Michael Howard, the former Conservative leader who now sits in the House of Lords, said he was "appalled" by the government's behaviour.

He added, "I voted and campaigned for Brexit, and I don't regret a moment or resist that vote. But I want the independent and sovereign state that voted for it to be a state that holds its head high in the world, fulfils its promise, abides by the rule of law and respects its treaty obligations."

Charlie Falconer, who served as justice minister in a previous Labour government, said that the bill would make the United Kingdom "an international outsider". He also told Sky News: "The House of Lords is serving the government by seeking to repeal these illegal provisions now."

The government says it will restore the controversial measures when the bill returns to the House of Commons in the coming weeks.

Joe Biden, who the media declared the winner of the US presidential election, warned on Saturday that the Good Friday peace agreement in Northern Ireland could not become "a victim of Brexit." He said the United States will not sign a trade agreement with Britain if the peace process is damaged.

Britain left the political structures of the European Union on January 31, 2020, but is still in its economic embrace until the transition period ends on December 31, 2020. Both sides say that any deal between them must be agreed by mid-November so that it can be ratified by the end of the year.

Despite that, Johnson said Sunday that there is a trade deal "to be done", and Frost and Barnier cautioned that serious "divergences" remain.

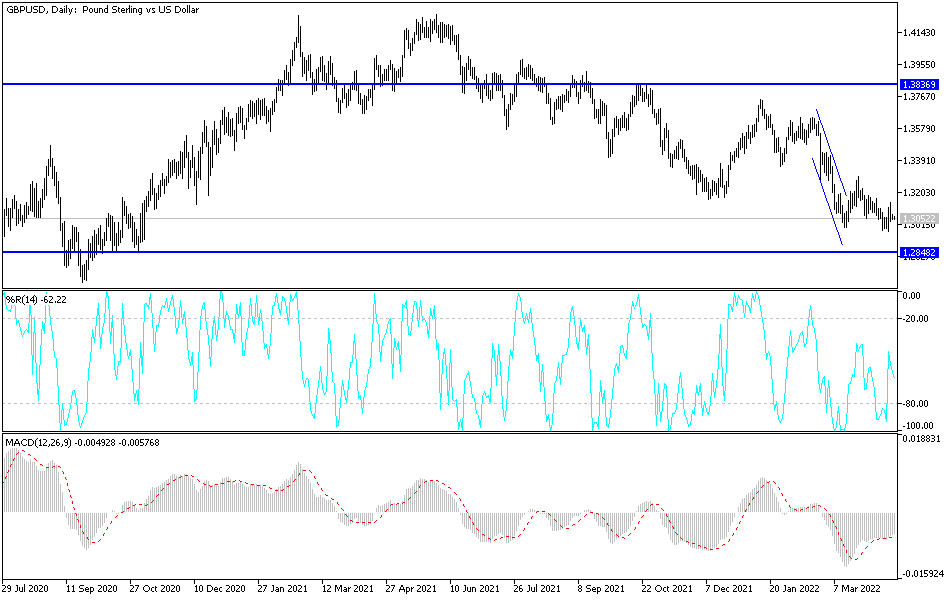

Technical analysis of the pair:

As I expected before, the stability of the GBP/USD above the 1.3000 psychological resistance will remain supportive of the upward momentum, and the bulls are now waiting to push the pair to breach the most important resistance at 1.3200. This is taking into account that the pound gains may be blown in the wind in the event that the two sides of Brexit fail to agree on a deal, at a very sensitive time. An agreement would mean stronger gains for the pair, which is sensitive to Brexit headlines. On the downside, there will be no new control of the bears without moving towards the support level at 1.3000. So far, I still prefer selling the currency pair from every upward level.

The future of the new US administration is not yet clear. Therefore, the currency pair will interact today with the announcement of details of the UK job and wages numbers, as well as statements by a number of monetary policy officials from the US Federal Reserve. The importance of the statements comes from the fact they may hint at what the bank wants from the new administration in order to revive the US economy from the consequences of the pandemic.