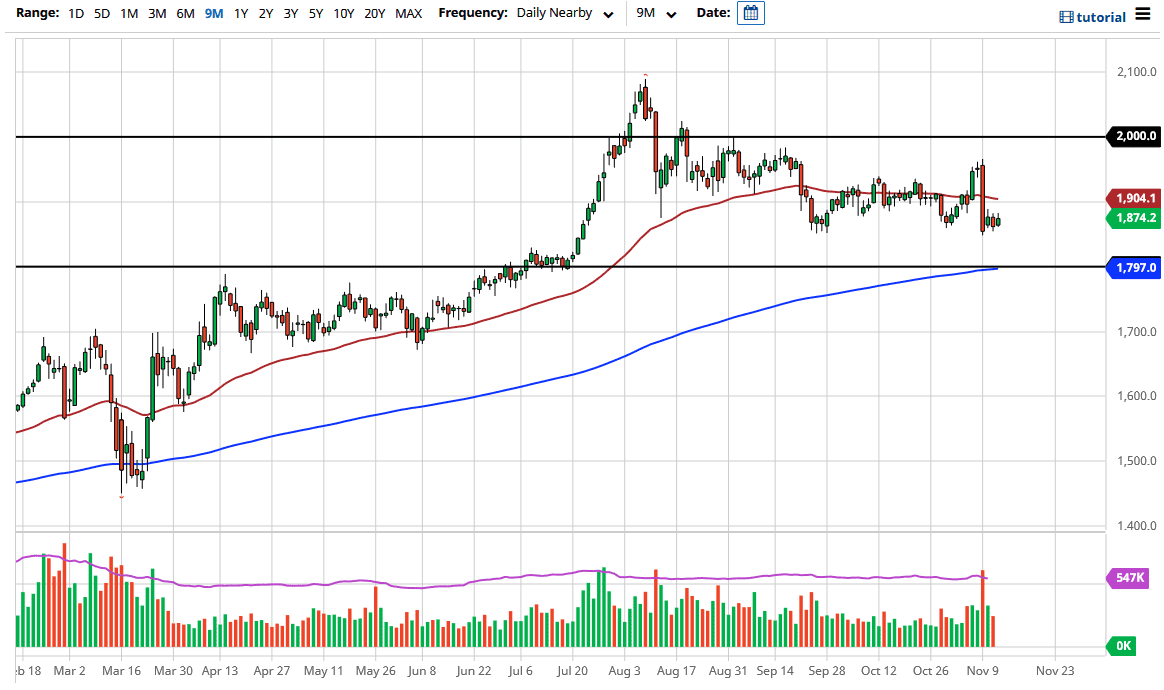

This is an area that has been supportive more than once and therefore it is not a huge surprise to see this market going sideways. The $1850 level of course would be an area that a lot of traders are paying attention to, but at this point one has to take a look at the fact that the last three days have been somewhat supportive, and that is a good sign. However, the massive red candlestick on Monday suggests that there could be more downward pressure. If we that does in fact kick off selling, there are multiple areas where I would be looking at potential buying of gold.

The first obvious level is $1800 level, which was the scene of a major breakout. That is not only a large, round, psychologically significant figure, but it is also an area that has not been tested again. After that, the 200 day EMA is also there, and that in and of itself will attract a certain amount of attention from longer-term traders.

Another thing to pay attention to is what the US dollar is doing. After all, the US dollar can have a significant amount of influence on gold, as it is of course priced in that currency. However, both can go higher and because of this you need to keep an eye on the reason why we are going higher. Quite often, the US dollar will work against the value of gold, but it can also rally right along with it depending on whether or not it is a safety trade, or if it is a trade against the value of flooding the markets with currency.

At this point in time, I like the idea of buying pullbacks, and I am very interested in the $1800 level as a potential value play. I have no interest whatsoever in shorting this market, because the central banks around the world looking at liquidity will certainly drive up the price of gold given enough time, if for no other reason than people trying to protect their wealth. If we did break down below the $1800 level, then things get a little dicer.