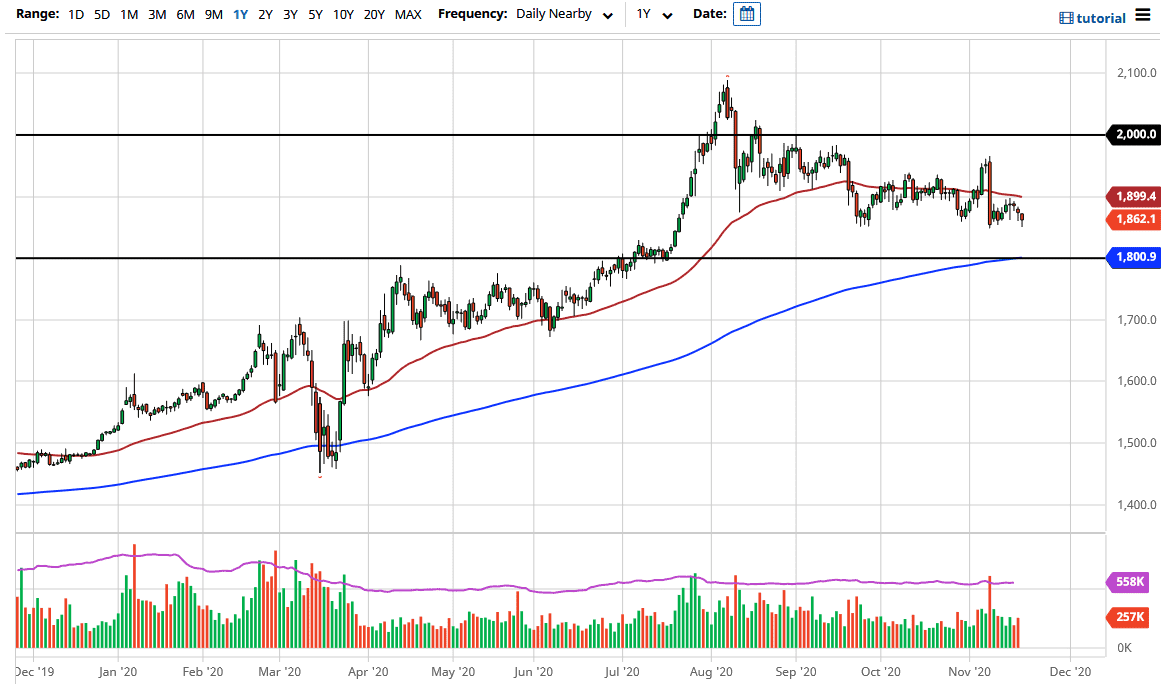

Gold markets have fallen again during the trading session on Thursday to reach down towards the $1850 level. This is an area that has been supportive more than once it is not a huge surprise to see that we had bounced a little bit. That being the case, I think it is only a matter of time before we do bounce for a longer-term move, but we may need to break down below the $1850 level initially to get to the more structured and psychologically important $1800 level.

What is even more interesting about the $1800 level is the 200 day EMA crossing in that general vicinity which tends to attract a lot of longer-term technical traders. Furthermore, gold has a certain amount of a “bottom to it” at this point in time due to the fact that central banks around the world continue to loosen monetary policy. As long as central banks around the world are loose, it is probably only a matter of time before gold takes off to the upside because of this. Overall, I like the idea of buying gold on dips in general, so the $1800 level is an area that I have a lot of interest. If we break down below there, then I have to “reset” and start to think about the longer-term scenario.

Keep in mind that the US Dollar Inde has a strong negative correlation to the gold market as of late, so that of course is going to be worth paying attention to. However, if we do get some type of shock to the system, and let us face it: it would not take much to imagine that, we could see gold fall initially as the US dollar strengthens, only to turn around and rally right along with it. While the US dollar is extremely negatively correlated to gold at this point in time, the reality is that it can change at the drop of hat depending on what is driving everything. Between the central banks and the virus situation, let alone all of the lock down orders that we are bound to see over the next several weeks if not months, I think gold eventually goes much higher. We are in a short-term pull back, perhaps even in a bit of a correction, but that should offer a nice up opportunity going forward. I have no interest whatsoever in shorting.