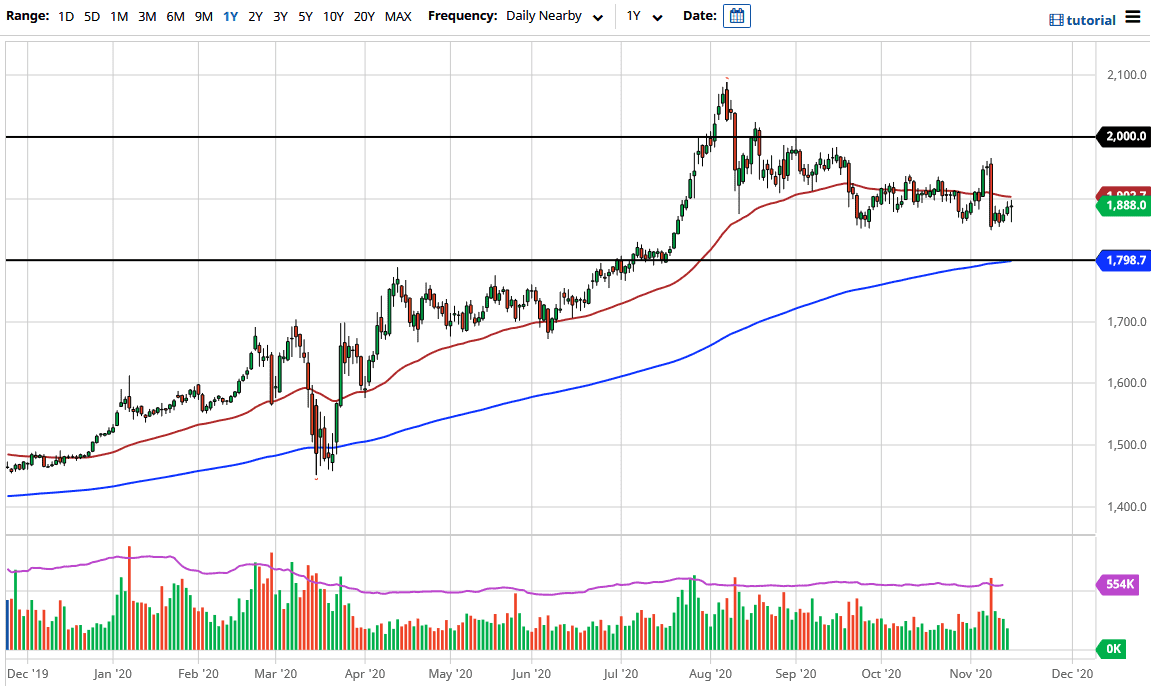

Gold markets fluctuated during the course of the trading session on Tuesday, as we bounce around just below the 50-day EMA. The market seems to be looking for clarity, and we did get news about another vaccine, so risk appetite was all over the place to say the least. This made the US dollar and, by extension the gold market, vacillate.

The market will continue seeing a lot of volatility and we will continue to see the 50-day EMA above as massive resistance. If we do break above there, it opens up the possibility of trying to take out the candlestick from last week that sold the market off to begin with. But I would point out that we did not seem to be able to hang on to the gains. This tells me that we will continue to see a lot of volatility and negativity, so we will eventually go looking towards more significant support.

One of the most significant support levels that I am looking at right now is the $1850 level. That is an area where we have seen buying pressure previously, so it will continue to attract attention. However, I am even more interested in gold on a breakdown below there, and perhaps heading down towards the $1800 level. The $1800 level is a large, round and psychologically significant figure, and a place where we have seen a major breakout previously. This suggests that there is some market memory in that general vicinity. Furthermore, we also have the 200-day EMA sitting right there as well, so the longer-term traders would be looking at that as a possible entry point.

If we were to break down below it, then it is possible that we could drop from there, but I don't think that will happen anytime soon. But if it does, that would suggest that the US dollar would strengthen quite rapidly. The one thing that is working against gold might be the US dollar, but eventually we will go higher due to the central bank's quantitative easing, which will be a main factor in the next year or two.