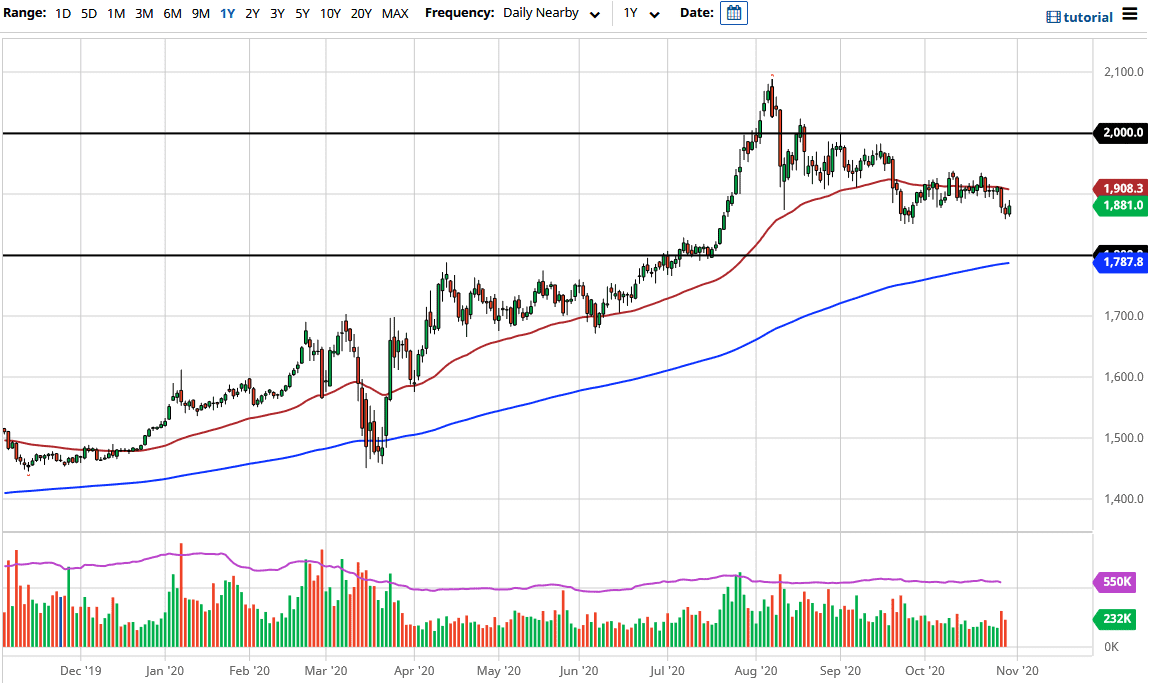

Gold markets rallied a bit during the trading session on Friday, breaking above the top of the candlestick for the Thursday session. The market is likely to go towards the upside from here, perhaps reaching towards the $1900 level. However, we did give back a bit of the gains towards the end of the day so it is possible that we may see more of a pullback towards the $1850 level.

The $1850 level has been a scene of buying recently, so we may see this market trying to retest that area for stability. I would love to see a fall from there and go down towards $1800 level where I see a lot more in the way of support.

The $1800 level is a major confluence of interest for the market, because we broke out of it and then shot straight up in the air. I would anticipate a lot of demand in that region, and of course the 200 day EMA sitting just below that nature figure makes quite a bit of sense as well. Looking at this chart, I do think that we may drift a little bit lower in the short term, maybe due to the US dollar strengthening in a bit of a “risk off trade.” However, both the US dollar and gold could rally if we get a significant amount of fear into the marketplace, which is not a real stretch of the imagination given current events.

From a longer-term standpoint, central banks around the world will continue to loosen monetary policy, so gold would be a preferred way to protect wealth when fiat currency is going to get crushed over the longer term. I do believe that we eventually go looking towards the $2000 level, and then after that much higher. Buying on dips continues to be the way I want to play this market, and I have no interest whatsoever in shorting gold because the fundamentals for this market may not only go to the $2000 level, but much higher than that. However, you do not want to jump “all in” in this type of environment.