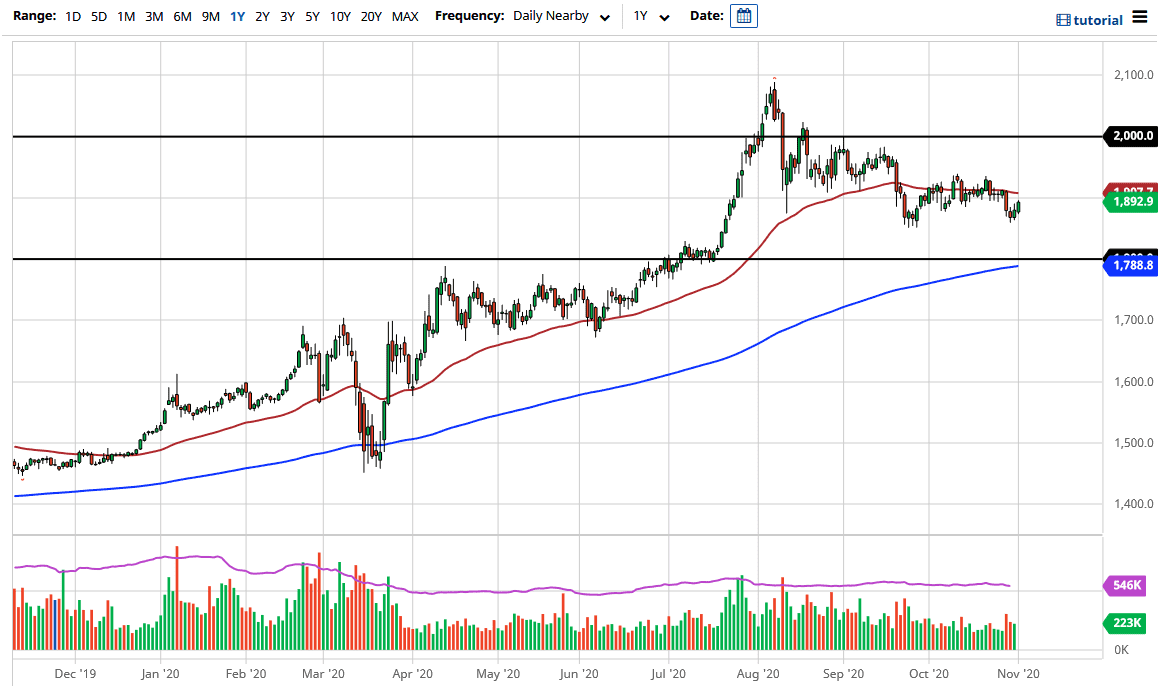

Gold markets have rallied during the trading session on Monday, reaching towards the top of the candlestick from the previous session. There is still plenty of noise above, especially around the 50-day EMA which is just above the $1900 level. There is a lot of noise in that general vicinity, so it can be difficult to break above there; unless, of course, we get a major bearish situation when it comes to the US dollar. After all, the US dollar has been negatively correlated to the gold market over the last couple of months, which should continue to be the case.

The length of the candlestick is not necessarily impressive, but closing towards the top of the range is a good sign. I think we will see some type of pullback, because the US dollar will depend on the US elections and what traders discern from that. We also have the FOMC meeting this week and the jobs number. There is a lot of noise out there that could throw the US dollar round and, by extension, the gold markets as well.

Underneath, the $1800 level will probably be targeted, which might be a very interesting place to get long of gold for a bigger move. The central banks around the world will continue to flood the markets with cheap fiat currency, and gold will therefore rally. There is the possibility that someday we get inflation, but we are not there yet. Gold will be a great way to protect wealth over the longer term, but not necessarily a market that moves in one direction forever. Gold does tend to be very noisy. This is why gold tends to be more of an investment and less of a trade.

The negative correlation between the US dollar and gold has been roughly -.9 over the last 90 days, which is worth noting. This is part of the reason why the gold market has been pulling back, as the US dollar has strengthened. But given enough time, it is possible that we could see both markets rally in a major “risk off” situation. In fact, it is essentially what I am expecting in a few months.