Gold markets rallied during the trading session on Friday, breaking above the highs of the previous three sessions from the week. This is a bullish sign, but we gave back some of the gains at the end, so it is possible that we are simply just now trying to break out of a short-term base. Remember, the Monday candlestick was very vicious to the downside and will have scared quite a few people. It was built upon the premise that the vaccine was going to come in and save everybody, so the economy was going to go screaming to the upside and there was no need for safety. Reality has set back in, as even under the best of circumstances, the vaccine is several months away.

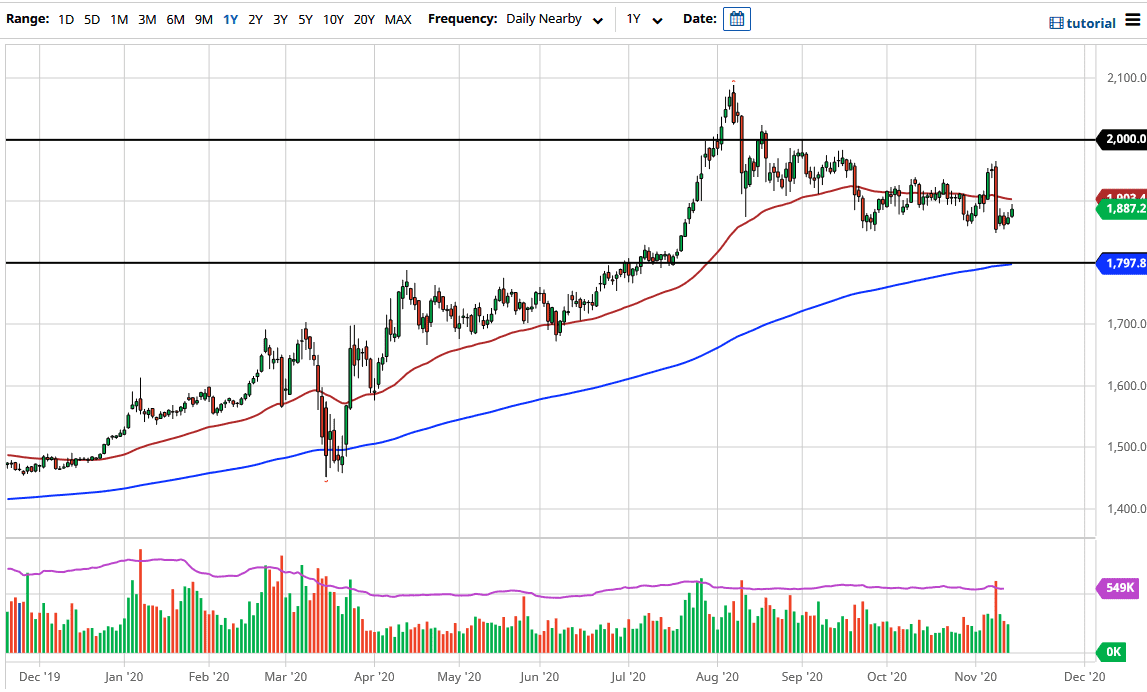

The 50-day EMA is sitting at the $1900 level, an area that will continue to be crucial because it is a large, round, psychologically significant figure, and is also a highly followed technical analysis tool. Nonetheless, eventually we break out to the upside. But the fact that we gave back some of the gains later in the day suggests that we still have some work to do. I would be looking at a supportive candlestick closer to the $1850 level, or even as low as the $1800 level to start buying.

I particularly like the $1800 level, as it is where the 200-day EMA currently sits and is where we broke out of from previous trading. A retest of that level makes sense, as it is typical for markets to do such things. A lot of interest will be built into that area, so I will be watching closely as to how the daily candlestick forms if we drop down there. I would then become much more aggressively bullish. So far, I see no reason whatsoever to short the gold market, so I am simply looking at pullbacks as potential value plays, not reasons to get short. This market has central banks around the world pushing it higher given the fact that so many of them are looking to flood the markets with liquidity.