Gold markets rallied slightly during the trading session on Friday, as we continue to see a sideways grind in general. The $1850 level continues to be an area to which people are paying close attention, but it is possible that we would see the market break down below there. If it does, I would not be selling; I would simply wait for a buying opportunity underneath. In fact, I am counting on this as a longer-term possibility.

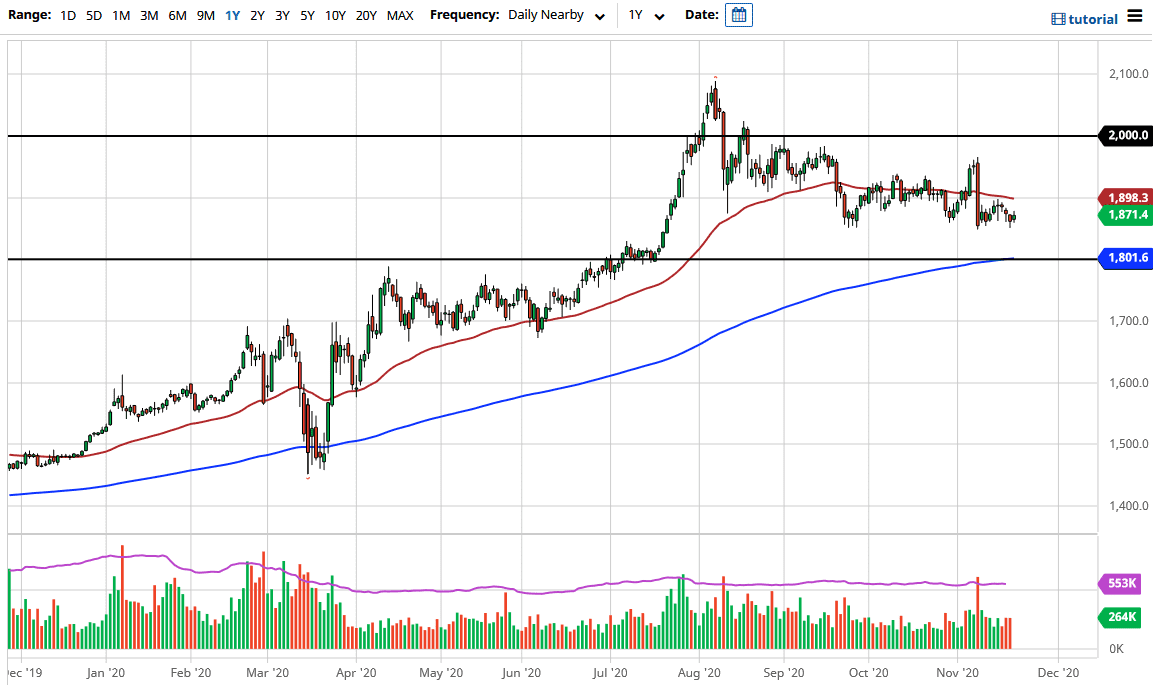

Underneath, I believe that the $1800 level is crucial and an area in which we had broken out from previously and should now be support. Furthermore, the 200-day EMA sits in that area, so we will see buyers come back into play due to the fact that it is a longer-term technical signal. There are also plenty of fundamental factors when it comes to the idea of picking up the value of gold.

Central banks around the world continue to see the need to flood the markets with liquidity, which should bring down the value of fiat currencies. We are right now currently in a “race to the bottom”, meaning that central banks are trying to undercut their own currencies in order to boost exports. That is very toxic for fiat currencies, and eventually the gold markets would get a lift due to that. Buyers will eventually find a reason to get long, due to the central bank. We also have to keep in mind that there are many concerns out there, so a risk scenario will likely come in and have people running for safety. Gold will increase in value in both of those scenarios, so we are in a bit of a “Goldilocks economy” when it comes to the gold market. I like buying dips and I am especially interested in the $1800 level. However, if we turn around and break above the $1900 level, then it is likely that we have already put in the bottom and we will continue to grind to the upside.