Gold markets were crushed during the trading session on Monday following the news that Pfizer is close to having a coronavirus vaccine with over 90% efficacy. This had all the “risk off” traders covering their positions, so gold took a beating. However, gold is not unidimensional, so this is not the end of the upward momentum.

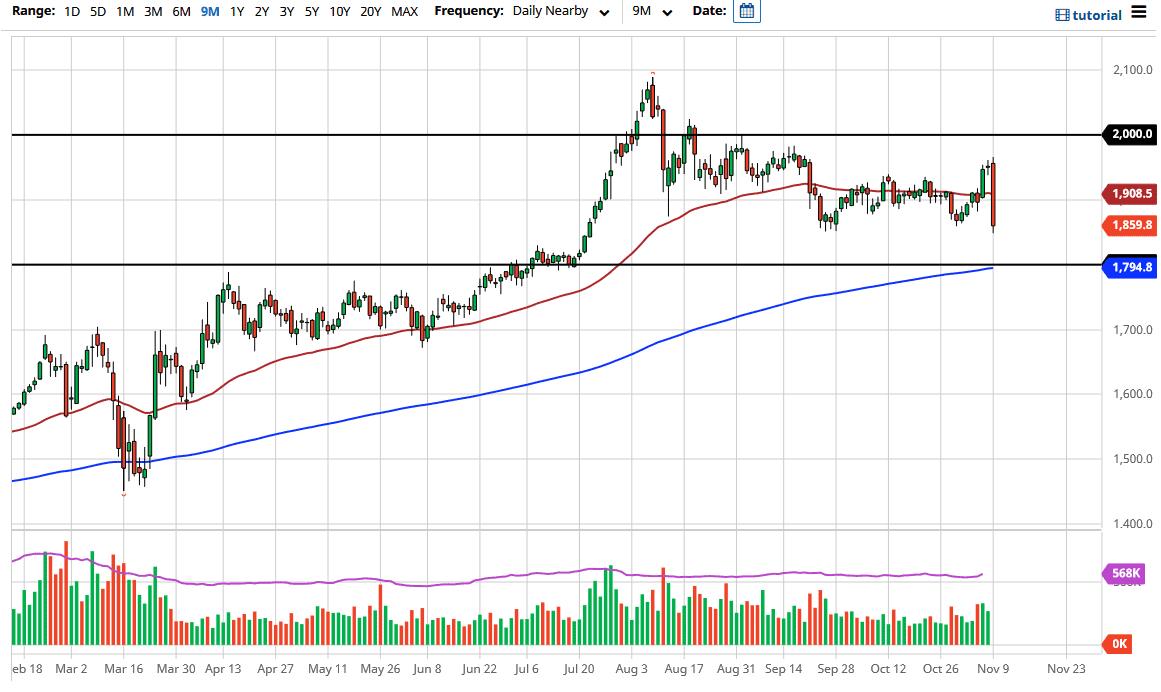

While the candlestick for the trading session does look rather ugly and signifies that we could see some trouble, the $1850 level should offer support, right along with the $1800 level which is where the 200-day EMA sits. I am waiting for a daily candlestick in that area to start buying gold again. Central banks around the world will continue to flood the markets with liquidity, which will drive up the value of gold over the longer term. The question is not so much whether or not you should own gold, but against which currency should you buy it?

The easiest way is to buy gold against the US dollar, which is the standard, but you can also buy it against the euro, Australian dollar, and Japanese yen. In the end it goes higher against all those currencies, but we need to see a day or two of initial stability before we start buying again based on value. The fundamentals have not changed much; even if there is a vaccine coming, you are looking at three months minimum before it is distributed. And if central banks are going to stimulate the economy ad infinitum, that makes a strong case for gold as well. It is then likely that we will continue to see buyers underneath, and the $1800 level is an excellent place to get long of this market if you get the opportunity. If not, we will have a supportive candlestick near the $1850 level that will be advantageous. I have no interest in shorting this market. I believe it is a market that is going to go much higher, and we should continue to see value hunters out there.