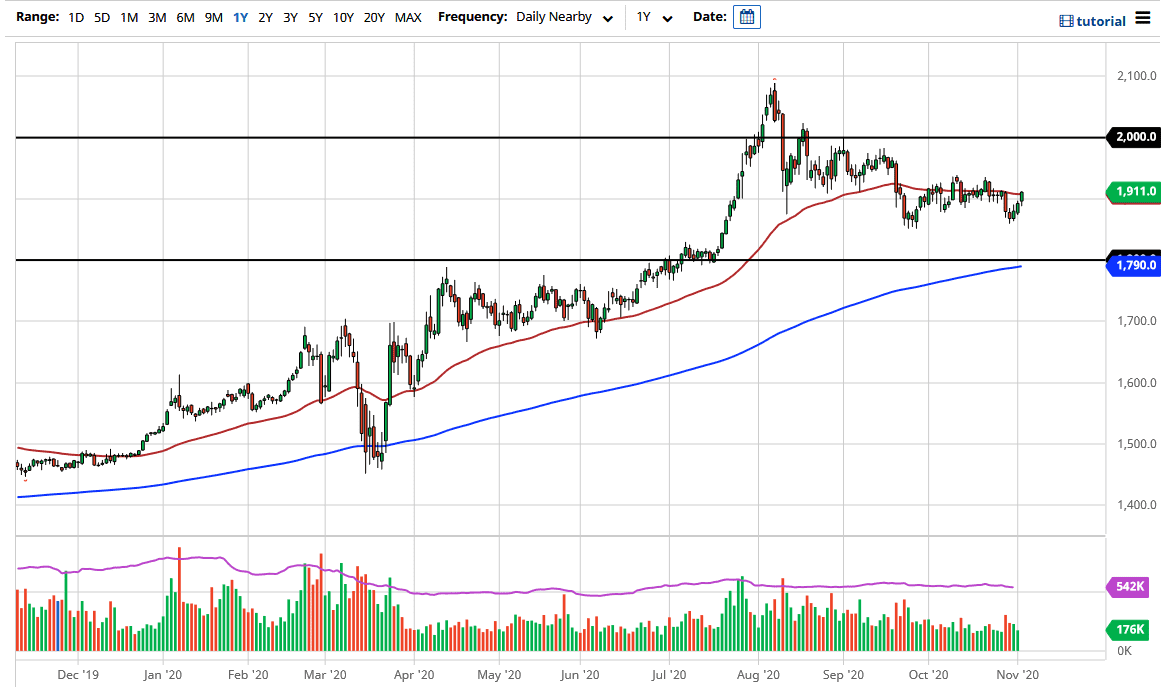

Gold markets initially fell during the trading session on Tuesday, but they got a boost as the US dollar started listing. We cleared the $1900 level during the trading session but are currently struggling with the 50-day EMA. If we can break above there, it is possible that we could go looking towards the $1925 level, after which the $1950 level will be the next target.

The size of the candlestick is relatively good, and it shows strength as we are closing towards the top but let us be honest here: the US election is what is driving things, and as traders are betting on a quick outcome, they are selling the greenback. If we do not get a quick outcome, or even a “mixed government”, then it is possible that the US dollar will strengthen, albeit perhaps in the short term. This commodity tends to move with an extreme negative correlation to the greenback as of late, so it is worth your attention.

In fact, it is possible that we continue to see volatility based on that greenback, so that you get an opportunity to pick up gold “on the cheap.” To the downside, the $1850 level has been very supportive, and it could offer advantageous value. But I prefer to wait and see if we can get down to the $1800 level, which is near the 200-day EMA. The $1800 level was the scene of a major breakout and we need to retest it eventually. However, the possibility is that we break out to the upside. I think that we continue to have a lot of choppy behavior.

The 50-day EMA is sitting right at the top of the candlestick, so it certainly looks as if we continue to hear a lot of noise in general. The 50-day EMA is a significant technical indicator to which many people will pay attention. The fact that it is flat is very indicative of a market that is not ready to go anywhere, at least not in the short term, as momentum seems to be all but dead.