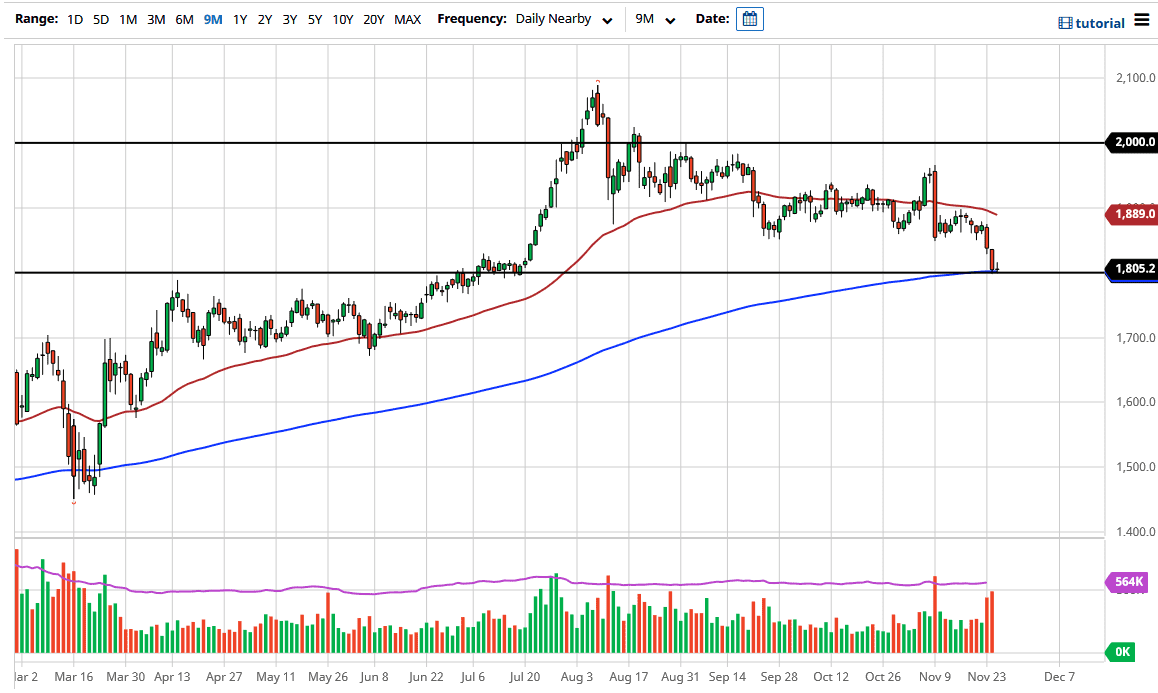

Gold markets initially tried to rally during the trading session on Wednesday but gave back the gains. By doing so, we ended up forming an inverted hammer and it does not look very impressive. We also have to keep in mind that it was the day before Thanksgiving, so a certain amount of slack can be given to the market.

This is a very interesting level which could set the tone for the next few weeks, if not months. We are sitting right at a large, round, psychologically significant figure in the form of the $1800 level, but we are also at the same area in which the market initially broke out to make its run past $2000. You would expect a certain amount of support and, so far, it has held. But it has not bounced that hard. We also have the 200-day EMA sitting there, which could cause some support as well. If there is a place where the stars are aligning for a long position, it is right here.

That is a bit concerning, though, because gold has not behaved that well. I'll give it a pass for a day or two because of the holiday; but by Monday, if we do not see a turn around and rally, we may go a bit lower. Longer-term, I believe gold will have buyers - mainly due to central bank liquidity measures - but we do not see inflation at the moment. If we do break down below this area, we could very well find this market going down to the $1700 level rather quickly.

On the other hand, if we get a decent-sized candlestick in the next couple of sessions that breaks the top of the candlestick from the Wednesday session, then I would assume that a run towards the 50-day EMA makes sense. It's currently sitting at the $1888 level, so we will have to see whether or not we can create that bounce. I think things look rather bleak at this point, so the safest position is to simply sit on the sidelines because there are so many moving pieces. I do like the idea of buying gold at lower levels if I get the opportunity, but I am going to be very patient because I think of this as an investment.