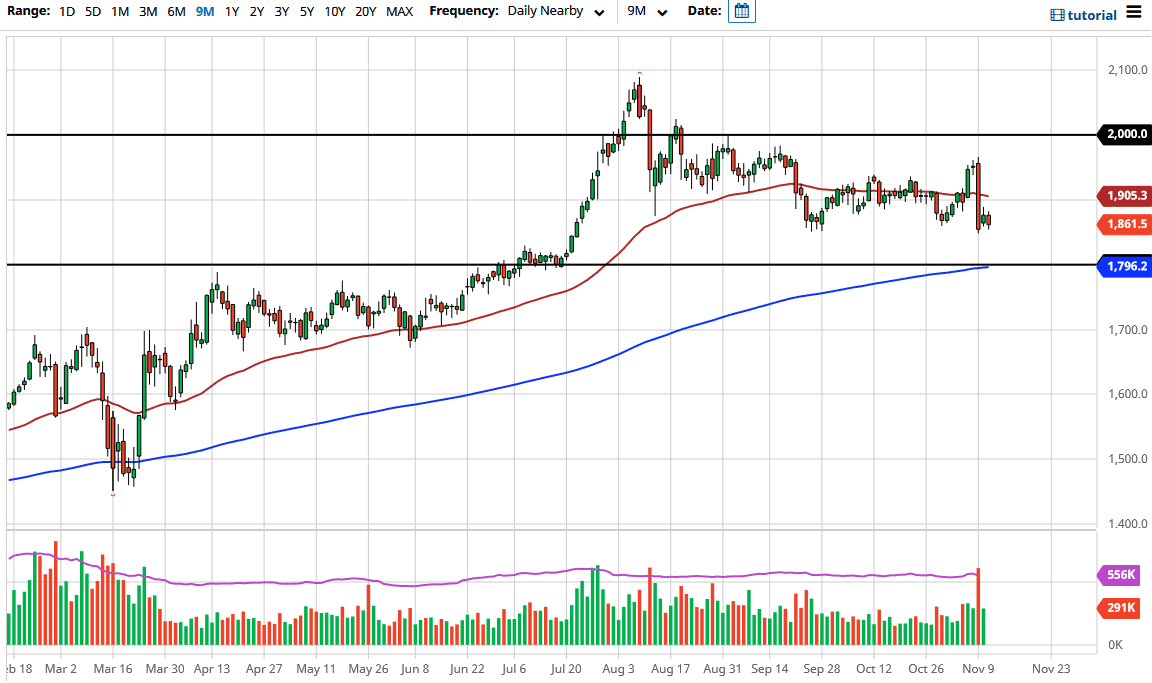

The gold markets have dropped a bit during the trading session on Wednesday, testing the $1850 level yet again. This is an area that has been important more than once, so we should be testing it again. I am waiting to see whether or not we bounce, or if we break down through here. I would love to see gold break down through here because it offers value at lower levels.

If we do break down below the $1850 level, then the market may go looking towards the $1800 level. The $1800 level course also features the 200-day EMA and was the scene of a major breakout, so there are multiple reasons to think we will find plenty of buyers in that area. Looking at this chart, a break down to that area will attract a lot of attention due to multiple factors, like the ones I just mentioned. However, if we do not break down below the $1850 level and turn around, then it opens up the possibility of a move back to the $1900 level where the 50-day EMA sits, or even the $1950 level where the beginning of that massive red candle on Monday began.

I have no interest in shorting gold anytime soon, because global central banks will continue to flood the markets with liquidity and thereby drive down the value of paper money. Gold is a great way to hedge that, which is exactly what people are looking to do. But you have plenty of time to get involved, so I am looking for a daily candlestick to trigger some type of trade. Right now I do not have that, so the market is likely to see more sideways action. But I will be taking a look at the daily chart at the end of every session, looking for the opportunity to go long of gold as we have had a significant pullback in what has been a longer-term uptrend. It should be noted that the massive candlestick that formed on Monday is one of those candlesticks that very rarely happen in a vacuum, so I would anticipate that we may get an opportunity to buy at lower levels.