For the third day in a row, and despite the USD drop, the gold price fell to $1858 an ounce at the time of this writing. Since the beginning of the week's trading, the gold price failed to breach the resistance at $1900 an ounce, which supports the upward momentum. The decline in gold coincided with a rise in riskier assets such as stocks amid encouraging updates from Pfizer regarding the coronavirus vaccine. However, reports showed sharp spikes in new coronavirus cases in the United States, the United Kingdom, France and many other countries around the world, limiting the decline in gold.

Silver futures closed lower at $24.448 an ounce, while copper futures settled at $3.1980 per pound, unchanged from the previous close.

The United States reported that new coronavirus cases in the country increased by more than 160,000. In Europe, the number of COVID-19 cases has risen to nearly 14.5 million, making it the hardest-hit region in the world and accounting for more than 26% of global cases so far.

France has become the first country in Europe to exceed 2 million confirmed cases of coronavirus.

Pfizer and BioNTech announced that the final experimental results of the COVID-19 vaccine candidate indicate a 95% success rate. The companies said they plan to submit an application to the Food and Drug Administration to obtain an emergency use of the vaccine "within days".

New residential construction in the US increased more than expected in October, according to a report by the Department of Commerce. The report said that housing construction rose 4.9% to an annual rate of 1.530 million in October, after rising by 6.3% to a rate of 1.459 million in September. Economists had expected new housing to jump 3.2% to 1.460 million from the 1.415 million originally reported in the previous month.

The United States of America is currently facing a second wave of record coronavirus cases, which has caused various states to tighten restrictions on social distancing. Given this impact, calls for more financial support are just getting stronger. Jerome Powell, Chair of the Federal Reserve, has largely called on Congress to provide more support over the past few months.

A deal on Capitol Hill appears to be less likely due to partisan conflicts. Hopes for a bigger stimulus package of 2021 appear to be dying down. The anticipated Biden administration still has to face the Senate, which is Republican-dominated.The impact of the coronavirus pandemic on the economy combined with the lack of additional fiscal stimulus appears to put additional pressure on the inflation bets.

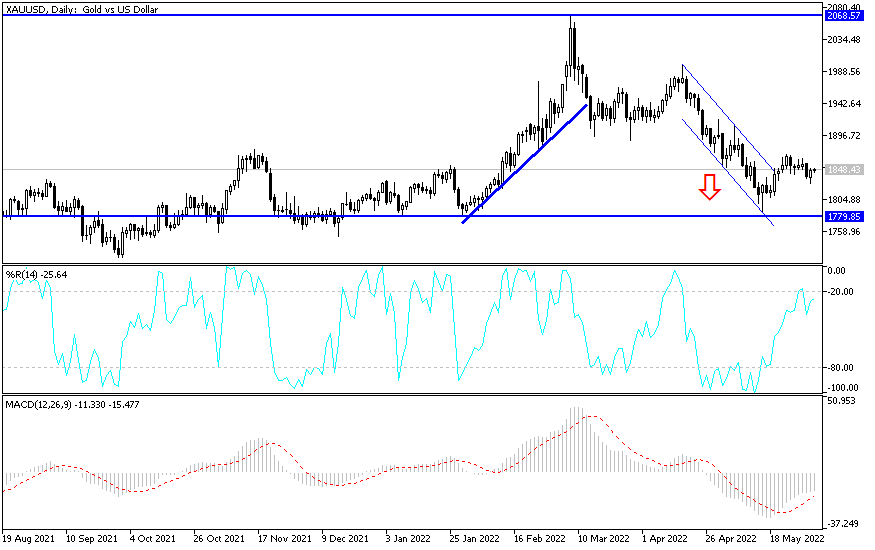

Technical analysis of gold:

Recent sales of gold pushed prices to areas of interest to gold investors as it is the closest to moving towards the $1850 support, which has been bought several times as evidenced on the daily chart. Therefore, we still prefer to buy gold from every downward level; the support levels at 1850, 1838 and 1820 may be the most important to do so currently. On the upside, I still see that the $1900 resistance is the most important for the bulls to control performance again.

The price of gold will interact today with the extent of investor’s risk appetite and the release of US data, including jobless claims, the Philadelphia Industrial Index reading and US existing-home sales.