During last week’s trading, the price of gold recorded its best weekly performance since last July. The price of the yellow metal jumped towards $1960 an ounce before closing the week’s transactions, stabilizing around $1952 an ounce. What added to the upward momentum of the yellow metal price was the collapse of the US currency amid strong competition and accusations that took place after last Tuesday's presidential elections. It was announced that Joe Biden had won over his rival Trump with an historic sweep. Therefore, we expect strong price gaps at the beginning of this week's trading. Then markets and investors will focus on Biden's plans, which are expected to be the ultimate opposite of Trump's policies.

Gold is expected to continue rising and lead gains in precious metals as the US dollar continues to decline. The US dollar is very likely to remain under severe pressure amid hopes that equity market volatility will decrease, which could open the door to higher gold prices. This happens because both the US dollar and gold have a strong inverse relationship.

December silver futures ended Friday's session up by $0.471 at $25.66 an ounce, while December copper futures settled at $3.1540 a pound.

Data from the US Labour Department showed that non-farm payrolls in the United States jumped by 638,000 jobs in October, after increasing by 672,000 revised jobs in September. Economists had expected an increase of 600,000 jobs compared to the 661,000 jobs originally reported for the previous month. The Labour Department also said that the unemployment rate fell to 6.9% in October from 7.9% in September. The unemployment rate was expected to decline to 7.7%.

On the other hand, a report issued by the Commerce Department showed that wholesale inventories in the United States increased by 0.4% in September, after rising by 0.5% in August. Economists had expected inventories to drop 0.1%.

The number of new coronavirus cases in the United States increased by more than 120,000 cases a day. Also, many countries in Europe, including Spain, Germany, the United Kingdom and Switzerland, continued to see spikes in new cases, raising concerns about the global economic recovery.

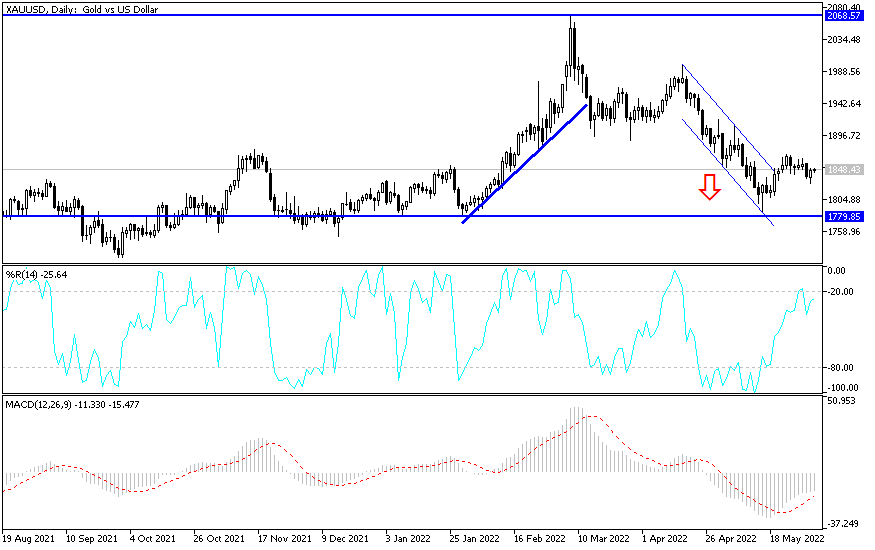

Technical analysis of gold:

The general trend of the gold price is still upward, which supports stability above the psychological resistance at $1900 an ounce. On the four-hour chart, the price of gold has reached oversold areas according to technical indicators. Profits-reaping sales are expected at any time, especially if the dollar strengthens again and investors' risk appetite increases. On the daily chart, the price of gold still has some room to move towards resistance levels, and the closest gains in case the dollar's decline continues are 1972, 1985 and 2020, respectively. In general, there will be no real break of the current bullish outlook for gold without breaching the $1900 support. I still prefer to buy gold from every drop.

The economic calendar today has no important or influential releases on the gold track, and investor sentiment will have the biggest impact on today's performance.