Gold prices rose to $1880 an ounce by the end of last week's trading, despite the uncertainty about the rapid financial stimulus in the United States amid rising COVID-19 infections and despite the stronger dollar. Nevertheless, gold futures contracted by 0.7% over the past week. Silver futures ended higher at $24.363 an ounce, while copper futures for December were steady at $3.2910 a pound. What added to the dispersion of investors was the news about coronavirus infections and effective vaccines, which are now the issues that determine the course of the financial markets.

The development of a vaccine is seen as a sign that the end of the virus is approaching. On the other hand, there is a record high number of COVID-19 cases in the United States of America, which in turn led to the renewal of restrictions that impede economic activity. But it looks as if the markets were trendless as gold slowly consolidated.

Since the vaccine was announced again on November 9th, it appears that the price of gold has failed to regain significant resistance at $1900, as gold was found hovering below its recent range again. Gold's sentiment has also declined over the past few weeks with more funds cutting net buy positions to the smallest level since March 2019, and the retail trade has also lost buying interest, which is evident in the decline in ETF holdings.

The US Treasury has requested the Fed to return unspent funds earmarked under the CARES Act to Congress, prompting criticism from the US Central Bank and increasing market concerns about global economic growth. For its part, the Federal Reserve responded to the decision in a rare public statement, saying that it prefers the full range of emergency facilities established during the coronavirus pandemic to continue to play an important role as an anchor for an economy that is still stressed and weak.

In this regard, people familiar with the decision say that Mnuchin or the new Treasury Secretary in the Biden administration may decide to renew the emergency loan programs.

Data from AstraZeneca and the University of Oxford showed that their potential COVID-19 vaccine produced a strong immune response in the elderly. The researchers expect to announce the results of the late-stage experiments by Christmas. Treasury yields plummeted and the dollar rose after a rare presentation of a row between Mnuchin and Fed Chairman Jerome Powell over releasing funds to further support the economy.

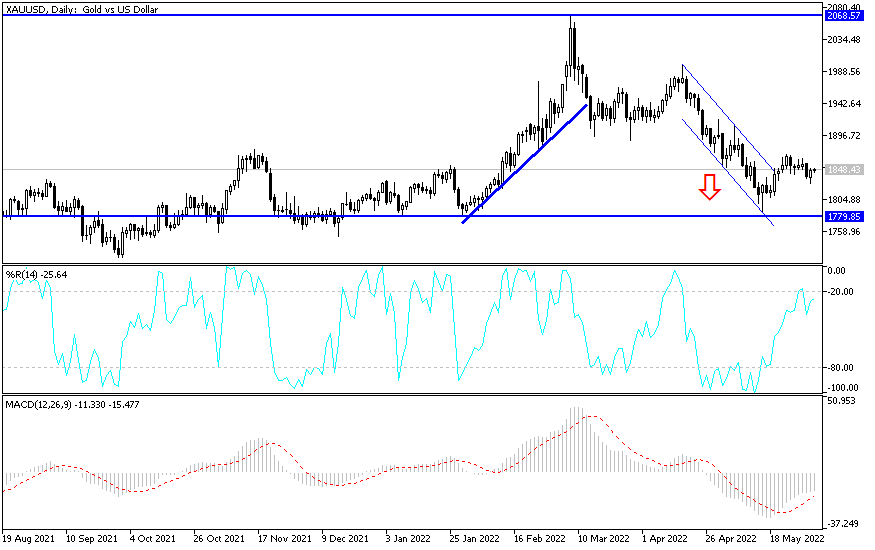

Technical analysis of the price of gold:

Gold investors' attention focuses on the support at $1845 an ounce, as stability below it may bring strong selling of gold. Attention then turns to the $1800 psychological support, which is of great technical importance on the daily chart. Despite the pessimistic outlook, I am still waiting for the opportunity to buy gold more than the opportunity to sell it. Gold bulls are still focusing on the $1900 psychological resistance to renew the bullish outlook for the general trend. Investor sentiment towards coronavirus vaccines, global infection numbers, the level of the US dollar and the US dispute over economic stimulus plans will be the most important factors affecting the performance of the gold price in the coming days.