For seven trading sessions in a row, gold prices have been moving within very narrow ranges, at the support level between $1856 and $1900 an ounce and stabilizing around $1882 at the time of writing. The price of gold is looking for a direction and, as per recent markets’ performance, we notice a retreat in the USD, which helps gold go higher. But there is positive news about successful coronavirus vaccines and regarding the Brexit situation. Recently, stocks have fallen amid fears of an increase in coronavirus cases.

December silver futures closed lower by $0.151 at $24,651 an ounce, while December copper futures settled at $3.1980 a pound.

Despite optimism about COVID-19 vaccines, concerns about growth continued to emerge due to the sudden rise in coronavirus cases in the United States, Europe and many other countries around the world. The head of the World Health Organization, Tedros Adhanon Ghebreyesus, praised the "encouraging news" about COVID-19 vaccines, but stressed that complacency is not an option as cases in many countries continue to rise. After Pfizer reported last week that the phase 3 trial of its coronavirus vaccine had proven more than 90% effective, Moderna announced on Monday that its candidate vaccine is 94.5% effective.

After the announcement of a greater-than-expected decline in US retail sales, which is a disappointing indicator as consumer spending represents more than 70% of economic activity, US industrial production rose by 1.1% in October, reversing much of the spring decline caused by the coronavirus pandemic.

The Federal Reserve reported that there was a rebound after the September decline, but production is still below pre-epidemic levels. The rise was slightly better than analysts' expectations of 1% and, coupled with a bullish review in the September figure, should be seen as good news as coronavirus cases have increased across the US and states reimpose restrictions.

Therefore, it is not clear what manufacturers will face in the coming months, but a sudden drop in demand, possibly coupled with government restrictions on their operations due to the virus, could severely weaken industrial production.

A major category reflecting manufacturing production rose 1% but is still about 5% below its level in February prior to the coronavirus outbreak. In October, the industry worked at 72.8% of capacity, down from a reading of 77% capacity a year earlier.

Despite the gains, economists saw the October report as lukewarm and said future gains will largely depend on how the United States handles the third wave of infections, and whether it can deliver a much-needed aid package to Americans.

Any hope for Congress to pass another aid package in the weeks before the US election has faded, and it appears unlikely to happen before Joe Biden takes office while President Donald Trump refuses to concede the election. In contrast, the COVID-19 virus has killed more than 247,000 Americans this year and infected at least 11.1 million - nearly a million in the past week alone.

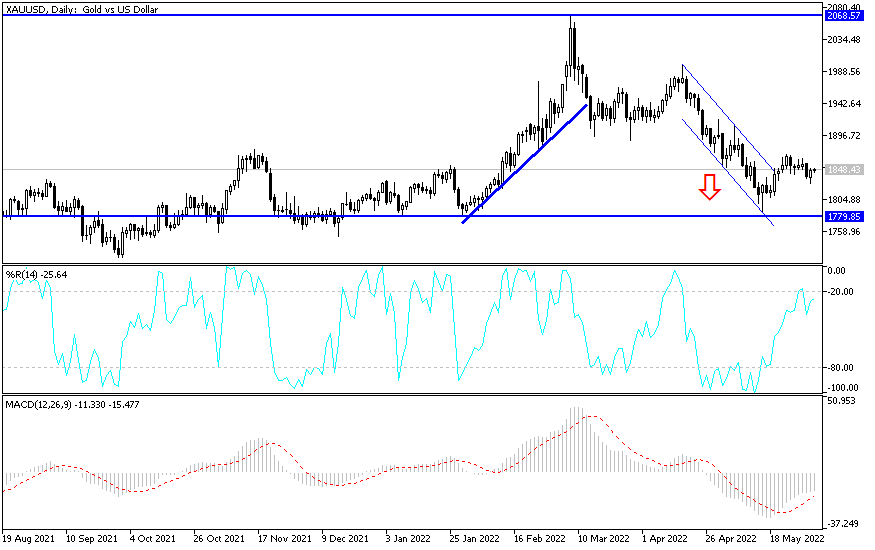

Technical analysis of gold:

There is no change in gold price movements, so there is no change in my technical view. The price of gold is waiting to launch above the psychological resistance at $1900 an ounce to push prices to higher resistance levels. Moving in narrow ranges for several trading sessions in a row technically portends an imminent price explosion for the yellow metal at any time. This will be determined by the price of the dollar and the extent of investors’ risk appetite. On the downside, the support level at $1850 has been breached, according to the performance on the daily chart, which supports the strength of the downside. I still prefer to buy gold from every lower level.