Throughout last week’s transactions, the price of gold was in a continuous decline. The decline in the US dollar has not stopped the sales that pushed the price of gold to the support level at $1775. That is the exact support level we expected in case the price stabilized below $1800, because it is a psychological support that may increase the bears’ control of the performance. According to the latest performance, the price of the yellow metal recorded its biggest weekly loss in about two months. Gold has become less attractive since the announcement of three successful vaccines that could eliminate the coronavirus, which increased investors’ confidence in global financial markets. Despite inflation concerns, investors appear to be ending the year in a cheerful rally, delving deeper into stocks and industrial metals.

Gold prices recorded a weekly decline of 4.22%, trimming its rise since the beginning of trading in 2020 to date to less than 18%.

Silver, the sister commodity of gold, also fell to end the shortened trading week. Accordingly, silver futures fell to $22.77 an ounce. Therefore, silver suffered a weekly decline of 6%, but it is still up by more than 27% since the beginning of 2020 trading to date.

The question now is: will the price of gold face a correction or is it heading towards a bear market? The yellow metal is trading below the 200-day moving average of $1802, but bears believe that the contracts may go down to $1700.00.

The metal asset class failed to benefit from the drop in US currency. The US Dollar Index, which measures the greenback against six major rival currencies, fell 0.22% to 91.80 from an opening of 92.02. Accordingly, the index recorded a weekly drop of 0.65%, adding to its annual loss during 2020 to date of 4.8%. Usually, the lower exchange rate is good for dollar-denominated goods as it makes them cheaper for foreign investors to buy.

In general, there is greater optimism about the global economic recovery currently, as three mostly effective COVID-19 vaccines are being produced by Pfizer, Moderna and AstraZeneca, along with announcements from other companies. Nevertheless, with very low interest rates and the potential for further fiscal and monetary stimulus, the inflationary effects will support the precious metals.

Joe Biden's victory in the US presidential election negatively contributed to the price of precious metals because he is expected to take a more relaxed approach to trade policy with a country like China. This has also been reflected in the global stock markets.

Regarding prices of other metals, copper futures rose to $3,404 a pound. Platinum futures rose to $970.80 an ounce. Palladium futures settled at $2,440.70 an ounce.

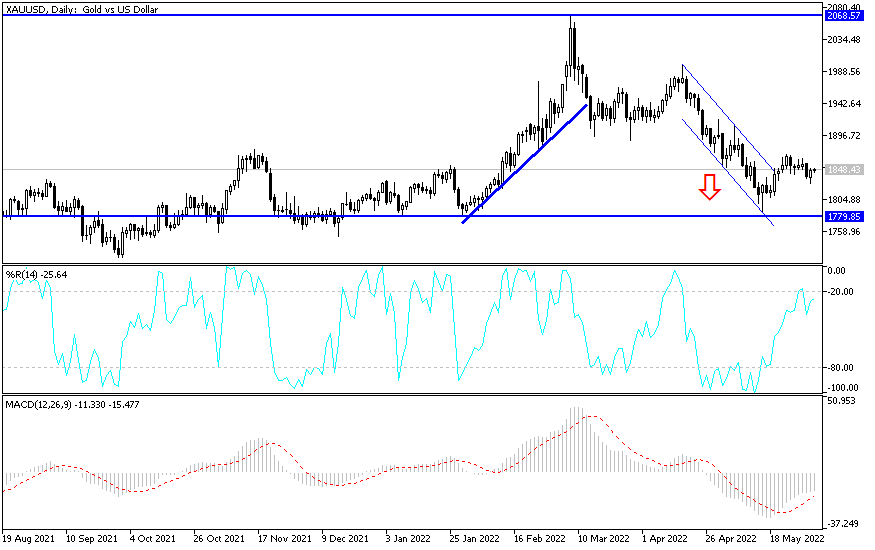

Technical analysis of gold:

Bears’ control increased over the general trend of the gold price amid a violent breach of the psychological support level at $1,800. In previous technical analyses, we indicated that the breakout would push the price of the yellow metal towards stronger support levels. It reached the first target at $1775 and the next target will be $1760. One of these levels can be considered for buying in preparation for a bounce higher at any time, as the support will push the technical indicators to oversold areas. On the upside, it is awaiting a return to stability above the $1800 resistance - which was previous psychological support - to search for incentives for the bullish retracement. Failure to obtain that will increase the bears' control and thus the rush towards stronger support levels. We will see the return of liquidity to the markets after the long American holiday and the beginning of data releases at the end of November. Investor risk appetite may pause a little.