Despite the continued USD strength, the price of gold found an opportunity (although limited) to rebound higher. It tested the $1898 an ounce level in early trading today before stabilizing around $1891 an ounce at the time of this writing. Today is an important date for the price of gold, with the US presidential elections determining the fate of the USD and gold. The price of gold may remain moving in a limited range and instability until the results of those elections are announced. What contributed to the recent gains in gold were increased concerns about the increase in coronavirus cases and new lockdown restrictions in several places across Europe, which increased investors' demand for gold as a safe haven.

Uncertainty about the outcome of the US presidential election also contributed to the rise in the price of gold. Investors are also waiting for the results of a Federal Reserve Bank meeting led by Jerome Powell to determine monetary policy amid the second COVID-19 wave and in the event Trump loses. This is in addition to the US jobs numbers at the end of the week.

December silver futures rose $0.387 at $24,033 an ounce, while December copper futures were steady at $3.0770, $0.0295 higher than the previous close.

According to opinion polls, Democratic nominee Joe Biden has a major lead in major states, but races are said to be tight in combat states.

On the COVID-19 front, the total number of coronavirus cases in Europe has exceeded 10 million, forcing governments across the continent to re-impose lockdown measures. British Prime Minister Boris Johnson announced at the weekend that a month-long lockdown across England would begin on Thursday to contain the coronavirus spread. France, Belgium and Germany also announced closures in several places.

A report issued by the Institute of Supply Management said that the ISM PMI rose to a reading of 59.3 in October from a reading of 55.4 in September. According to the index data, any reading above the 50 level indicates a growth in manufacturing activity. Economists had expected the index to reach 55.8 points.

Meanwhile, spending on construction in the US rose less than expected in September, the Commerce Department revealed in a special report. The report said construction spending rose 0.3% to an annual rate of $1.414 trillion in September after rising by 0.8% to $1.410 trillion in August. Economists had expected construction spending to jump 1%.

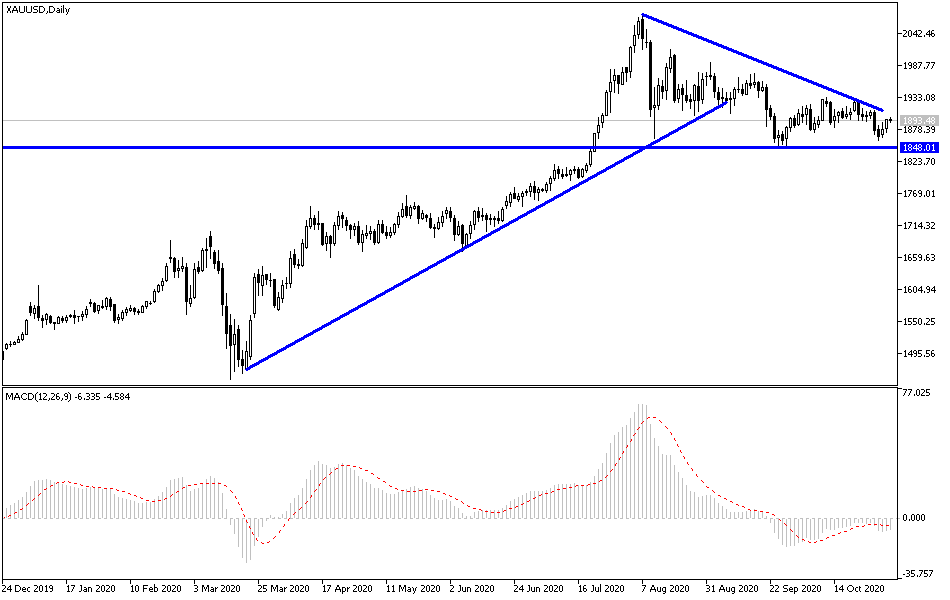

Technical analysis of gold:

On the daily chart, bulls are trying to push the price of gold to stabilize above $1900 an ounce again, so that there is an opportunity to stimulate more purchases to move gold to stronger levels. Then, the resistance levels 1916, 1928 and 1950 will be the next targets for the ascending path. On the other hand, surpassing the support level at $1885 an ounce will support the dominance of the bears, and the opportunity will be better to move down and, from there, investors’ interest in buying will start again. Technical indicators over the same period are in a fairly neutral position. Accordingly, a price explosion is expected in one of the two directions as a reaction to the important and influential events of this week: the results of the US elections, the monetary policy decisions of the Federal Reserve Bank and the US jobs numbers. All in all, I would still prefer to buy gold from every lower level.